Play-to-earn gaming revolutionizes investment by enabling users to generate real-world income through gameplay, leveraging blockchain technology and digital assets. Venture capital funds focus on providing capital to high-growth startups, emphasizing long-term equity returns and strategic business scaling. Explore how these distinct investment models reshape wealth creation and innovation opportunities today.

Why it is important

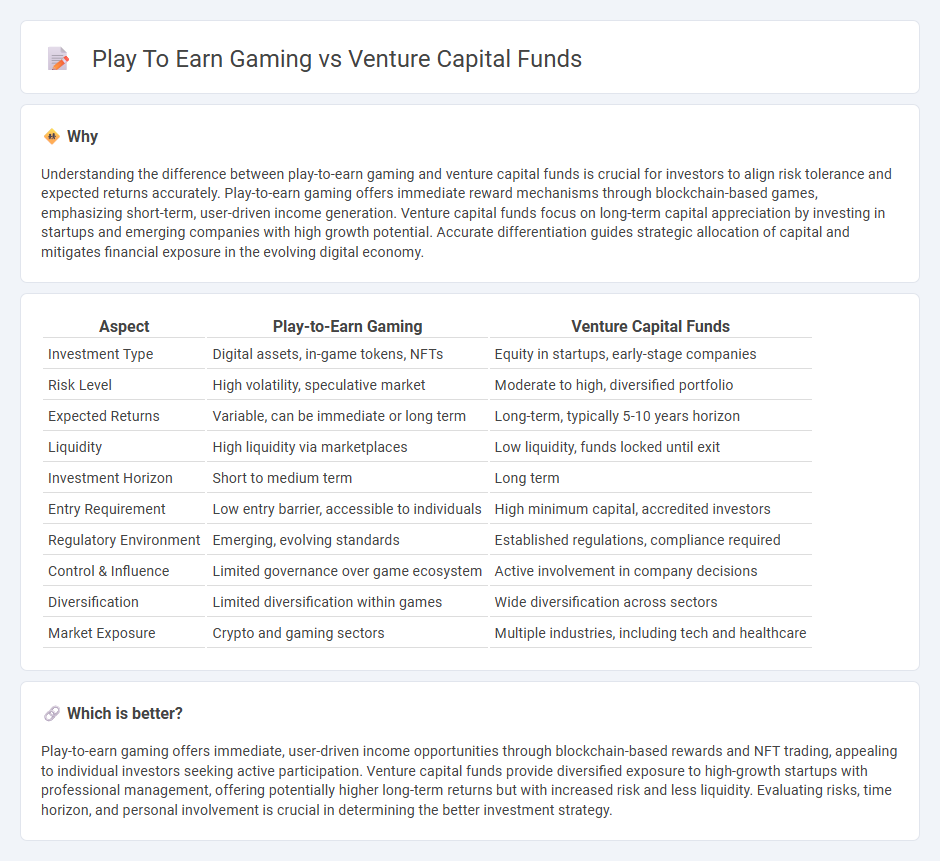

Understanding the difference between play-to-earn gaming and venture capital funds is crucial for investors to align risk tolerance and expected returns accurately. Play-to-earn gaming offers immediate reward mechanisms through blockchain-based games, emphasizing short-term, user-driven income generation. Venture capital funds focus on long-term capital appreciation by investing in startups and emerging companies with high growth potential. Accurate differentiation guides strategic allocation of capital and mitigates financial exposure in the evolving digital economy.

Comparison Table

| Aspect | Play-to-Earn Gaming | Venture Capital Funds |

|---|---|---|

| Investment Type | Digital assets, in-game tokens, NFTs | Equity in startups, early-stage companies |

| Risk Level | High volatility, speculative market | Moderate to high, diversified portfolio |

| Expected Returns | Variable, can be immediate or long term | Long-term, typically 5-10 years horizon |

| Liquidity | High liquidity via marketplaces | Low liquidity, funds locked until exit |

| Investment Horizon | Short to medium term | Long term |

| Entry Requirement | Low entry barrier, accessible to individuals | High minimum capital, accredited investors |

| Regulatory Environment | Emerging, evolving standards | Established regulations, compliance required |

| Control & Influence | Limited governance over game ecosystem | Active involvement in company decisions |

| Diversification | Limited diversification within games | Wide diversification across sectors |

| Market Exposure | Crypto and gaming sectors | Multiple industries, including tech and healthcare |

Which is better?

Play-to-earn gaming offers immediate, user-driven income opportunities through blockchain-based rewards and NFT trading, appealing to individual investors seeking active participation. Venture capital funds provide diversified exposure to high-growth startups with professional management, offering potentially higher long-term returns but with increased risk and less liquidity. Evaluating risks, time horizon, and personal involvement is crucial in determining the better investment strategy.

Connection

Play-to-earn gaming has attracted significant venture capital funds due to its innovative blockchain-based economy and potential for high user engagement. Venture capital investments fuel the development of play-to-earn platforms by providing necessary capital for technology, marketing, and user acquisition. The success of these gaming ecosystems depends on the scalability and sustainability of their token economies, making venture capital a critical driver for growth and innovation in the play-to-earn sector.

Key Terms

**Venture Capital Funds:**

Venture capital funds provide critical funding and strategic support to startups, accelerating innovation and market growth by investing in early-stage companies with high potential. These funds often target emerging sectors, leveraging industry expertise and networks to maximize returns and scale disruptive technologies. Explore how venture capital funds shape the future of innovation and entrepreneurial success.

Equity

Venture capital funds primarily invest capital in play-to-earn gaming startups by acquiring equity stakes, enabling these companies to scale operations and innovate gameplay mechanics. Equity ownership allows venture capitalists to share in the financial growth driven by the increasing adoption of blockchain and NFT technologies in the gaming industry. Explore further to understand how equity dynamics influence funding strategies and growth potential in play-to-earn gaming ventures.

Portfolio

Venture capital funds typically prioritize diversified portfolios that balance high-risk startups across sectors like technology, healthcare, and finance, optimizing for long-term growth and exit potential. Play-to-earn gaming portfolios, however, concentrate on digital assets and blockchain-based games, emphasizing in-game economies and NFT ownership as revenue streams and user engagement catalysts. Explore the unique portfolio strategies that define these emerging investment landscapes.

Source and External Links

Venture Capital Funds: What they are & how to invest in them - Venture capital funds pool money from investors to finance early-stage startup companies with high long-term growth potential.

Top 100 Best Performing VC Funds from the US - This article highlights key US venture capital firms driving innovation, including top performers like Endeavor Catalyst.

Venture Capital - Venture capital is a form of private equity financing provided to startups and early-stage companies, supporting various stages of their development.

dowidth.com

dowidth.com