Royalty streams provide investors with ongoing payments based on the sales or usage of a patented product, intellectual property, or creative work, ensuring a steady income tied to the asset's success. Revenue sharing involves distributing a percentage of a company's gross or net revenue to investors, aligning their returns directly with the business's overall performance. Explore how these distinct investment models can diversify your portfolio and optimize returns.

Why it is important

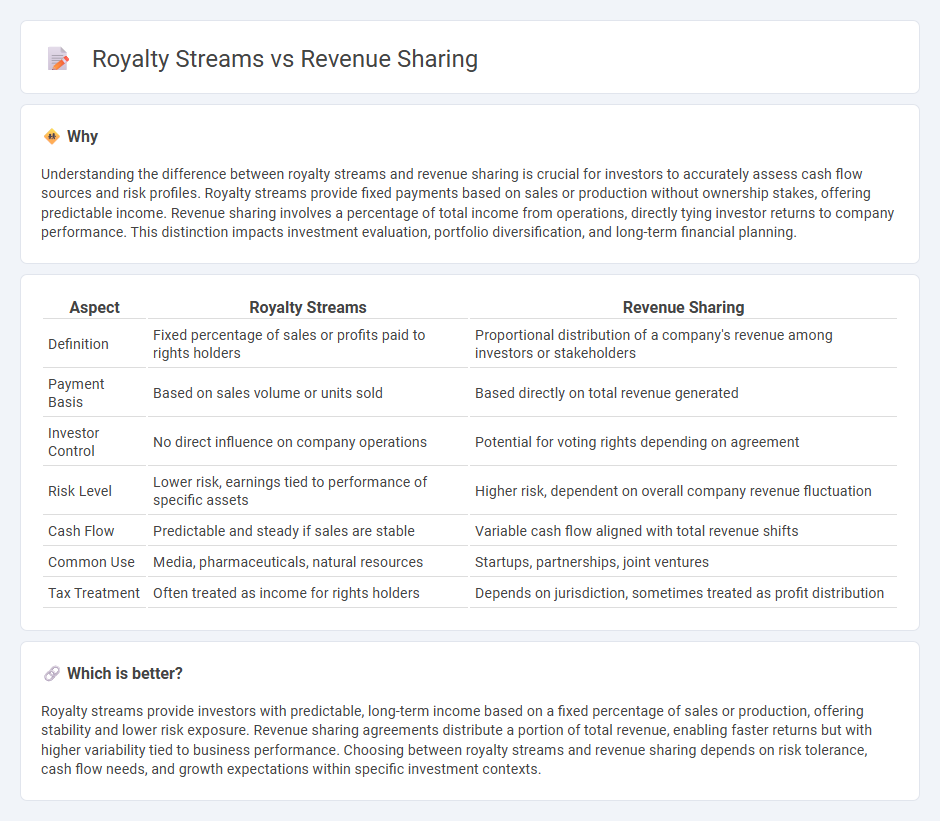

Understanding the difference between royalty streams and revenue sharing is crucial for investors to accurately assess cash flow sources and risk profiles. Royalty streams provide fixed payments based on sales or production without ownership stakes, offering predictable income. Revenue sharing involves a percentage of total income from operations, directly tying investor returns to company performance. This distinction impacts investment evaluation, portfolio diversification, and long-term financial planning.

Comparison Table

| Aspect | Royalty Streams | Revenue Sharing |

|---|---|---|

| Definition | Fixed percentage of sales or profits paid to rights holders | Proportional distribution of a company's revenue among investors or stakeholders |

| Payment Basis | Based on sales volume or units sold | Based directly on total revenue generated |

| Investor Control | No direct influence on company operations | Potential for voting rights depending on agreement |

| Risk Level | Lower risk, earnings tied to performance of specific assets | Higher risk, dependent on overall company revenue fluctuation |

| Cash Flow | Predictable and steady if sales are stable | Variable cash flow aligned with total revenue shifts |

| Common Use | Media, pharmaceuticals, natural resources | Startups, partnerships, joint ventures |

| Tax Treatment | Often treated as income for rights holders | Depends on jurisdiction, sometimes treated as profit distribution |

Which is better?

Royalty streams provide investors with predictable, long-term income based on a fixed percentage of sales or production, offering stability and lower risk exposure. Revenue sharing agreements distribute a portion of total revenue, enabling faster returns but with higher variability tied to business performance. Choosing between royalty streams and revenue sharing depends on risk tolerance, cash flow needs, and growth expectations within specific investment contexts.

Connection

Royalty streams and revenue sharing both involve the distribution of income generated from assets or business activities, linking investors to ongoing financial returns. Royalty streams typically grant investors a percentage of sales or usage revenues from specific intellectual properties or products, creating a predictable income flow. Revenue sharing expands this concept by allocating a portion of the total business revenue among stakeholders, aligning interests in company growth and profitability.

Key Terms

Gross Revenue

Revenue sharing and royalty streams both involve payments based on Gross Revenue, but they differ in structure and application. Revenue sharing typically distributes a percentage of total Gross Revenue among partners or stakeholders, while royalty streams allocate payments to IP holders based on sales or usage of a specific product or service. Explore detailed insights to understand which model suits your business needs best.

Licensing Agreement

Licensing agreements generate revenue sharing and royalty streams by granting rights to use intellectual property in exchange for income, typically calculated as a percentage of sales or a fixed fee per unit. Revenue sharing involves distributing generated income proportionally among stakeholders, while royalties are ongoing payments based on the licensed product's performance or usage. Explore detailed strategies to optimize licensing agreements and maximize financial returns.

Percentage Payout

Revenue sharing models typically involve distributing a portion of total revenue generated, often ranging from 10% to 50%, depending on the industry and agreement specifics. Royalty streams usually provide a fixed percentage payout, commonly between 5% and 15%, based on sales, licensing, or usage metrics. Explore how selecting the optimal percentage payout can maximize your financial returns by understanding detailed revenue sharing and royalty structures.

Source and External Links

Revenue Sharing - DealHub - Revenue sharing is a business model where companies distribute profits and losses among partners, employees, or other stakeholders.

Revenue sharing: How to structure an agreement & more - This resource provides guidance on structuring revenue-sharing agreements and highlights different models such as 50/50 splits and royalties.

Revenue sharing - Wikipedia - Revenue sharing involves distributing income among stakeholders, commonly seen in industries like web-based content creation and professional sports leagues.

dowidth.com

dowidth.com