Sports memorabilia investment offers tangible assets such as autographed jerseys, game-used equipment, and rare trophies that often appreciate based on athlete fame and historical significance. Collectible card investment emphasizes trading cards featuring key athletes, limited editions, and rookie cards, with value driven by rarity, condition, and player performance. Explore deeper insights to determine which investment aligns best with your portfolio goals.

Why it is important

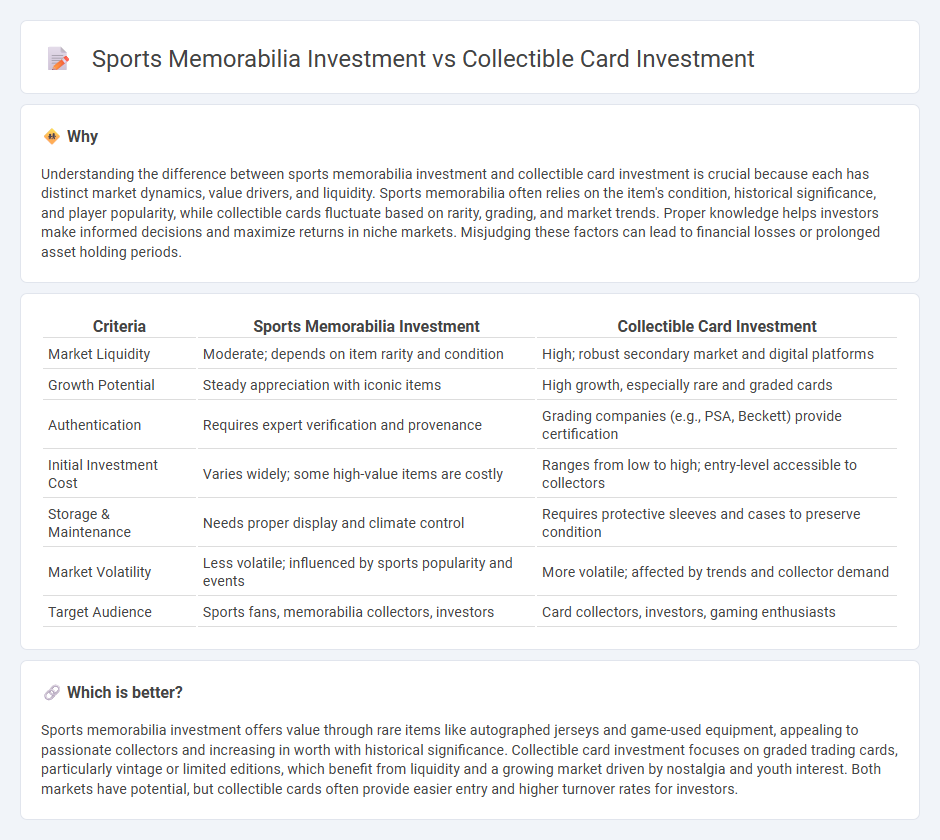

Understanding the difference between sports memorabilia investment and collectible card investment is crucial because each has distinct market dynamics, value drivers, and liquidity. Sports memorabilia often relies on the item's condition, historical significance, and player popularity, while collectible cards fluctuate based on rarity, grading, and market trends. Proper knowledge helps investors make informed decisions and maximize returns in niche markets. Misjudging these factors can lead to financial losses or prolonged asset holding periods.

Comparison Table

| Criteria | Sports Memorabilia Investment | Collectible Card Investment |

|---|---|---|

| Market Liquidity | Moderate; depends on item rarity and condition | High; robust secondary market and digital platforms |

| Growth Potential | Steady appreciation with iconic items | High growth, especially rare and graded cards |

| Authentication | Requires expert verification and provenance | Grading companies (e.g., PSA, Beckett) provide certification |

| Initial Investment Cost | Varies widely; some high-value items are costly | Ranges from low to high; entry-level accessible to collectors |

| Storage & Maintenance | Needs proper display and climate control | Requires protective sleeves and cases to preserve condition |

| Market Volatility | Less volatile; influenced by sports popularity and events | More volatile; affected by trends and collector demand |

| Target Audience | Sports fans, memorabilia collectors, investors | Card collectors, investors, gaming enthusiasts |

Which is better?

Sports memorabilia investment offers value through rare items like autographed jerseys and game-used equipment, appealing to passionate collectors and increasing in worth with historical significance. Collectible card investment focuses on graded trading cards, particularly vintage or limited editions, which benefit from liquidity and a growing market driven by nostalgia and youth interest. Both markets have potential, but collectible cards often provide easier entry and higher turnover rates for investors.

Connection

Sports memorabilia investment and collectible card investment are connected through their shared appeal to enthusiasts and collectors seeking tangible assets with historical and emotional value. Both markets are driven by rarity, player significance, and condition, which directly impact their potential appreciation and liquidity. Investors leverage authentication and grading services to validate and enhance the marketability of these items, creating a dynamic ecosystem where passion meets portfolio diversification.

Key Terms

**Collectible card investment:**

Collectible card investment offers significant opportunities due to rising demand driven by nostalgia, rarity, and historical relevance of cards, with key examples including vintage baseball cards and iconic trading card games like Pokemon and Magic: The Gathering. Market trends show substantial appreciation, with top-grade cards often achieving multi-million dollar sales at auctions, supported by grading companies such as PSA and Beckett that authenticate and increase value. Explore deeper insights into collectible card investment strategies, market dynamics, and best practices for maximizing returns.

Grading

Grading plays a crucial role in both collectible card investment and sports memorabilia investment, impacting value and market demand significantly. High-grade cards typically fetch premium prices due to their condition, rarity, and certification from companies like PSA, BGS, or SGC, while sports memorabilia is graded based on authenticity, condition, and provenance by organizations such as PSA/DNA or JSA. Explore the nuances of grading to optimize your investment strategy and maximize returns.

Rarity

Rarity significantly influences both collectible card investment and sports memorabilia investment, with limited-edition cards or autographed items commanding higher market value due to their scarcity. Collectible cards often have print runs that are quantifiable, making rarity easier to assess, whereas sports memorabilia rarity can hinge on unique game-used items or historic moments, increasing appeal to niche collectors. Explore detailed insights to understand how rarity shapes value differently in these two investment markets.

Source and External Links

Invest in Trading Cards - Investing in trading cards can offer high return potential, portfolio diversification, and benefits from increasing demand and limited supply, making collectible cards a viable and nostalgic investment option for enthusiasts and investors alike.

Unlocking Financial Gains: Trading Cards as Lucrative ... - Successful collectible card investment relies on researching market trends, rarity, and player performance, as well as diversifying card types and leveraging auction houses and marketplaces to generate consistent passive income.

Is Investing in Sports Cards a Viable Investment? - Sports card investing has produced substantial returns, particularly for rare and high-demand cards, though it carries risks such as market volatility and external factors affecting card value, requiring investor knowledge and strategy.

dowidth.com

dowidth.com