Rare streetwear flipping involves buying limited-edition clothing and reselling it at a higher price due to high demand and scarcity, while art flipping focuses on purchasing artworks and selling them for profit based on trends and artist popularity. Both investment strategies require market knowledge, timing, and an understanding of value appreciation in their respective domains. Explore deeper insights into these lucrative flipping markets to optimize your investment approach.

Why it is important

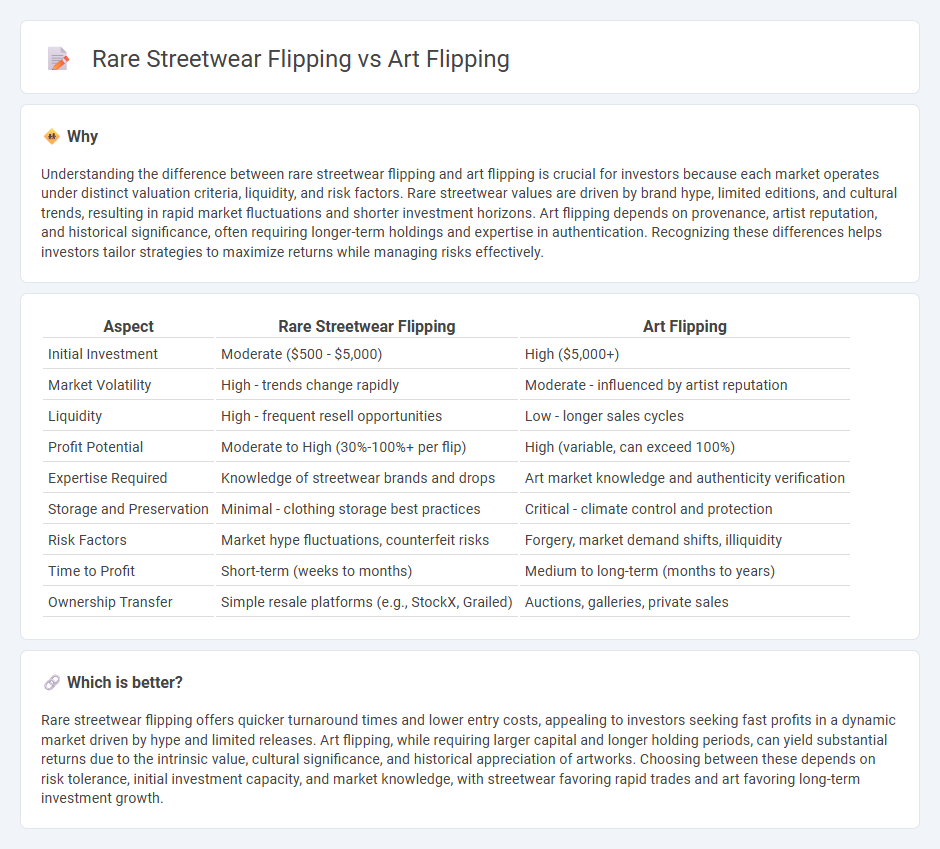

Understanding the difference between rare streetwear flipping and art flipping is crucial for investors because each market operates under distinct valuation criteria, liquidity, and risk factors. Rare streetwear values are driven by brand hype, limited editions, and cultural trends, resulting in rapid market fluctuations and shorter investment horizons. Art flipping depends on provenance, artist reputation, and historical significance, often requiring longer-term holdings and expertise in authentication. Recognizing these differences helps investors tailor strategies to maximize returns while managing risks effectively.

Comparison Table

| Aspect | Rare Streetwear Flipping | Art Flipping |

|---|---|---|

| Initial Investment | Moderate ($500 - $5,000) | High ($5,000+) |

| Market Volatility | High - trends change rapidly | Moderate - influenced by artist reputation |

| Liquidity | High - frequent resell opportunities | Low - longer sales cycles |

| Profit Potential | Moderate to High (30%-100%+ per flip) | High (variable, can exceed 100%) |

| Expertise Required | Knowledge of streetwear brands and drops | Art market knowledge and authenticity verification |

| Storage and Preservation | Minimal - clothing storage best practices | Critical - climate control and protection |

| Risk Factors | Market hype fluctuations, counterfeit risks | Forgery, market demand shifts, illiquidity |

| Time to Profit | Short-term (weeks to months) | Medium to long-term (months to years) |

| Ownership Transfer | Simple resale platforms (e.g., StockX, Grailed) | Auctions, galleries, private sales |

Which is better?

Rare streetwear flipping offers quicker turnaround times and lower entry costs, appealing to investors seeking fast profits in a dynamic market driven by hype and limited releases. Art flipping, while requiring larger capital and longer holding periods, can yield substantial returns due to the intrinsic value, cultural significance, and historical appreciation of artworks. Choosing between these depends on risk tolerance, initial investment capacity, and market knowledge, with streetwear favoring rapid trades and art favoring long-term investment growth.

Connection

Rare streetwear flipping and art flipping both capitalize on scarcity and cultural trends to generate significant returns on investment. Limited-edition sneakers and exclusive art pieces appreciate in value as demand from collectors and enthusiasts outpaces supply. This dynamic creates thriving secondary markets where savvy investors leverage hype, brand reputation, and provenance to maximize profits.

Key Terms

Provenance

Art flipping relies heavily on verified provenance to establish authenticity and historical ownership, which significantly influences its market value. Rare streetwear flipping also values provenance but often highlights limited edition releases and celebrity endorsements to validate rarity and demand. Explore more to understand how provenance shapes investment strategies across these markets.

Hype Cycle

Art flipping capitalizes on rapid value appreciation driven by emerging artists and gallery buzz, aligning with the early phases of the hype cycle where excitement peaks before mainstream adoption. Rare streetwear flipping thrives during the peak and plateau stages, leveraging limited releases, brand collaborations, and cultural trends that sustain high demand and resale prices. Explore deeper insights on navigating the hype cycle to maximize profits in both markets.

Liquidity

Art flipping often requires significant capital and longer holding periods, resulting in lower liquidity due to the niche market and appraisal processes. Rare streetwear flipping benefits from higher liquidity, driven by fast turnover, strong sneakerhead and fashion communities, and accessible online marketplaces. Explore deeper insights into how liquidity impacts profitability in both markets.

Source and External Links

Art Flipping: What can be done to reduce this practice? - This article discusses the negative impacts of art flipping, particularly on emerging artists, and explores ways to reduce this practice.

Always flip your art - This article suggests flipping art as a technique to improve drawings by identifying flaws and enhancing composition through mirroring images.

Why "Flipping" Art Is so Controversial - This piece delves into the controversies surrounding art flipping, highlighting its potential to harm emerging artists' careers by creating speculative bubbles.

dowidth.com

dowidth.com