Sports memorabilia funds focus on acquiring valuable collectibles such as autographed jerseys, rare trading cards, and championship trophies, capitalizing on the growing market for authentic sports assets. Venture capital funds prioritize investing in early-stage startups with high growth potential, typically within technology, healthcare, or innovative sectors, seeking significant equity returns. Explore the unique benefits and risks of both investment types to determine the best strategy for your portfolio.

Why it is important

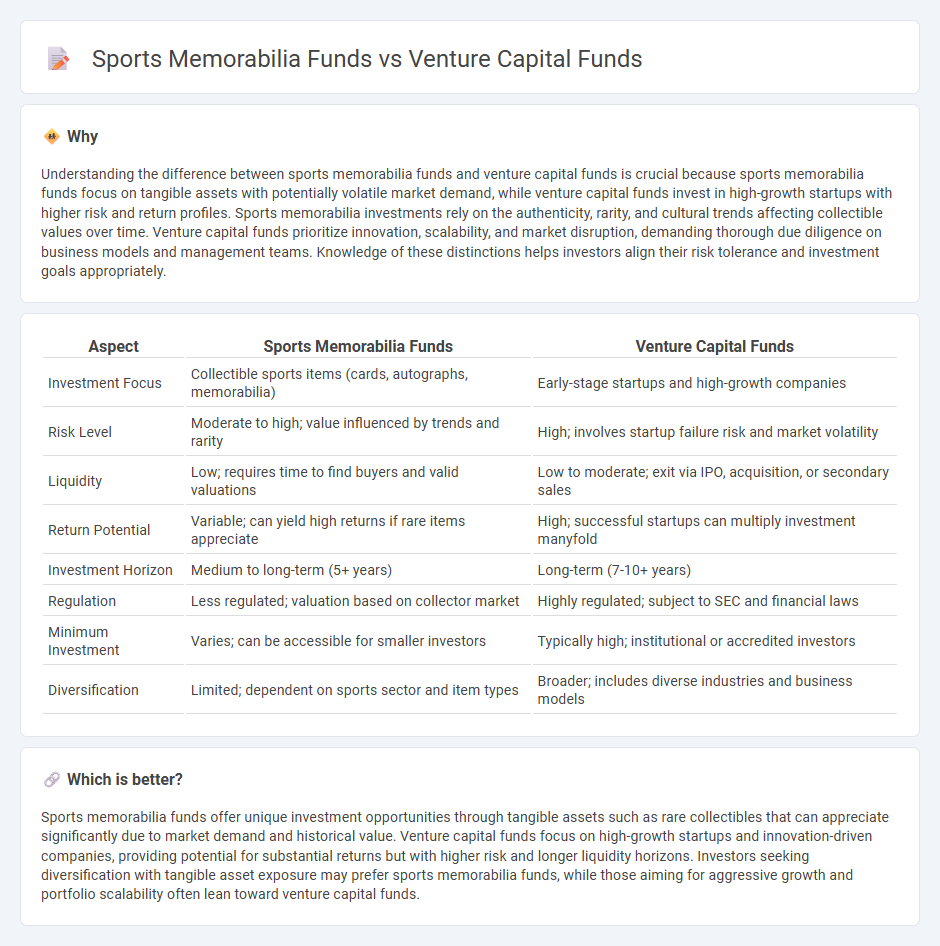

Understanding the difference between sports memorabilia funds and venture capital funds is crucial because sports memorabilia funds focus on tangible assets with potentially volatile market demand, while venture capital funds invest in high-growth startups with higher risk and return profiles. Sports memorabilia investments rely on the authenticity, rarity, and cultural trends affecting collectible values over time. Venture capital funds prioritize innovation, scalability, and market disruption, demanding thorough due diligence on business models and management teams. Knowledge of these distinctions helps investors align their risk tolerance and investment goals appropriately.

Comparison Table

| Aspect | Sports Memorabilia Funds | Venture Capital Funds |

|---|---|---|

| Investment Focus | Collectible sports items (cards, autographs, memorabilia) | Early-stage startups and high-growth companies |

| Risk Level | Moderate to high; value influenced by trends and rarity | High; involves startup failure risk and market volatility |

| Liquidity | Low; requires time to find buyers and valid valuations | Low to moderate; exit via IPO, acquisition, or secondary sales |

| Return Potential | Variable; can yield high returns if rare items appreciate | High; successful startups can multiply investment manyfold |

| Investment Horizon | Medium to long-term (5+ years) | Long-term (7-10+ years) |

| Regulation | Less regulated; valuation based on collector market | Highly regulated; subject to SEC and financial laws |

| Minimum Investment | Varies; can be accessible for smaller investors | Typically high; institutional or accredited investors |

| Diversification | Limited; dependent on sports sector and item types | Broader; includes diverse industries and business models |

Which is better?

Sports memorabilia funds offer unique investment opportunities through tangible assets such as rare collectibles that can appreciate significantly due to market demand and historical value. Venture capital funds focus on high-growth startups and innovation-driven companies, providing potential for substantial returns but with higher risk and longer liquidity horizons. Investors seeking diversification with tangible asset exposure may prefer sports memorabilia funds, while those aiming for aggressive growth and portfolio scalability often lean toward venture capital funds.

Connection

Sports memorabilia funds and venture capital funds intersect through their shared focus on alternative asset investment strategies, diversifying portfolios beyond traditional markets. Both fund types leverage market trends and collector demand to generate returns, with venture capital funds sometimes investing in startups within the sports memorabilia industry. The growing digital marketplace and blockchain technology further connect these funds by enabling fractional ownership and enhanced liquidity of sports collectibles.

Key Terms

**Venture Capital Funds:**

Venture capital funds invest in early-stage companies with high growth potential, providing critical capital to startups across technology, healthcare, and fintech sectors. These funds typically offer higher returns but come with increased risk due to market volatility and company failures. Explore more about how venture capital funds can diversify your investment portfolio and fuel innovation.

Equity Stake

Venture capital funds primarily seek significant equity stakes in early-stage startups to maximize long-term growth potential and influence company strategy. Sports memorabilia funds invest in rare collectibles and physical assets, offering limited or indirect equity exposure with value largely driven by market demand and rarity. Explore the nuances between these investment vehicles to make informed decisions on equity participation and asset appreciation.

Startups

Venture capital funds primarily invest in high-growth startups across technology, healthcare, and other innovative sectors, aiming for substantial equity returns through early-stage company success. Sports memorabilia funds focus on acquiring and managing valuable collectibles related to athletes and historic sports moments, with returns tied to the appreciation and market demand for these physical assets. Explore detailed comparisons to understand the investment strategies and risk profiles of these distinct fund types.

Source and External Links

Venture Capital Funds: What they are & how to invest in them - Venture capital funds pool money from investors to finance early-stage startups with high growth potential, often managing risk by investing in many companies and actively supporting them to eventually exit via IPO or acquisition.

What is a Venture Capital Fund? - Venture capital funds are pooled investment vehicles managed by general partners who invest in startups in exchange for ownership, with limited partners providing capital and returns realized mostly through liquidity events like IPOs or acquisitions.

Venture capital - VC is private equity financing for startups and emerging companies, covering multiple financing stages from pre-seed to growth capital, with exits typically occurring through IPOs, acquisitions, or secondary sales to new investors.

dowidth.com

dowidth.com