Investment in royalty streams offers consistent income through rights to a percentage of revenue generated by assets like music, patents, or natural resources, contrasting with capital gains that rely on asset appreciation and eventual sale. Royalty streams provide predictable cash flow with lower volatility, while capital gains investments can yield higher returns but carry greater risk and longer time horizons. Explore how blending both strategies can optimize portfolio diversification and financial stability.

Why it is important

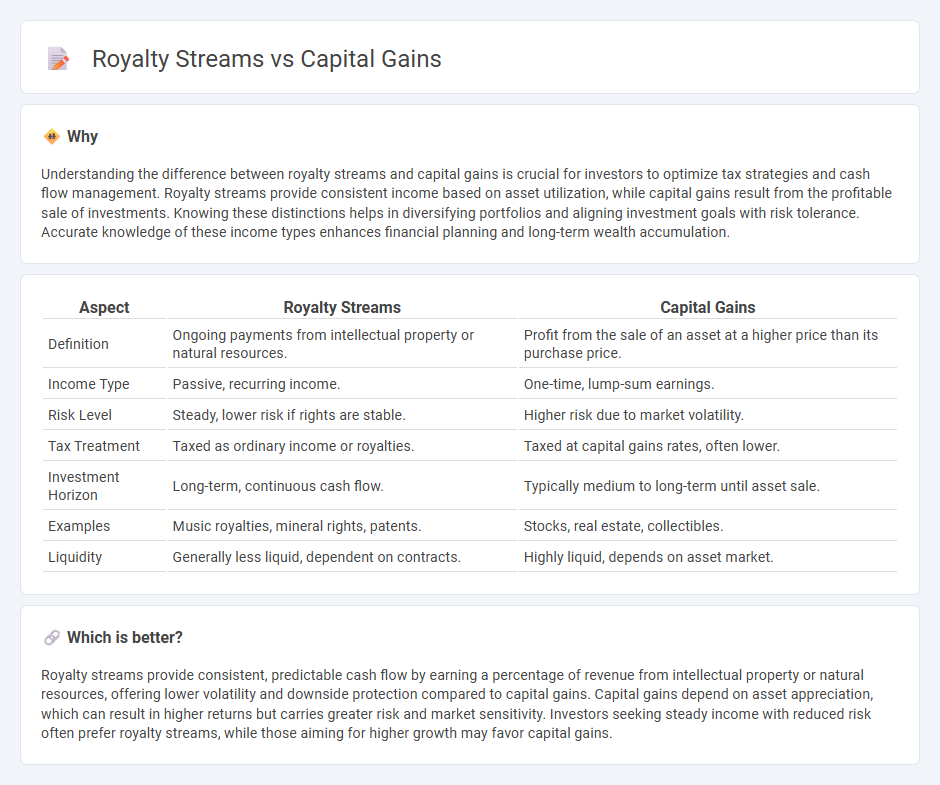

Understanding the difference between royalty streams and capital gains is crucial for investors to optimize tax strategies and cash flow management. Royalty streams provide consistent income based on asset utilization, while capital gains result from the profitable sale of investments. Knowing these distinctions helps in diversifying portfolios and aligning investment goals with risk tolerance. Accurate knowledge of these income types enhances financial planning and long-term wealth accumulation.

Comparison Table

| Aspect | Royalty Streams | Capital Gains |

|---|---|---|

| Definition | Ongoing payments from intellectual property or natural resources. | Profit from the sale of an asset at a higher price than its purchase price. |

| Income Type | Passive, recurring income. | One-time, lump-sum earnings. |

| Risk Level | Steady, lower risk if rights are stable. | Higher risk due to market volatility. |

| Tax Treatment | Taxed as ordinary income or royalties. | Taxed at capital gains rates, often lower. |

| Investment Horizon | Long-term, continuous cash flow. | Typically medium to long-term until asset sale. |

| Examples | Music royalties, mineral rights, patents. | Stocks, real estate, collectibles. |

| Liquidity | Generally less liquid, dependent on contracts. | Highly liquid, depends on asset market. |

Which is better?

Royalty streams provide consistent, predictable cash flow by earning a percentage of revenue from intellectual property or natural resources, offering lower volatility and downside protection compared to capital gains. Capital gains depend on asset appreciation, which can result in higher returns but carries greater risk and market sensitivity. Investors seeking steady income with reduced risk often prefer royalty streams, while those aiming for higher growth may favor capital gains.

Connection

Royalty streams generate consistent income from intellectual property or natural resources, providing investors with a reliable cash flow. Capital gains arise when the underlying asset, such as patents or mineral rights, appreciates in value over time. Combining royalty income with capital appreciation enhances overall investment returns by leveraging both steady earnings and asset growth.

Key Terms

Appreciation

Capital gains stem from the appreciation of an asset's value over time, resulting in profit upon sale. Royalty streams generate ongoing income based on usage or sales of intellectual property without necessarily reflecting asset appreciation. Explore the differences to optimize investment strategies and income potential.

Passive Income

Capital gains generate profit from the sale of assets like stocks or real estate, providing substantial but often sporadic passive income. Royalty streams deliver continuous passive income through ongoing payments from intellectual property rights, such as patents, copyrights, or mineral rights. Explore deeper insights to optimize your passive income strategy effectively.

Intellectual Property

Capital gains from intellectual property (IP) arise when an IP asset, such as a patent or trademark, is sold or transferred at a profit, reflecting the asset's increased market value. Royalty streams generate ongoing revenue by licensing the IP to others, providing a steady cash flow based on usage or sales agreements. Explore the differences in financial impact and strategic implications of capital gains versus royalty income on your IP portfolio.

Source and External Links

What is capital gains tax? | Vanguard - Capital gains are profits made when you sell investments at a higher price than you paid, and taxes are owed only when those gains are realized upon sale, with rates varying by how long you held the investment.

2024-2025 Long-Term Capital Gains Tax Rates - Capital gains tax is a tax on profit from selling assets like stocks or real estate, with rates depending on how long you held the asset and your income, with long-term gains (held over a year) taxed at 0%, 15%, or 20%.

2024 and 2025 Capital Gains Tax Rates and Rules - Capital gains are profits from selling assets including investments or tangible items at a price higher than original value, and the tax owed depends on the type of asset, length of ownership, and other factors.

dowidth.com

dowidth.com