Investing in viticulture land offers tangible asset value, agricultural income potential, and capital appreciation tied to wine industry growth, contrasting with hedge funds' diversified portfolios and high liquidity but increased market volatility exposure. Viticulture provides long-term stability and tax advantages, while hedge funds target rapid returns through complex strategies often involving higher risk. Explore detailed analyses to determine which investment aligns with your financial goals and risk appetite.

Why it is important

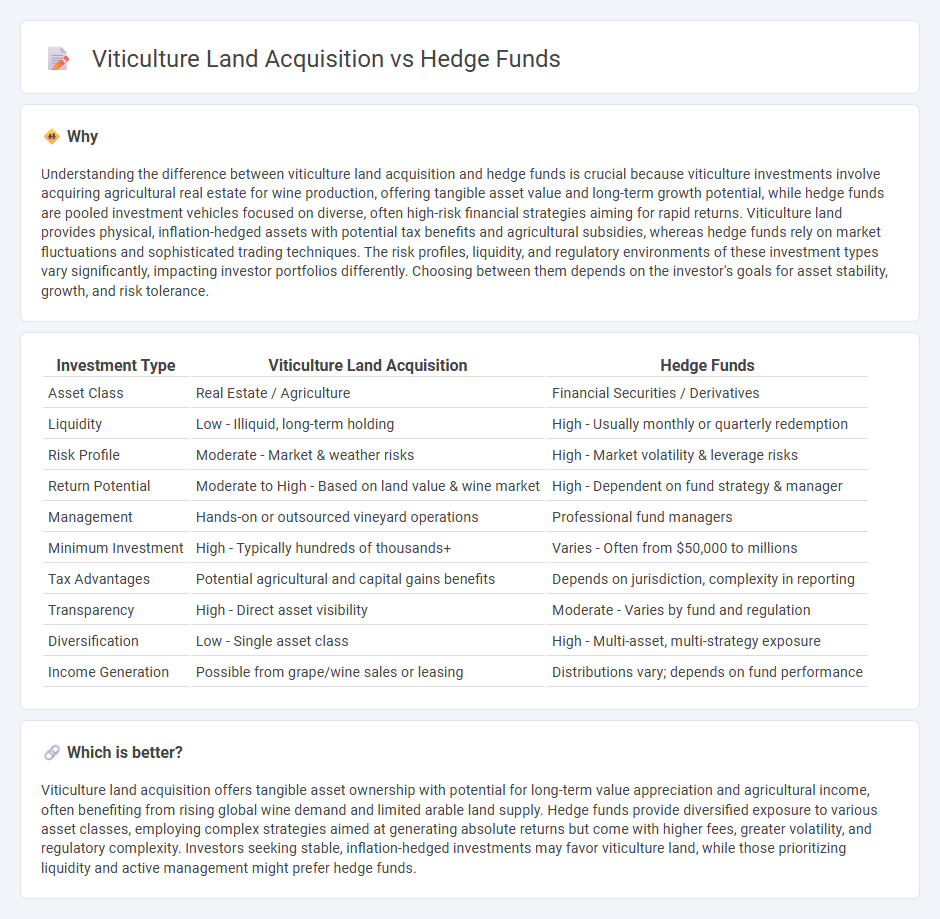

Understanding the difference between viticulture land acquisition and hedge funds is crucial because viticulture investments involve acquiring agricultural real estate for wine production, offering tangible asset value and long-term growth potential, while hedge funds are pooled investment vehicles focused on diverse, often high-risk financial strategies aiming for rapid returns. Viticulture land provides physical, inflation-hedged assets with potential tax benefits and agricultural subsidies, whereas hedge funds rely on market fluctuations and sophisticated trading techniques. The risk profiles, liquidity, and regulatory environments of these investment types vary significantly, impacting investor portfolios differently. Choosing between them depends on the investor's goals for asset stability, growth, and risk tolerance.

Comparison Table

| Investment Type | Viticulture Land Acquisition | Hedge Funds |

|---|---|---|

| Asset Class | Real Estate / Agriculture | Financial Securities / Derivatives |

| Liquidity | Low - Illiquid, long-term holding | High - Usually monthly or quarterly redemption |

| Risk Profile | Moderate - Market & weather risks | High - Market volatility & leverage risks |

| Return Potential | Moderate to High - Based on land value & wine market | High - Dependent on fund strategy & manager |

| Management | Hands-on or outsourced vineyard operations | Professional fund managers |

| Minimum Investment | High - Typically hundreds of thousands+ | Varies - Often from $50,000 to millions |

| Tax Advantages | Potential agricultural and capital gains benefits | Depends on jurisdiction, complexity in reporting |

| Transparency | High - Direct asset visibility | Moderate - Varies by fund and regulation |

| Diversification | Low - Single asset class | High - Multi-asset, multi-strategy exposure |

| Income Generation | Possible from grape/wine sales or leasing | Distributions vary; depends on fund performance |

Which is better?

Viticulture land acquisition offers tangible asset ownership with potential for long-term value appreciation and agricultural income, often benefiting from rising global wine demand and limited arable land supply. Hedge funds provide diversified exposure to various asset classes, employing complex strategies aimed at generating absolute returns but come with higher fees, greater volatility, and regulatory complexity. Investors seeking stable, inflation-hedged investments may favor viticulture land, while those prioritizing liquidity and active management might prefer hedge funds.

Connection

Viticulture land acquisition offers hedge funds a unique opportunity to diversify their portfolios by investing in the agricultural and luxury goods sectors, which can provide stable long-term returns due to growing global demand for wine. Hedge funds leverage their capital to acquire prime vineyard properties, capitalizing on rising land values and favorable climatic conditions that enhance grape quality and yield. This strategic investment approach mitigates risks associated with traditional markets and taps into the premium wine industry's profitability.

Key Terms

Alternative Assets

Hedge funds increasingly diversify portfolios by acquiring viticulture land, capitalizing on the rising global demand for premium wine and the stability of agricultural assets. Viticulture land offers hedge funds a unique blend of alternative asset benefits, including long-term capital appreciation, income generation from grape production, and resilience against market volatility. Explore the strategic advantages of integrating viticulture land into alternative investment portfolios to enhance diversification and optimize risk-adjusted returns.

Risk Management

Hedge funds prioritize risk diversification through complex financial instruments and market analysis, while viticulture land acquisition involves evaluating agricultural risks like climate variability and soil quality. The inherent volatility in hedge fund investments contrasts with the long-term physical asset management required in vineyard ownership. Explore further to understand how risk management strategies diverge between financial markets and agricultural real estate.

Liquidity

Hedge funds prioritize liquidity by investing in assets that can be quickly bought or sold, allowing for rapid portfolio adjustments in response to market changes. Viticulture land acquisition involves significant capital tied in long-term, illiquid agricultural property, often requiring years before yielding profitable returns through grape production or wine sales. Explore more to understand the liquidity dynamics and investment strategies in these contrasting asset classes.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are private investment firms that use diverse strategies like short-selling and derivatives to seek absolute returns by investing in liquid, publicly traded assets, differing from mutual funds by targeting positive returns regardless of market conditions.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds pooling money from sophisticated investors to pursue flexible investment strategies, often with higher risks and limited investor protections compared to mutual funds and ETFs.

Hedge fund - Wikipedia - Hedge funds employ complex trading and risk management techniques, typically charging management and performance fees, managing trillions in assets, and historically aimed to hedge risk but now use a wide range of strategies that may include significant leverage and systemic risk.

dowidth.com

dowidth.com