Whisky cask investment offers potential high returns through the aging and rarity of premium barrels, with market demand driven by collectors and connoisseurs. Luxury watch investment provides value appreciation tied to brand prestige, limited editions, and historical significance, appealing to affluent collectors and enthusiasts. Explore detailed insights to determine which asset aligns best with your investment goals and risk profile.

Why it is important

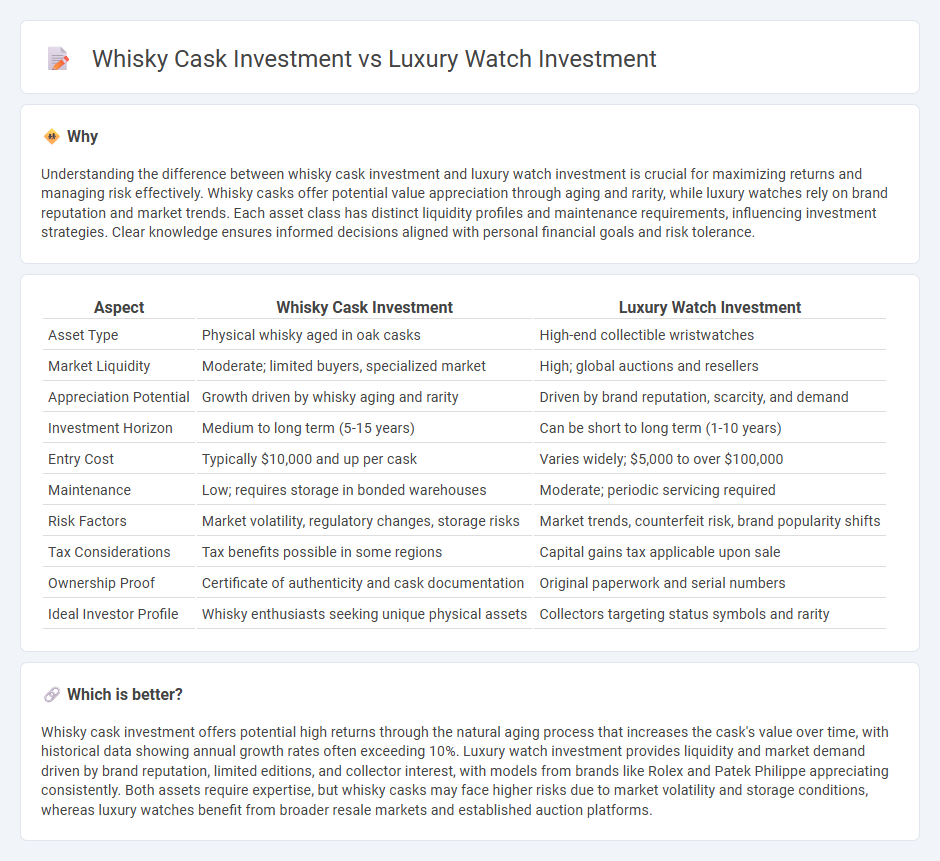

Understanding the difference between whisky cask investment and luxury watch investment is crucial for maximizing returns and managing risk effectively. Whisky casks offer potential value appreciation through aging and rarity, while luxury watches rely on brand reputation and market trends. Each asset class has distinct liquidity profiles and maintenance requirements, influencing investment strategies. Clear knowledge ensures informed decisions aligned with personal financial goals and risk tolerance.

Comparison Table

| Aspect | Whisky Cask Investment | Luxury Watch Investment |

|---|---|---|

| Asset Type | Physical whisky aged in oak casks | High-end collectible wristwatches |

| Market Liquidity | Moderate; limited buyers, specialized market | High; global auctions and resellers |

| Appreciation Potential | Growth driven by whisky aging and rarity | Driven by brand reputation, scarcity, and demand |

| Investment Horizon | Medium to long term (5-15 years) | Can be short to long term (1-10 years) |

| Entry Cost | Typically $10,000 and up per cask | Varies widely; $5,000 to over $100,000 |

| Maintenance | Low; requires storage in bonded warehouses | Moderate; periodic servicing required |

| Risk Factors | Market volatility, regulatory changes, storage risks | Market trends, counterfeit risk, brand popularity shifts |

| Tax Considerations | Tax benefits possible in some regions | Capital gains tax applicable upon sale |

| Ownership Proof | Certificate of authenticity and cask documentation | Original paperwork and serial numbers |

| Ideal Investor Profile | Whisky enthusiasts seeking unique physical assets | Collectors targeting status symbols and rarity |

Which is better?

Whisky cask investment offers potential high returns through the natural aging process that increases the cask's value over time, with historical data showing annual growth rates often exceeding 10%. Luxury watch investment provides liquidity and market demand driven by brand reputation, limited editions, and collector interest, with models from brands like Rolex and Patek Philippe appreciating consistently. Both assets require expertise, but whisky casks may face higher risks due to market volatility and storage conditions, whereas luxury watches benefit from broader resale markets and established auction platforms.

Connection

Whisky cask investment and luxury watch investment share a strong connection through their appeal as alternative assets that offer potential appreciation beyond traditional markets. Both markets capitalize on rarity, craftsmanship, and brand heritage, attracting collectors and investors seeking tangible, appreciating assets. Increased global demand and limited supply drive value growth, making these sectors complementary opportunities for portfolio diversification.

Key Terms

Luxury watch investment:

Luxury watch investment offers a blend of timeless craftsmanship and increasing market demand, with models from brands like Rolex, Patek Philippe, and Audemars Piguet appreciating steadily due to limited production and iconic status. The secondary market for luxury watches has demonstrated robust growth, driven by collectors and enthusiasts valuing rarity, mechanical complexity, and heritage. Discover how luxury watch investments can provide both passion and profit by exploring current trends and expert insights.

Brand provenance

Luxury watch investment benefits from established brand provenance, with iconic names like Rolex, Patek Philippe, and Audemars Piguet commanding premium resale values due to their heritage and craftsmanship. Whisky cask investment hinges on distillery reputation and cask rarity, where brands such as Macallan and Glenfiddich drive demand through limited releases and storied production techniques. Explore the nuances of brand provenance in these markets to make informed investment decisions.

Limited edition

Limited edition luxury watches often appreciate in value due to brand prestige, rarity, and meticulous craftsmanship, making them highly sought-after by collectors and investors globally. Limited edition whisky casks gain worth through unique aging processes, distillery reputation, and scarcity, attracting enthusiasts and investors in the alternative asset market. Explore the distinctive benefits and risks of these exclusive investments to make an informed decision.

Source and External Links

Luxury Watches: A Timeless Investment in Portfolio Diversification - Luxury watches have shown modest annual returns (5.68%), underperforming stocks and gold, but offer portfolio diversification benefits due to their low correlation with traditional markets and lower risk profile.

Invest in 'time' for high returns: Luxury watches have outperformed... - Over the past decade, luxury watches delivered 9% annual returns, outperforming vintage cars, art, and diamonds, with prices rising 147% in that period.

Best Investment Watches: Top Timepieces for Value Growth - Investment potential in luxury watches is driven by rarity, limited editions, and strong brand reputation, with brands like Patek Philippe and Rolex consistently showing value appreciation and retention.

dowidth.com

dowidth.com