Digital real estate offers ownership of virtual properties in metaverses and online platforms, providing unique opportunities for capital appreciation and passive income through digital asset management. Crowdfunding allows multiple investors to pool resources into real estate projects, enabling diversified portfolios and access to larger developments with lower individual capital. Explore the advantages and risks of these innovative investment methods to discover which aligns best with your financial goals.

Why it is important

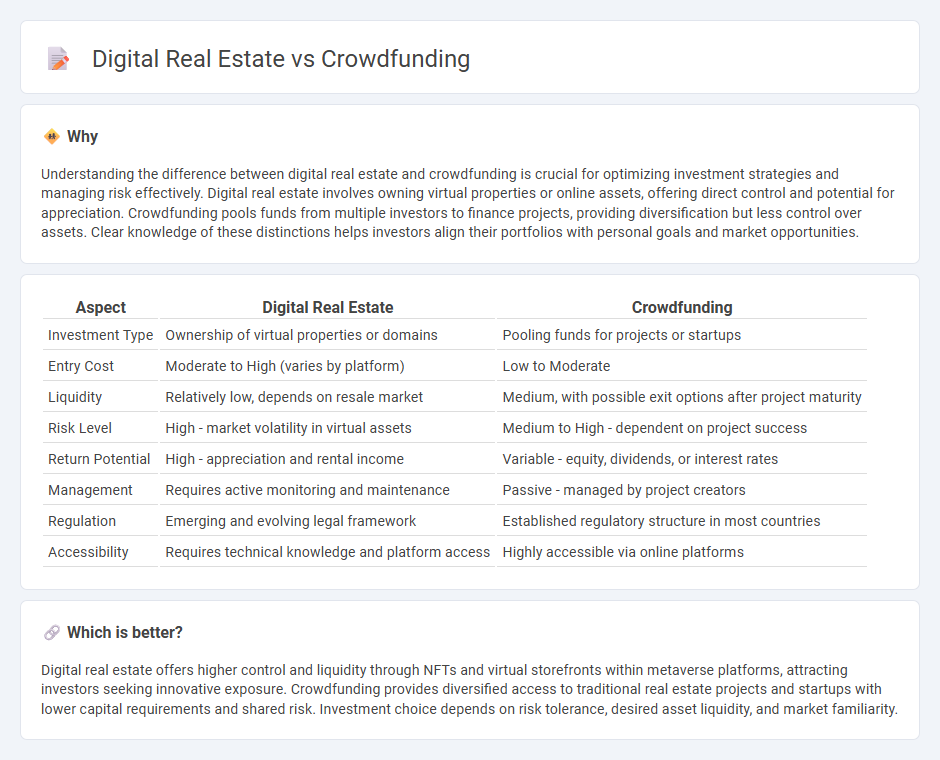

Understanding the difference between digital real estate and crowdfunding is crucial for optimizing investment strategies and managing risk effectively. Digital real estate involves owning virtual properties or online assets, offering direct control and potential for appreciation. Crowdfunding pools funds from multiple investors to finance projects, providing diversification but less control over assets. Clear knowledge of these distinctions helps investors align their portfolios with personal goals and market opportunities.

Comparison Table

| Aspect | Digital Real Estate | Crowdfunding |

|---|---|---|

| Investment Type | Ownership of virtual properties or domains | Pooling funds for projects or startups |

| Entry Cost | Moderate to High (varies by platform) | Low to Moderate |

| Liquidity | Relatively low, depends on resale market | Medium, with possible exit options after project maturity |

| Risk Level | High - market volatility in virtual assets | Medium to High - dependent on project success |

| Return Potential | High - appreciation and rental income | Variable - equity, dividends, or interest rates |

| Management | Requires active monitoring and maintenance | Passive - managed by project creators |

| Regulation | Emerging and evolving legal framework | Established regulatory structure in most countries |

| Accessibility | Requires technical knowledge and platform access | Highly accessible via online platforms |

Which is better?

Digital real estate offers higher control and liquidity through NFTs and virtual storefronts within metaverse platforms, attracting investors seeking innovative exposure. Crowdfunding provides diversified access to traditional real estate projects and startups with lower capital requirements and shared risk. Investment choice depends on risk tolerance, desired asset liquidity, and market familiarity.

Connection

Digital real estate and crowdfunding intersect as innovative investment strategies leveraging online platforms to democratize access to property markets. Crowdfunding enables multiple investors to pool capital digitally, acquiring shares in virtual or physical real estate assets without traditional barriers. This synergy accelerates capital inflow, diversifies portfolios, and enhances liquidity in the evolving real estate investment ecosystem.

Key Terms

Crowdfunding Platform

Crowdfunding platforms enable investors to pool their resources and fund diverse projects or startups, offering fractional ownership and reduced risk compared to traditional investments. These platforms enhance accessibility by lowering entry barriers and providing transparent performance metrics and real-time updates on campaign progress. Explore the dynamic features and benefits of top crowdfunding platforms to maximize your investment potential.

Tokenization

Crowdfunding in real estate allows multiple investors to pool funds into a property project, facilitating shared ownership and lower entry barriers, while digital real estate tokenization represents ownership through blockchain-based tokens that can be easily traded on secondary markets. Tokenization enhances liquidity and transparency by converting real estate assets into digital tokens, enabling fractional ownership and streamlined transactions. Explore deeper insights into how tokenization is revolutionizing investment strategies in real estate markets.

Passive Income

Crowdfunding allows investors to pool resources into projects like startups or real estate, generating passive income through dividends or profit shares without direct management responsibilities. Digital real estate involves owning and monetizing online properties such as websites, domain names, or virtual land, producing ongoing revenue streams via ads, affiliate marketing, or leasing. Explore the differences in risk, scalability, and income potential between crowdfunding and digital real estate to determine the best passive income strategy for your portfolio.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, bypassing traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding enables startups and projects to raise money through the collective efforts of individuals online, offering an alternative to conventional financing methods.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to collect small amounts from many people, and can take the form of donation, reward, equity-based, or peer-to-peer lending models.

dowidth.com

dowidth.com