Wine funds and venture capital represent distinct investment strategies targeting different asset classes and risk profiles. Wine funds focus on acquiring rare and collectible wines, leveraging market trends in luxury assets and the appreciation of fine wine values over time. Explore how these investment vehicles compare in returns, liquidity, and market dynamics to make informed financial decisions.

Why it is important

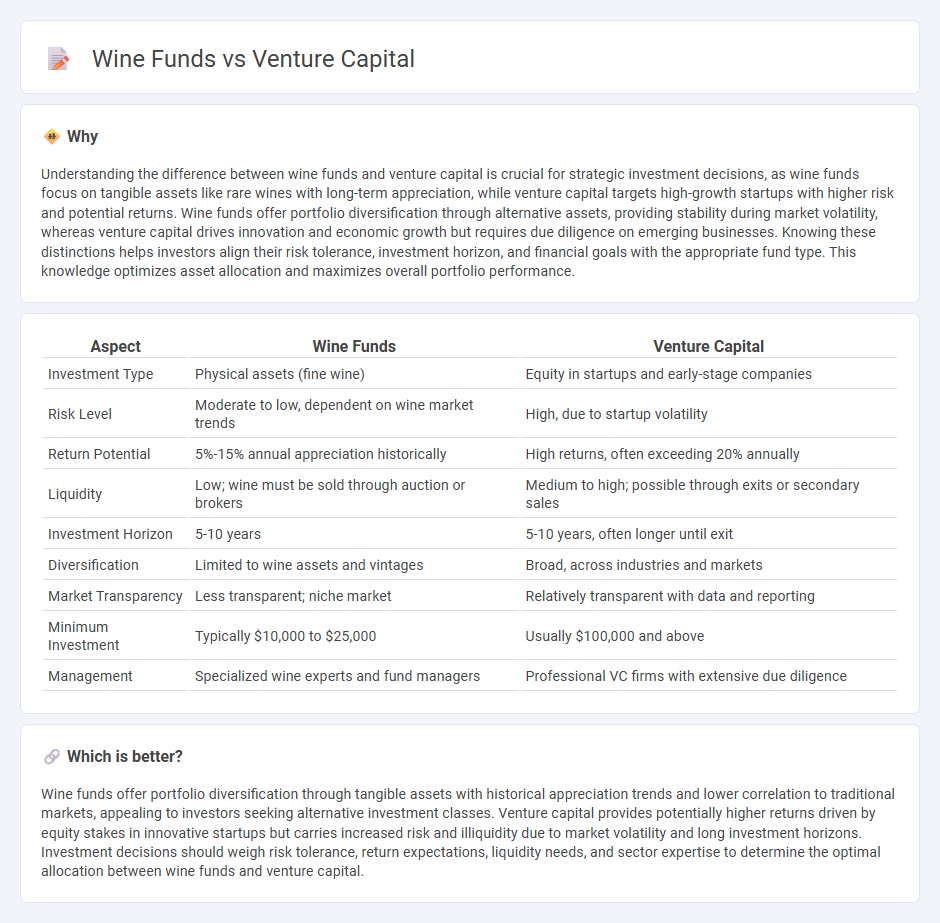

Understanding the difference between wine funds and venture capital is crucial for strategic investment decisions, as wine funds focus on tangible assets like rare wines with long-term appreciation, while venture capital targets high-growth startups with higher risk and potential returns. Wine funds offer portfolio diversification through alternative assets, providing stability during market volatility, whereas venture capital drives innovation and economic growth but requires due diligence on emerging businesses. Knowing these distinctions helps investors align their risk tolerance, investment horizon, and financial goals with the appropriate fund type. This knowledge optimizes asset allocation and maximizes overall portfolio performance.

Comparison Table

| Aspect | Wine Funds | Venture Capital |

|---|---|---|

| Investment Type | Physical assets (fine wine) | Equity in startups and early-stage companies |

| Risk Level | Moderate to low, dependent on wine market trends | High, due to startup volatility |

| Return Potential | 5%-15% annual appreciation historically | High returns, often exceeding 20% annually |

| Liquidity | Low; wine must be sold through auction or brokers | Medium to high; possible through exits or secondary sales |

| Investment Horizon | 5-10 years | 5-10 years, often longer until exit |

| Diversification | Limited to wine assets and vintages | Broad, across industries and markets |

| Market Transparency | Less transparent; niche market | Relatively transparent with data and reporting |

| Minimum Investment | Typically $10,000 to $25,000 | Usually $100,000 and above |

| Management | Specialized wine experts and fund managers | Professional VC firms with extensive due diligence |

Which is better?

Wine funds offer portfolio diversification through tangible assets with historical appreciation trends and lower correlation to traditional markets, appealing to investors seeking alternative investment classes. Venture capital provides potentially higher returns driven by equity stakes in innovative startups but carries increased risk and illiquidity due to market volatility and long investment horizons. Investment decisions should weigh risk tolerance, return expectations, liquidity needs, and sector expertise to determine the optimal allocation between wine funds and venture capital.

Connection

Wine funds and venture capital both represent alternative investment opportunities that diversify traditional portfolios by targeting niche markets with potential for high returns. Wine funds invest in collectible wines, leveraging market trends and rarity to appreciate value, while venture capital injects capital into innovative startups with scalable business models. Both rely on expertise in asset selection and market timing to maximize investor gains and mitigate risks.

Key Terms

Equity

Venture capital funds primarily invest equity in high-growth startups, seeking significant ownership stakes to influence company direction and achieve exponential returns. Wine funds allocate capital into fine wine collections, leveraging market appreciation and rarity rather than active business involvement or equity ownership. Explore the nuances of equity focus in these distinct investment vehicles to enhance your portfolio strategy.

Portfolio Diversification

Venture capital funds invest primarily in high-growth startups across technology, healthcare, and fintech sectors, offering exposure to innovative and scalable business models. Wine funds focus on acquiring fine wines as alternative assets, providing lower correlation to traditional markets and a hedge against inflation. Explore the nuances of portfolio diversification between venture capital and wine funds to make informed investment decisions.

Exit Strategy

Venture capital funds prioritize exit strategies such as initial public offerings (IPOs), mergers, or acquisitions to achieve liquidity and maximize investor returns within a 5 to 10-year horizon. Wine funds, focusing on rare and investment-grade wines, rely on market appreciation and auction sales for exit, with holding periods often extending beyond a decade due to the asset's aging potential. Explore detailed comparisons and strategic insights to optimize your investment choices in these niche markets.

Source and External Links

What is Venture Capital? - Venture capital finances high-growth startups by providing risk capital in exchange for equity, offering strategic guidance, and partnering with entrepreneurs to build transformative companies that often drive significant economic impact.

What is Venture Capital? | J.P. Morgan - Venture capital fuels innovation by investing in early-stage companies with high potential and risk, typically acquiring equity stakes and aiming for future returns through acquisitions or public offerings.

Fund your business | U.S. Small Business Administration - Venture capital is a form of equity investment focused on high-growth startups, differing from traditional loans by involving higher risk, longer time horizons, and active investor participation in company decisions.

dowidth.com

dowidth.com