Investment in sports team ownership shares offers potential for dividends, brand association, and long-term capital appreciation tied to the team's performance and market value. Collectible cars provide tangible assets with unique historical and aesthetic appeal, often appreciating due to rarity, condition, and market trends. Explore the distinctive advantages and risks of each to identify the best fit for your investment portfolio.

Why it is important

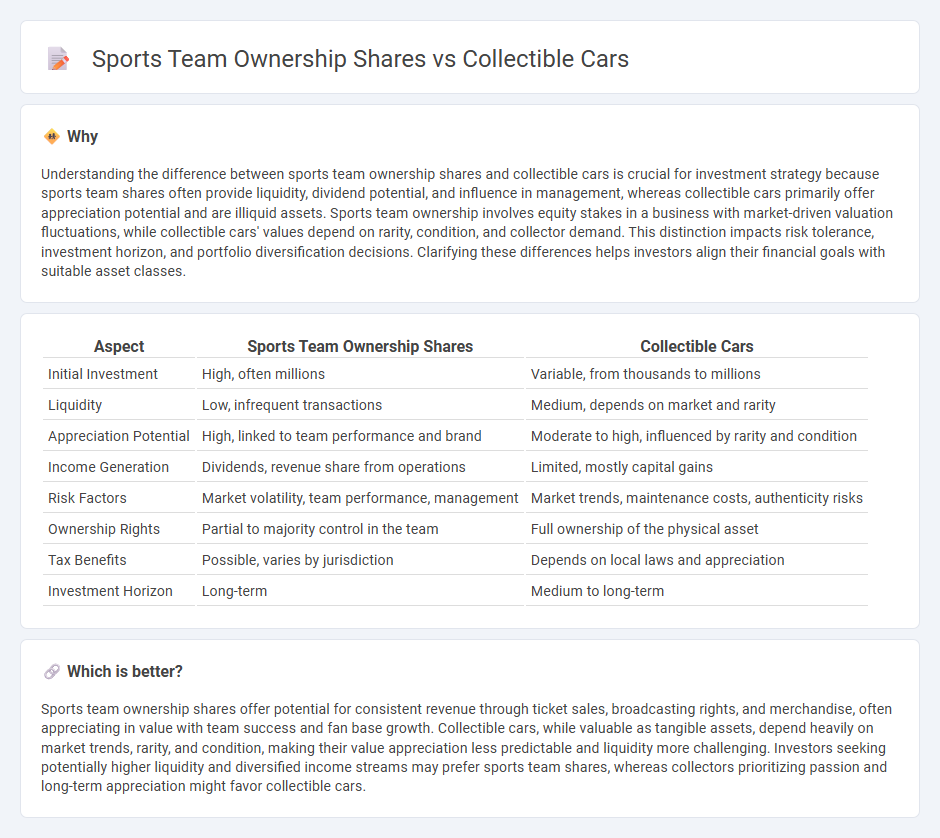

Understanding the difference between sports team ownership shares and collectible cars is crucial for investment strategy because sports team shares often provide liquidity, dividend potential, and influence in management, whereas collectible cars primarily offer appreciation potential and are illiquid assets. Sports team ownership involves equity stakes in a business with market-driven valuation fluctuations, while collectible cars' values depend on rarity, condition, and collector demand. This distinction impacts risk tolerance, investment horizon, and portfolio diversification decisions. Clarifying these differences helps investors align their financial goals with suitable asset classes.

Comparison Table

| Aspect | Sports Team Ownership Shares | Collectible Cars |

|---|---|---|

| Initial Investment | High, often millions | Variable, from thousands to millions |

| Liquidity | Low, infrequent transactions | Medium, depends on market and rarity |

| Appreciation Potential | High, linked to team performance and brand | Moderate to high, influenced by rarity and condition |

| Income Generation | Dividends, revenue share from operations | Limited, mostly capital gains |

| Risk Factors | Market volatility, team performance, management | Market trends, maintenance costs, authenticity risks |

| Ownership Rights | Partial to majority control in the team | Full ownership of the physical asset |

| Tax Benefits | Possible, varies by jurisdiction | Depends on local laws and appreciation |

| Investment Horizon | Long-term | Medium to long-term |

Which is better?

Sports team ownership shares offer potential for consistent revenue through ticket sales, broadcasting rights, and merchandise, often appreciating in value with team success and fan base growth. Collectible cars, while valuable as tangible assets, depend heavily on market trends, rarity, and condition, making their value appreciation less predictable and liquidity more challenging. Investors seeking potentially higher liquidity and diversified income streams may prefer sports team shares, whereas collectors prioritizing passion and long-term appreciation might favor collectible cars.

Connection

Sports team ownership shares and collectible cars both serve as alternative investment assets that combine passion with potential financial returns. These assets often appreciate based on rarity, brand value, and fan or collector demand, influencing their market value beyond traditional investment metrics. Investors leverage market trends and historical appreciation rates to diversify portfolios, balancing liquidity and long-term capital gains.

Key Terms

Asset Appreciation

Collectible cars have demonstrated significant asset appreciation due to their rarity, historical significance, and condition, often outperforming traditional investments over time. Sports team ownership shares offer the potential for substantial returns driven by franchise valuation growth, media rights, and market expansion in major leagues. Explore more to understand which asset class aligns better with your investment strategy and risk tolerance.

Liquidity

Collectible cars typically exhibit lower liquidity compared to sports team ownership shares due to limited market demand and lengthy transaction processes. Sports team ownership shares offer higher liquidity, especially when traded within established equity markets or private equity platforms. Explore deeper insights into how liquidity influences investment strategies in these asset classes.

Due Diligence

Due diligence for collectible cars involves verifying provenance, condition reports, and market trends to assess potential appreciation and maintenance costs, while sports team ownership shares require deep financial audits, legal reviews, and analysis of league regulations to evaluate revenue streams and risk exposure. Evaluating liquidity, historical performance, and the impact of external factors like economic shifts is crucial in both investment types. Explore detailed due diligence strategies to make informed decisions in these high-stake markets.

Source and External Links

Collectible Cars & Diecast Vehicles - Offers collectible die-cast cars and exclusive model cars, including Hot Wheels and Matchbox, with cultural relevance and precision craftsmanship.

Diecast Model Cars - Features meticulously crafted replicas of classic and modern vehicles, celebrating automotive history and design with detailed precision.

Classic Cars for Sale - A marketplace for collector and vintage cars, including muscle cars, convertibles, and exotics from trusted sellers.

dowidth.com

dowidth.com