Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them online for a profit, capitalizing on market demand and brand hype. Business acquisition requires purchasing an existing company, offering potential long-term revenue streams, operational control, and asset ownership. Explore the advantages and challenges of each investment strategy to determine which aligns best with your financial goals.

Why it is important

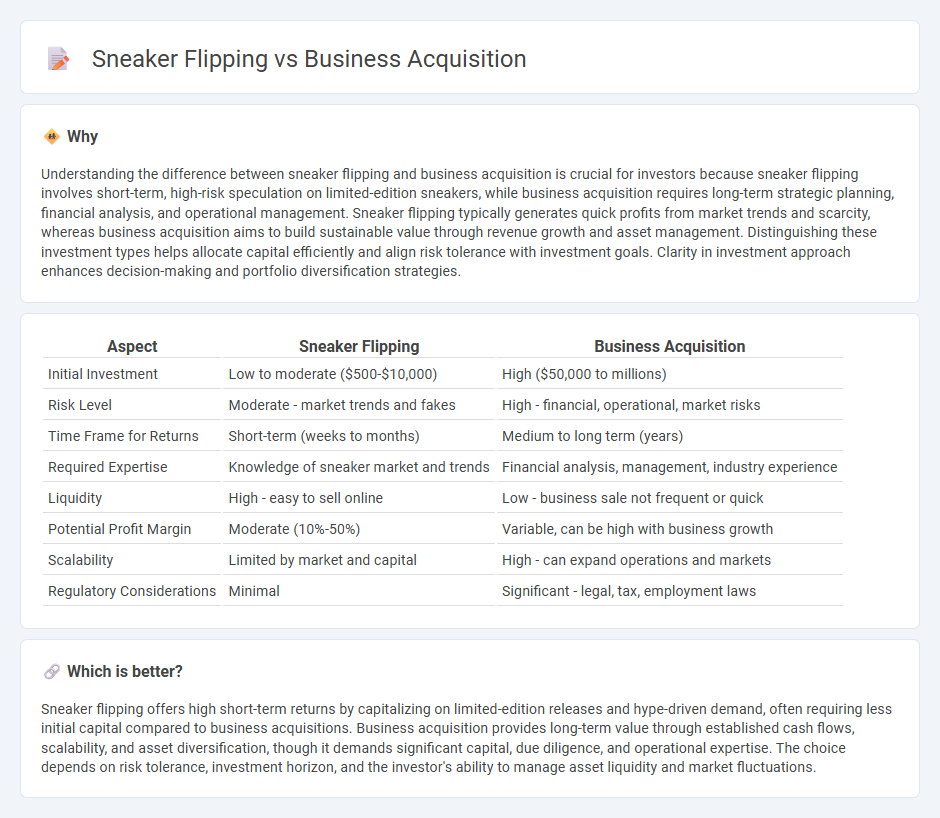

Understanding the difference between sneaker flipping and business acquisition is crucial for investors because sneaker flipping involves short-term, high-risk speculation on limited-edition sneakers, while business acquisition requires long-term strategic planning, financial analysis, and operational management. Sneaker flipping typically generates quick profits from market trends and scarcity, whereas business acquisition aims to build sustainable value through revenue growth and asset management. Distinguishing these investment types helps allocate capital efficiently and align risk tolerance with investment goals. Clarity in investment approach enhances decision-making and portfolio diversification strategies.

Comparison Table

| Aspect | Sneaker Flipping | Business Acquisition |

|---|---|---|

| Initial Investment | Low to moderate ($500-$10,000) | High ($50,000 to millions) |

| Risk Level | Moderate - market trends and fakes | High - financial, operational, market risks |

| Time Frame for Returns | Short-term (weeks to months) | Medium to long term (years) |

| Required Expertise | Knowledge of sneaker market and trends | Financial analysis, management, industry experience |

| Liquidity | High - easy to sell online | Low - business sale not frequent or quick |

| Potential Profit Margin | Moderate (10%-50%) | Variable, can be high with business growth |

| Scalability | Limited by market and capital | High - can expand operations and markets |

| Regulatory Considerations | Minimal | Significant - legal, tax, employment laws |

Which is better?

Sneaker flipping offers high short-term returns by capitalizing on limited-edition releases and hype-driven demand, often requiring less initial capital compared to business acquisitions. Business acquisition provides long-term value through established cash flows, scalability, and asset diversification, though it demands significant capital, due diligence, and operational expertise. The choice depends on risk tolerance, investment horizon, and the investor's ability to manage asset liquidity and market fluctuations.

Connection

Sneaker flipping and business acquisition both involve strategic investment aimed at maximizing returns through market demand and asset appreciation. Sneaker flipping leverages limited-edition, high-demand footwear to generate quick profits, while business acquisition focuses on acquiring companies with growth potential or undervalued assets. Both methods rely on deep market research, timing, and an understanding of consumer trends to capitalize on value fluctuations.

Key Terms

Business acquisition:

Business acquisition involves purchasing an existing company or its assets to gain market share, increase revenue, and leverage operational synergies, often requiring significant capital investment and due diligence. It provides strategic advantages such as established customer bases, brand equity, and operational infrastructure, distinguishing it from sneaker flipping, which focuses on short-term profit through reselling limited-edition footwear. Explore the key benefits and challenges of business acquisition to make informed investment decisions.

Due diligence

Due diligence in business acquisition involves a comprehensive evaluation of financial statements, legal contracts, market positioning, and potential liabilities to ensure informed decision-making and risk mitigation. In sneaker flipping, due diligence primarily focuses on verifying authenticity, market trends, and resale values to maximize profit and avoid counterfeit products. Explore more about effective due diligence strategies and their impact on investment outcomes.

Valuation

Business acquisition valuation involves analyzing financial statements, market conditions, and growth potential to determine a company's fair market value. Sneaker flipping valuation primarily depends on brand reputation, rarity, demand, and resale market trends, often influenced by limited releases and hype cycles. Explore in-depth strategies to accurately assess value in both domains.

Source and External Links

The Acquisition Timeline: How Long Does It Really Take? - Completing a business acquisition typically ranges from several months to years, involving phases of due diligence and integration planning that vary based on deal complexity and the extent of integration planned.

The 10 Steps of the Business Acquisition Process - The business acquisition process involves key steps such as acquisition strategy, target evaluation, drafting and signing purchase agreements, surmounting regulatory approvals, and closing the deal, with financing often finalized post-agreement.

Mergers and acquisitions - Business acquisitions legally take the form of asset purchases, equity purchases, or mergers, where buyers acquire assets, liabilities, or ownership interests, with the specific structure chosen based on strategic goals and transaction details.

dowidth.com

dowidth.com