Litigation funding involves third-party financing of legal cases, offering potential high returns linked to case outcomes, while corporate bonds are debt securities providing fixed income with lower risk. Both investment options present unique risk profiles and liquidity considerations crucial for portfolio diversification. Discover how these strategies can fit your investment goals and risk tolerance.

Why it is important

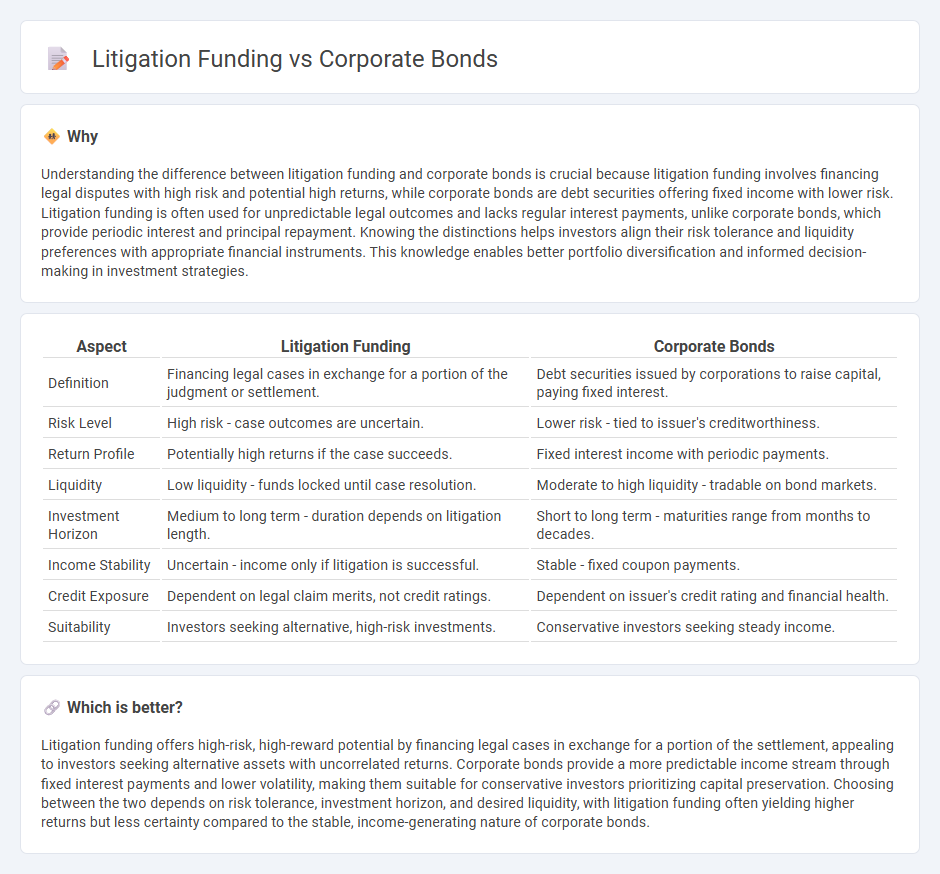

Understanding the difference between litigation funding and corporate bonds is crucial because litigation funding involves financing legal disputes with high risk and potential high returns, while corporate bonds are debt securities offering fixed income with lower risk. Litigation funding is often used for unpredictable legal outcomes and lacks regular interest payments, unlike corporate bonds, which provide periodic interest and principal repayment. Knowing the distinctions helps investors align their risk tolerance and liquidity preferences with appropriate financial instruments. This knowledge enables better portfolio diversification and informed decision-making in investment strategies.

Comparison Table

| Aspect | Litigation Funding | Corporate Bonds |

|---|---|---|

| Definition | Financing legal cases in exchange for a portion of the judgment or settlement. | Debt securities issued by corporations to raise capital, paying fixed interest. |

| Risk Level | High risk - case outcomes are uncertain. | Lower risk - tied to issuer's creditworthiness. |

| Return Profile | Potentially high returns if the case succeeds. | Fixed interest income with periodic payments. |

| Liquidity | Low liquidity - funds locked until case resolution. | Moderate to high liquidity - tradable on bond markets. |

| Investment Horizon | Medium to long term - duration depends on litigation length. | Short to long term - maturities range from months to decades. |

| Income Stability | Uncertain - income only if litigation is successful. | Stable - fixed coupon payments. |

| Credit Exposure | Dependent on legal claim merits, not credit ratings. | Dependent on issuer's credit rating and financial health. |

| Suitability | Investors seeking alternative, high-risk investments. | Conservative investors seeking steady income. |

Which is better?

Litigation funding offers high-risk, high-reward potential by financing legal cases in exchange for a portion of the settlement, appealing to investors seeking alternative assets with uncorrelated returns. Corporate bonds provide a more predictable income stream through fixed interest payments and lower volatility, making them suitable for conservative investors prioritizing capital preservation. Choosing between the two depends on risk tolerance, investment horizon, and desired liquidity, with litigation funding often yielding higher returns but less certainty compared to the stable, income-generating nature of corporate bonds.

Connection

Litigation funding provides capital to finance legal cases, often backed by investors seeking alternative assets, creating demand for corporate bonds issued by companies involved in legal disputes to manage cash flow and liabilities. Corporate bonds serve as a financing tool for corporations to raise funds for operations, including litigation expenses, linking bond issuance to the availability of litigation funding. This connection enhances liquidity and risk management for companies navigating costly legal proceedings, making investment in corporate bonds attractive to those involved in litigation funding.

Key Terms

Yield

Corporate bonds typically offer fixed yields based on the issuer's credit rating and prevailing interest rates, providing predictable income with moderate risk exposure. Litigation funding yields are often higher due to the inherent uncertainty and longer time horizon but carry increased risk of total loss if the case is unsuccessful. Explore detailed comparisons to understand which investment aligns with your risk tolerance and return expectations.

Risk assessment

Corporate bonds involve assessing credit risk by analyzing issuer's financial health, market conditions, and default probabilities to ensure stable returns. Litigation funding requires evaluating legal case merits, potential award values, and duration to gauge investment risks and expected outcomes. Explore detailed risk assessment strategies to optimize choices between these financial instruments.

Legal claim

Corporate bonds represent debt securities issued by companies to raise capital, with fixed interest payments and repayment of principal at maturity. Litigation funding involves third-party investment to finance legal claims, offering potential returns linked to the case's outcome rather than fixed payments. Explore the key differences and strategic advantages of legal claim financing to understand their unique roles in financial portfolios.

Source and External Links

Corporate Bonds - Fidelity - Corporate bonds are debt obligations issued by corporations to fund capital needs, with fixed-rate coupons being the most common form; they can be classified as investment grade or high yield based on credit ratings that reflect varying risk levels and yields.

Corporate Bonds - U.S. SEC Office of Investor Education - Corporate bonds represent loans from investors to companies, which legally obligate the company to pay periodic interest and return principal at maturity, with bondholders having priority over shareholders in bankruptcy.

Corporate bond - Wikipedia - Corporate bonds are issued by companies for financing purposes and trade mostly over-the-counter, categorized mainly as high grade (investment grade) or high yield (speculative/junk bonds) based on their credit ratings.

dowidth.com

dowidth.com