Royalty rights investing involves earning passive income through agreements that grant a percentage of revenue or profits from intellectual property, such as music, patents, or natural resources, without managing daily operations. Franchise ownership requires an upfront investment and active management of a business using an established brand, offering operational control but also operational risks and responsibilities. Explore the benefits and risks of each approach to determine which investment strategy aligns with your financial goals.

Why it is important

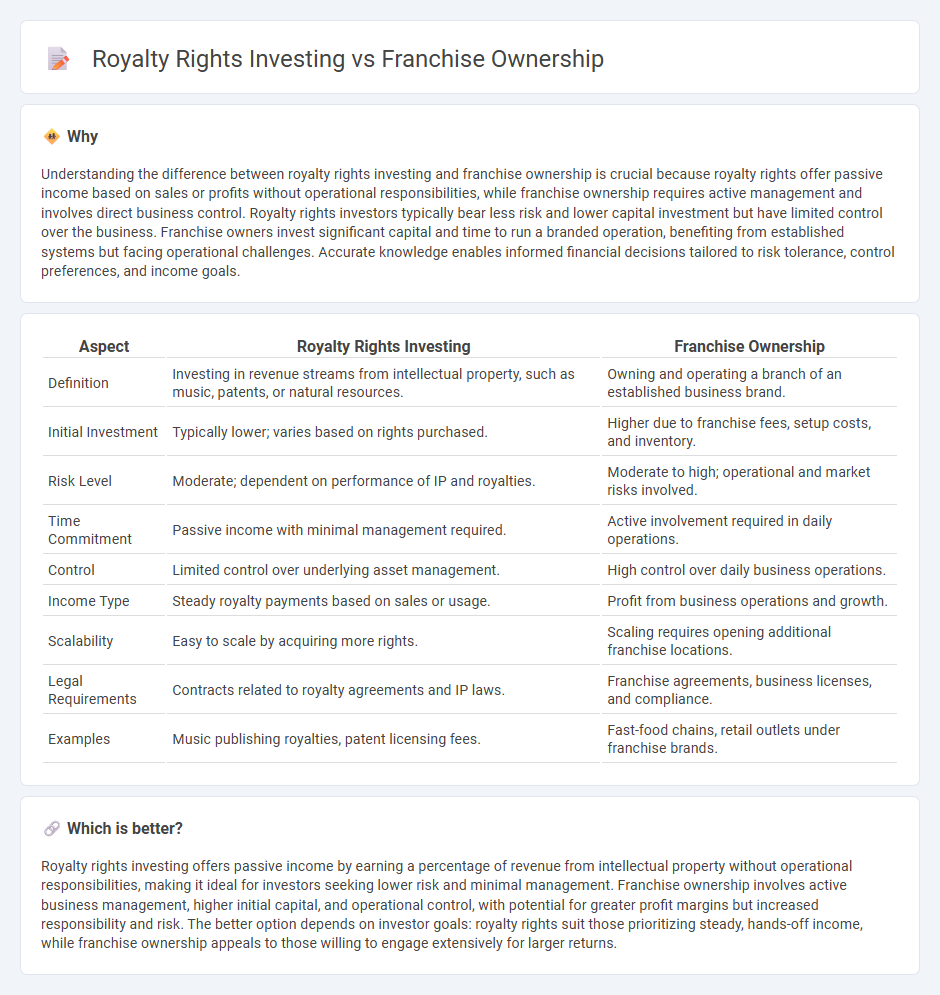

Understanding the difference between royalty rights investing and franchise ownership is crucial because royalty rights offer passive income based on sales or profits without operational responsibilities, while franchise ownership requires active management and involves direct business control. Royalty rights investors typically bear less risk and lower capital investment but have limited control over the business. Franchise owners invest significant capital and time to run a branded operation, benefiting from established systems but facing operational challenges. Accurate knowledge enables informed financial decisions tailored to risk tolerance, control preferences, and income goals.

Comparison Table

| Aspect | Royalty Rights Investing | Franchise Ownership |

|---|---|---|

| Definition | Investing in revenue streams from intellectual property, such as music, patents, or natural resources. | Owning and operating a branch of an established business brand. |

| Initial Investment | Typically lower; varies based on rights purchased. | Higher due to franchise fees, setup costs, and inventory. |

| Risk Level | Moderate; dependent on performance of IP and royalties. | Moderate to high; operational and market risks involved. |

| Time Commitment | Passive income with minimal management required. | Active involvement required in daily operations. |

| Control | Limited control over underlying asset management. | High control over daily business operations. |

| Income Type | Steady royalty payments based on sales or usage. | Profit from business operations and growth. |

| Scalability | Easy to scale by acquiring more rights. | Scaling requires opening additional franchise locations. |

| Legal Requirements | Contracts related to royalty agreements and IP laws. | Franchise agreements, business licenses, and compliance. |

| Examples | Music publishing royalties, patent licensing fees. | Fast-food chains, retail outlets under franchise brands. |

Which is better?

Royalty rights investing offers passive income by earning a percentage of revenue from intellectual property without operational responsibilities, making it ideal for investors seeking lower risk and minimal management. Franchise ownership involves active business management, higher initial capital, and operational control, with potential for greater profit margins but increased responsibility and risk. The better option depends on investor goals: royalty rights suit those prioritizing steady, hands-off income, while franchise ownership appeals to those willing to engage extensively for larger returns.

Connection

Royalty rights investing and franchise ownership both generate passive income streams by leveraging intellectual property and brand value. Investors in royalty rights earn returns from ongoing revenue generated by licensed products, while franchise owners pay royalties to use established trademarks and business models. This interconnected financial structure creates mutually beneficial opportunities for wealth creation through intellectual property monetization.

Key Terms

Control

Franchise ownership offers direct operational control and decision-making power over the business, while royalty rights investing provides passive income with little to no involvement in day-to-day management. Franchise owners bear the responsibility and risks associated with running the business, whereas royalty investors benefit from contractual revenue streams without operational burdens. Explore the nuances of control dynamics to determine the optimal investment strategy.

Revenue Stream

Franchise ownership generates revenue through direct sales, royalties, and fees from franchisees, ensuring multiple income streams tied to operational success. Royalty rights investing provides passive income by receiving a percentage of sales without involvement in daily management, appealing to investors seeking less active roles. Explore detailed analyses to understand which revenue stream aligns best with your financial goals.

Intellectual Property

Franchise ownership grants entrepreneurs the right to operate a business using a franchisor's established brand and business model, involving ongoing royalty payments and strict adherence to intellectual property guidelines. Royalty rights investing focuses on acquiring the legal rights to receive income generated from a particular intellectual property asset, such as patents, trademarks, or copyrighted material, without direct operational responsibilities. Discover how leveraging intellectual property through different models can maximize your investment portfolio's potential.

Source and External Links

What does a franchise owner do? - CareerExplorer - A franchise owner is an entrepreneur who operates one or more locations of a larger franchised business, utilizing the brand name, business model, and operational systems provided by the franchisor.

A Consumer's Guide to Buying a Franchise - This guide provides insights into the franchise business model, including the costs and responsibilities associated with purchasing and operating a franchise.

What is a Franchise Owner & How Do I Become One? - This resource outlines what it means to own a franchise and offers guidance on becoming a franchise owner, highlighting the benefits of lower risk and higher success rates compared to independent businesses.

dowidth.com

dowidth.com