Fractionalized art investment allows individuals to buy shares in high-value artworks, providing access to a diversified portfolio with lower capital requirements compared to traditional art acquisitions. Angel investing involves funding early-stage startups in exchange for equity, offering high growth potential but with increased risk and less liquidity. Explore these unique investment approaches to find the best fit for your financial goals.

Why it is important

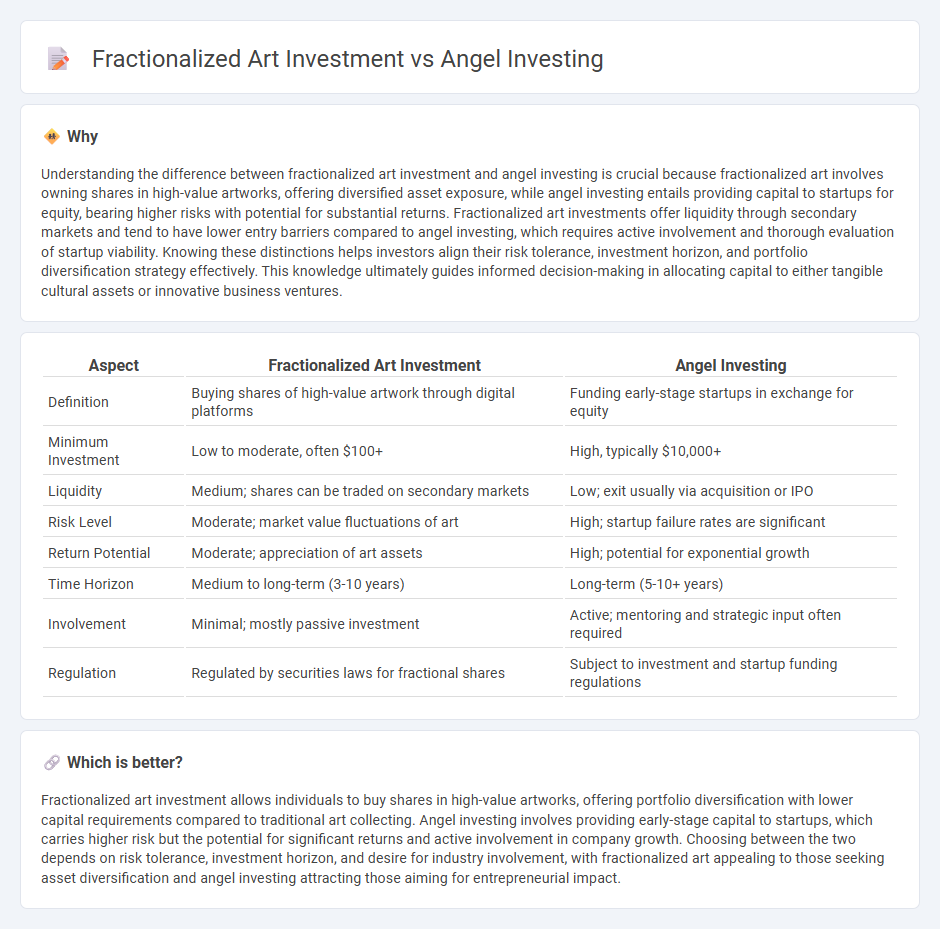

Understanding the difference between fractionalized art investment and angel investing is crucial because fractionalized art involves owning shares in high-value artworks, offering diversified asset exposure, while angel investing entails providing capital to startups for equity, bearing higher risks with potential for substantial returns. Fractionalized art investments offer liquidity through secondary markets and tend to have lower entry barriers compared to angel investing, which requires active involvement and thorough evaluation of startup viability. Knowing these distinctions helps investors align their risk tolerance, investment horizon, and portfolio diversification strategy effectively. This knowledge ultimately guides informed decision-making in allocating capital to either tangible cultural assets or innovative business ventures.

Comparison Table

| Aspect | Fractionalized Art Investment | Angel Investing |

|---|---|---|

| Definition | Buying shares of high-value artwork through digital platforms | Funding early-stage startups in exchange for equity |

| Minimum Investment | Low to moderate, often $100+ | High, typically $10,000+ |

| Liquidity | Medium; shares can be traded on secondary markets | Low; exit usually via acquisition or IPO |

| Risk Level | Moderate; market value fluctuations of art | High; startup failure rates are significant |

| Return Potential | Moderate; appreciation of art assets | High; potential for exponential growth |

| Time Horizon | Medium to long-term (3-10 years) | Long-term (5-10+ years) |

| Involvement | Minimal; mostly passive investment | Active; mentoring and strategic input often required |

| Regulation | Regulated by securities laws for fractional shares | Subject to investment and startup funding regulations |

Which is better?

Fractionalized art investment allows individuals to buy shares in high-value artworks, offering portfolio diversification with lower capital requirements compared to traditional art collecting. Angel investing involves providing early-stage capital to startups, which carries higher risk but the potential for significant returns and active involvement in company growth. Choosing between the two depends on risk tolerance, investment horizon, and desire for industry involvement, with fractionalized art appealing to those seeking asset diversification and angel investing attracting those aiming for entrepreneurial impact.

Connection

Fractionalized art investment and angel investing both leverage collective funding models to democratize access to high-value assets and early-stage startups, enabling investors to diversify portfolios with lower capital requirements. Both approaches utilize digital platforms to fractionalize ownership, increase liquidity, and provide transparent investment opportunities in alternative asset classes. This convergence enhances portfolio diversification strategies by blending tangible assets like art with high-growth potential investments in emerging companies.

Key Terms

Equity stake

Angel investing grants equity stakes in early-stage startups, offering investors ownership and potential high returns contingent on company growth. Fractionalized art investment provides partial ownership in high-value artworks through digital tokens, enabling liquidity and portfolio diversification without full asset control. Discover how these distinct equity models shape investment strategies and risk exposure.

Liquidity

Angel investing typically involves long-term commitments with limited liquidity, as investors often wait years for startups to exit via acquisition or IPO. Fractionalized art investment offers increased liquidity by enabling investors to buy and sell shares of artworks on secondary markets more freely. Explore deeper insights on liquidity advantages and risks in each investment type to optimize your portfolio.

Asset valuation

Angel investing typically involves evaluating startup companies based on projected revenue growth, market potential, and founder experience to assign equity value, while fractionalized art investment relies on appraisals, provenance, and market demand trends to determine the value of art shares. Startup valuations fluctuate with business performance and funding rounds, whereas art asset valuations depend heavily on expert assessments and auction results. Explore deeper insights into how these asset classes are valued to optimize your portfolio diversification strategies.

Source and External Links

Understanding angel financing and investing - Angel investing involves individuals providing early-stage capital to startups in exchange for equity or convertible debt, often mentoring and supporting the founders to help the business reach key milestones and attract further institutional investment.

Demystifying Angel Investing - Angel investors invest in promising startups to generate high returns, create economic impact, and may leverage tax incentives, typically joining networks like the Angel Capital Association for resources and deal flow.

Angel Investors - Wealthy individuals provide capital from their personal net worth to startups in exchange for ownership equity, often providing smaller investments and mentoring over longer periods compared to venture capital firms.

dowidth.com

dowidth.com