Designer sneaker portfolios offer high liquidity and strong market demand due to brand collaboration and limited releases, while vintage toy collections provide rare, tangible assets with historical and nostalgic value that appreciate steadily over time. Both investment types attract niche collectors but differ in market volatility and cultural significance. Explore more to determine which alternative investment aligns best with your financial goals.

Why it is important

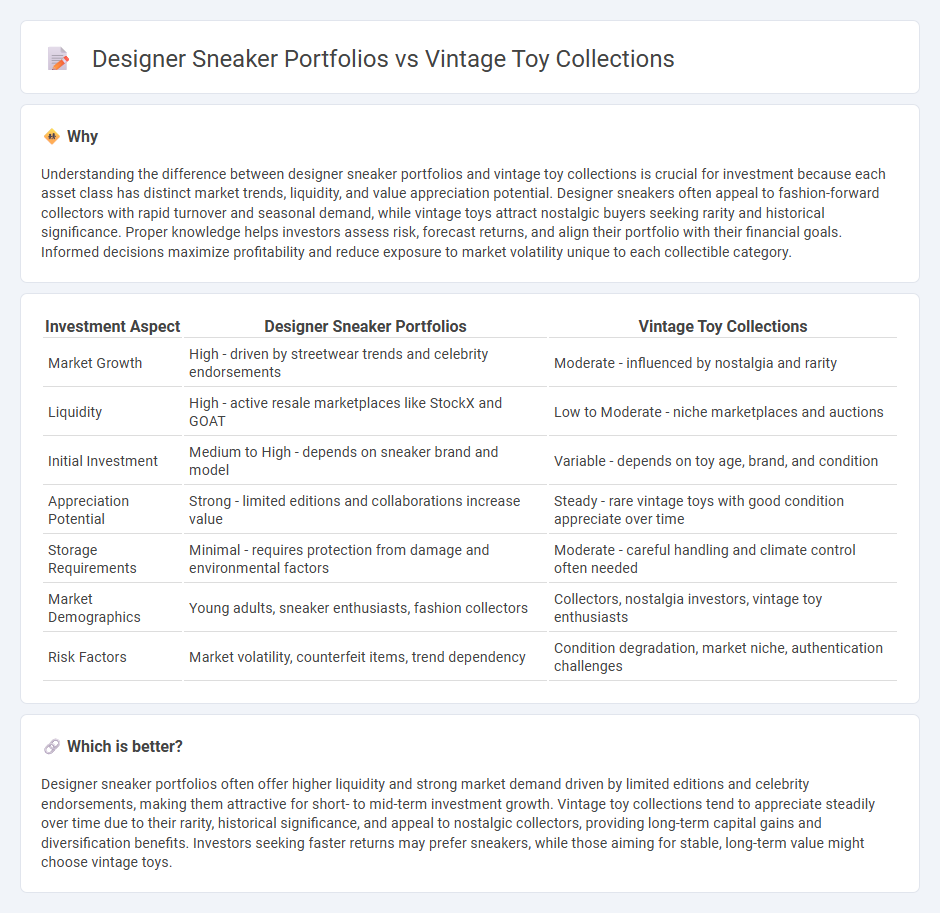

Understanding the difference between designer sneaker portfolios and vintage toy collections is crucial for investment because each asset class has distinct market trends, liquidity, and value appreciation potential. Designer sneakers often appeal to fashion-forward collectors with rapid turnover and seasonal demand, while vintage toys attract nostalgic buyers seeking rarity and historical significance. Proper knowledge helps investors assess risk, forecast returns, and align their portfolio with their financial goals. Informed decisions maximize profitability and reduce exposure to market volatility unique to each collectible category.

Comparison Table

| Investment Aspect | Designer Sneaker Portfolios | Vintage Toy Collections |

|---|---|---|

| Market Growth | High - driven by streetwear trends and celebrity endorsements | Moderate - influenced by nostalgia and rarity |

| Liquidity | High - active resale marketplaces like StockX and GOAT | Low to Moderate - niche marketplaces and auctions |

| Initial Investment | Medium to High - depends on sneaker brand and model | Variable - depends on toy age, brand, and condition |

| Appreciation Potential | Strong - limited editions and collaborations increase value | Steady - rare vintage toys with good condition appreciate over time |

| Storage Requirements | Minimal - requires protection from damage and environmental factors | Moderate - careful handling and climate control often needed |

| Market Demographics | Young adults, sneaker enthusiasts, fashion collectors | Collectors, nostalgia investors, vintage toy enthusiasts |

| Risk Factors | Market volatility, counterfeit items, trend dependency | Condition degradation, market niche, authentication challenges |

Which is better?

Designer sneaker portfolios often offer higher liquidity and strong market demand driven by limited editions and celebrity endorsements, making them attractive for short- to mid-term investment growth. Vintage toy collections tend to appreciate steadily over time due to their rarity, historical significance, and appeal to nostalgic collectors, providing long-term capital gains and diversification benefits. Investors seeking faster returns may prefer sneakers, while those aiming for stable, long-term value might choose vintage toys.

Connection

Designer sneaker portfolios and vintage toy collections both represent alternative investment assets that have gained significant appreciation due to cultural nostalgia and limited supply. These collectibles attract investors by combining emotional appeal with rarity, often yielding higher returns compared to traditional markets. Data shows that the designer sneaker resale market reached over $2 billion in 2023, while vintage toys have seen a consistent annual growth rate of 8-10% in auction sales.

Key Terms

Rarity

Vintage toy collections gain value from limited production runs, unique molds, and preserved packaging, making rare figures highly sought after by collectors. Designer sneaker portfolios thrive on exclusive collaborations, limited releases, and distinct colorways, where scarcity directly drives market demand and resale value. Explore the nuances of rarity in these collectibles to understand their impact on investment potential.

Provenance

Vintage toy collections showcase rich historical provenance, often linked to specific eras or cultural milestones, enhancing their nostalgic and monetary value. Designer sneaker portfolios emphasize limited releases and collaborations, with provenance traced through authentication certificates and original packaging to ensure exclusivity and authenticity. Discover more about how provenance influences the value and appeal in these unique collectible markets.

Market Liquidity

Vintage toy collections exhibit lower market liquidity due to niche demand and limited resale platforms, often resulting in longer holding periods and price volatility. Designer sneaker portfolios benefit from high market liquidity driven by widespread collector interest, frequent releases, and dynamic secondary marketplaces like StockX and GOAT. Explore further to understand how market liquidity impacts investment strategies in both asset classes.

Source and External Links

The Toys Time Forgot - Get Your Toys Back! - A vintage toy retailer offering a vast collection spanning nine decades, including popular and rare toys like classic action figures and Hot Wheels cars from childhood memories.

The BEST Vintage Toy Collection on the Planet - Part 1 - YouTube - A detailed video tour showcasing an extensive vintage toy collection from the late 70s through the mid 90s, highlighting a nostalgic array of curated retro toys.

Antique Toy Collectors of America: Public Home Page - An organization dedicated to the preservation, study, and collection of antique toys with resources including catalogs, articles, and a community for collectors.

dowidth.com

dowidth.com