Fractional ownership allows multiple investors to share equity in high-value assets such as real estate or luxury items, reducing individual capital requirements and risk exposure. Direct ownership involves full control and responsibility of the asset, offering greater autonomy but requiring substantial initial investment and ongoing management. Explore the benefits and trade-offs of both to determine the optimal investment strategy for your portfolio.

Why it is important

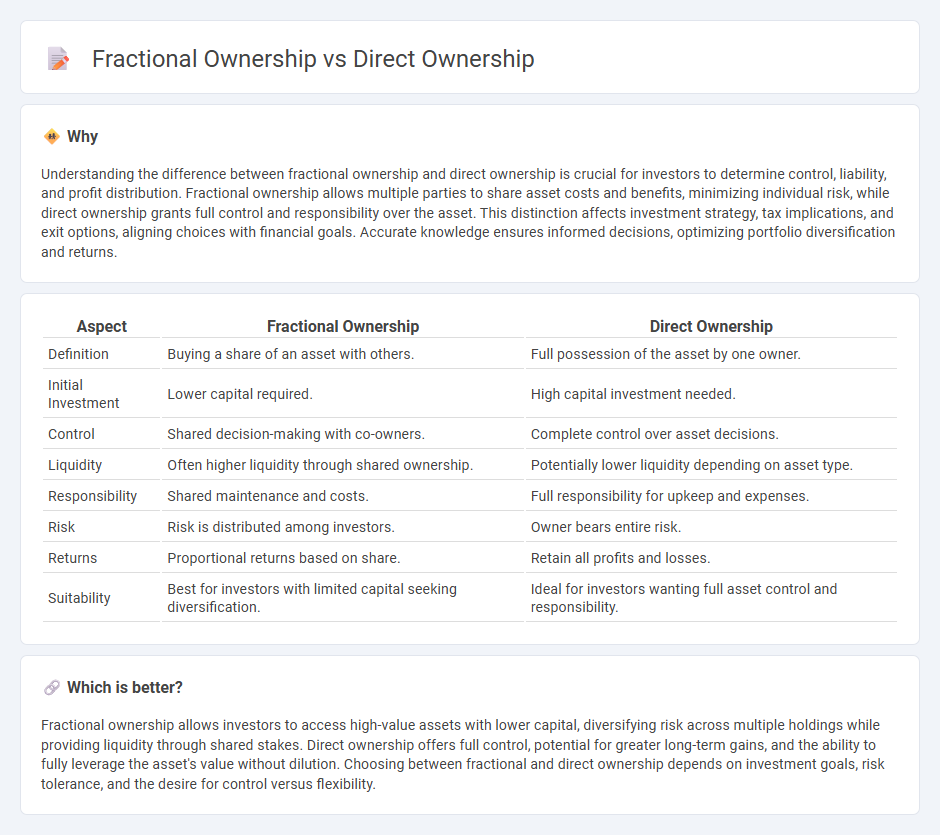

Understanding the difference between fractional ownership and direct ownership is crucial for investors to determine control, liability, and profit distribution. Fractional ownership allows multiple parties to share asset costs and benefits, minimizing individual risk, while direct ownership grants full control and responsibility over the asset. This distinction affects investment strategy, tax implications, and exit options, aligning choices with financial goals. Accurate knowledge ensures informed decisions, optimizing portfolio diversification and returns.

Comparison Table

| Aspect | Fractional Ownership | Direct Ownership |

|---|---|---|

| Definition | Buying a share of an asset with others. | Full possession of the asset by one owner. |

| Initial Investment | Lower capital required. | High capital investment needed. |

| Control | Shared decision-making with co-owners. | Complete control over asset decisions. |

| Liquidity | Often higher liquidity through shared ownership. | Potentially lower liquidity depending on asset type. |

| Responsibility | Shared maintenance and costs. | Full responsibility for upkeep and expenses. |

| Risk | Risk is distributed among investors. | Owner bears entire risk. |

| Returns | Proportional returns based on share. | Retain all profits and losses. |

| Suitability | Best for investors with limited capital seeking diversification. | Ideal for investors wanting full asset control and responsibility. |

Which is better?

Fractional ownership allows investors to access high-value assets with lower capital, diversifying risk across multiple holdings while providing liquidity through shared stakes. Direct ownership offers full control, potential for greater long-term gains, and the ability to fully leverage the asset's value without dilution. Choosing between fractional and direct ownership depends on investment goals, risk tolerance, and the desire for control versus flexibility.

Connection

Fractional ownership allows multiple investors to hold shares in a high-value asset, such as real estate or aircraft, while direct ownership involves complete control by a single investor. Both investment methods provide pathways to asset appreciation and potential income generation but differ in capital requirements and management responsibilities. Understanding the link between fractional and direct ownership helps investors diversify portfolios and optimize returns across various asset classes.

Key Terms

Title Deed

Direct ownership grants full legal rights and control over the property, as evidenced by the title deed held solely by the owner. Fractional ownership divides the title deed among multiple investors, each holding a legally recognized share that corresponds to their stake in the property. Explore the detailed differences in title deed implications to make informed decisions about property investment.

Shares

Direct ownership of shares grants investors full control and voting rights, with the ability to directly influence company decisions and receive dividends. Fractional ownership allows investors to hold only a portion of a share, often managed through platforms or funds, enabling diversification without large capital commitment. Discover the benefits and limitations of both ownership types to optimize your investment strategy.

Proportional Rights

Direct ownership grants full control and responsibility over an asset, including all rights to use, manage, and dispose of the property. Fractional ownership divides these rights proportionally among multiple owners, allowing each to hold a share corresponding to their investment, while sharing benefits and liabilities. Discover how proportional rights impact your investment strategy and legal protections by exploring detailed comparisons.

Source and External Links

How would you differentiate between direct or indirect ownership or control? - Direct ownership refers to individuals or entities who directly own shares in a legal entity, such as owning 20% of shares, while indirect ownership occurs when ownership is through another entity, for example, owning shares in a company that owns shares in another company.

Direct Ownership and Ultimate Beneficial Ownership - MyKYCBank - Direct ownership means holding shares or partnership interests directly in a legal entity and can be by individuals or entities, contrasting with indirect ownership where holding is through intermediary entities.

What's the Difference Between Direct and Indirect Shares? - Direct stock ownership gives investors voting rights and control over their shares, whereas indirect ownership occurs when shares are held through funds or companies that themselves own shares in other entities.

dowidth.com

dowidth.com