Blue economy funds focus on sustainable investments in marine and aquatic resources, aiming to support ocean conservation and promote renewable marine industries. Hedge funds employ diverse strategies to generate high returns, often involving high-risk, high-reward investments across global markets. Explore more to understand how these investment vehicles align with your financial and ethical goals.

Why it is important

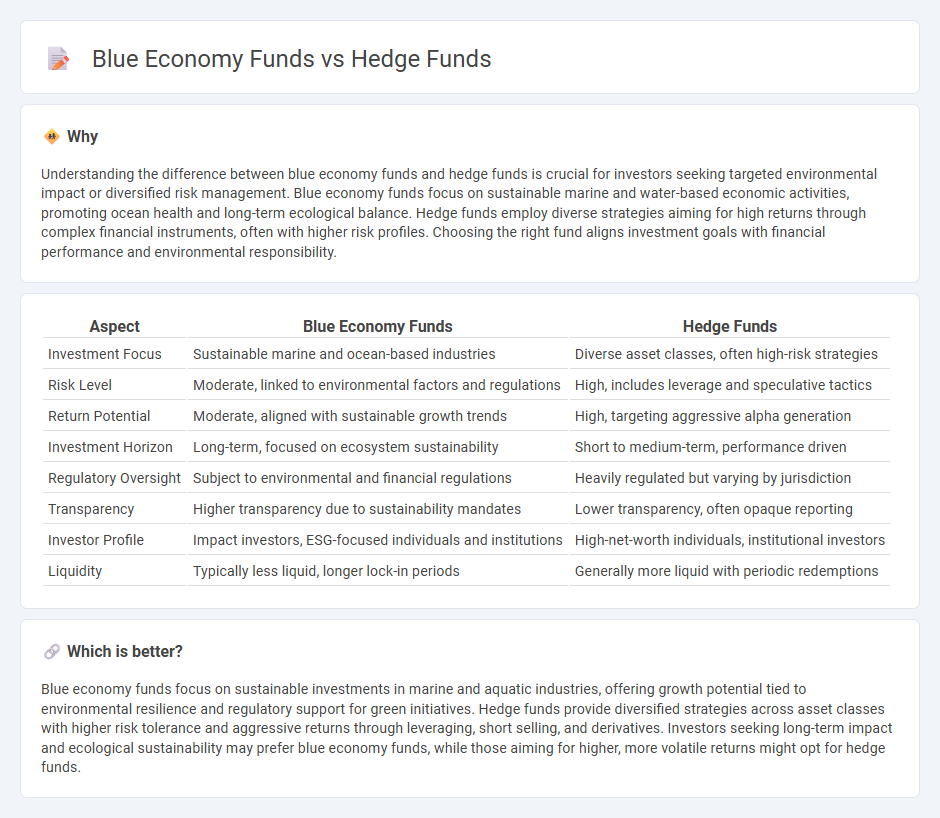

Understanding the difference between blue economy funds and hedge funds is crucial for investors seeking targeted environmental impact or diversified risk management. Blue economy funds focus on sustainable marine and water-based economic activities, promoting ocean health and long-term ecological balance. Hedge funds employ diverse strategies aiming for high returns through complex financial instruments, often with higher risk profiles. Choosing the right fund aligns investment goals with financial performance and environmental responsibility.

Comparison Table

| Aspect | Blue Economy Funds | Hedge Funds |

|---|---|---|

| Investment Focus | Sustainable marine and ocean-based industries | Diverse asset classes, often high-risk strategies |

| Risk Level | Moderate, linked to environmental factors and regulations | High, includes leverage and speculative tactics |

| Return Potential | Moderate, aligned with sustainable growth trends | High, targeting aggressive alpha generation |

| Investment Horizon | Long-term, focused on ecosystem sustainability | Short to medium-term, performance driven |

| Regulatory Oversight | Subject to environmental and financial regulations | Heavily regulated but varying by jurisdiction |

| Transparency | Higher transparency due to sustainability mandates | Lower transparency, often opaque reporting |

| Investor Profile | Impact investors, ESG-focused individuals and institutions | High-net-worth individuals, institutional investors |

| Liquidity | Typically less liquid, longer lock-in periods | Generally more liquid with periodic redemptions |

Which is better?

Blue economy funds focus on sustainable investments in marine and aquatic industries, offering growth potential tied to environmental resilience and regulatory support for green initiatives. Hedge funds provide diversified strategies across asset classes with higher risk tolerance and aggressive returns through leveraging, short selling, and derivatives. Investors seeking long-term impact and ecological sustainability may prefer blue economy funds, while those aiming for higher, more volatile returns might opt for hedge funds.

Connection

Blue economy funds and hedge funds intersect through their shared investment in sustainable and ocean-related assets, leveraging hedge funds' strategies to optimize returns in blue economy sectors like fisheries, marine technology, and renewable ocean energy. Hedge funds often provide liquidity and risk management expertise, enabling blue economy funds to scale projects that promote marine conservation and sustainable resource exploitation. This connection fosters capital flow into innovative ocean-centric businesses, enhancing environmental impact alongside financial performance.

Key Terms

Leverage

Hedge funds often utilize high leverage to amplify returns, employing derivatives and borrowing strategies to maximize capital efficiency. Blue economy funds typically adopt moderate leverage, focusing on sustainable investments within marine and aquatic sectors to balance growth potential with environmental impact. Explore more about the strategic differences in leverage between these fund types and their risk profiles.

Impact Investing

Hedge funds primarily seek high financial returns through diverse, often high-risk strategies, while blue economy funds invest in sustainable ocean-based industries to generate both financial gains and positive environmental impacts. Blue economy funds emphasize impact investing by targeting sectors like marine conservation, sustainable fisheries, and renewable ocean energy to support ecological health and community well-being. Explore how balancing profit and purpose can drive innovative investment approaches in these contrasting fund types.

Sustainable Finance

Hedge funds typically employ high-risk, high-return strategies with limited emphasis on environmental impact, while blue economy funds specifically invest in sustainable marine and coastal resources to promote long-term ecological and economic health. Blue economy funds prioritize projects like renewable ocean energy, sustainable fisheries, and marine conservation, aligning closely with Sustainable Finance principles to support global climate goals. Explore in-depth comparisons to understand how each fund type integrates sustainability and financial returns.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment funds that aim to beat the market or reduce risk by using a diverse range of alternative investment strategies not available to traditional funds, and they target absolute returns rather than relative ones.

Hedge Funds | Investor.gov - Hedge funds are private and unregistered investment funds that pool money from institutional or accredited investors to invest in a variety of assets, pursue flexible and potentially riskier strategies, and are not subject to the same regulations as mutual funds or ETFs.

Hedge fund - Wikipedia - Hedge funds are pooled investment vehicles that use complex trading and risk management techniques, generally charge both a management fee and a performance fee, and have become a major segment of the global asset management industry.

dowidth.com

dowidth.com