Investment in viticulture land acquisition offers long-term value through agricultural yields and premium wine production markets, while renewable energy projects provide scalable returns driven by increasing global demand for clean power and governmental incentives. Viticulture requires substantial initial capital and expertise in land management, contrasting with renewable energy's dependency on technological innovation and regulatory frameworks. Explore further to understand the strategic benefits and risks of investing in these distinct but promising sectors.

Why it is important

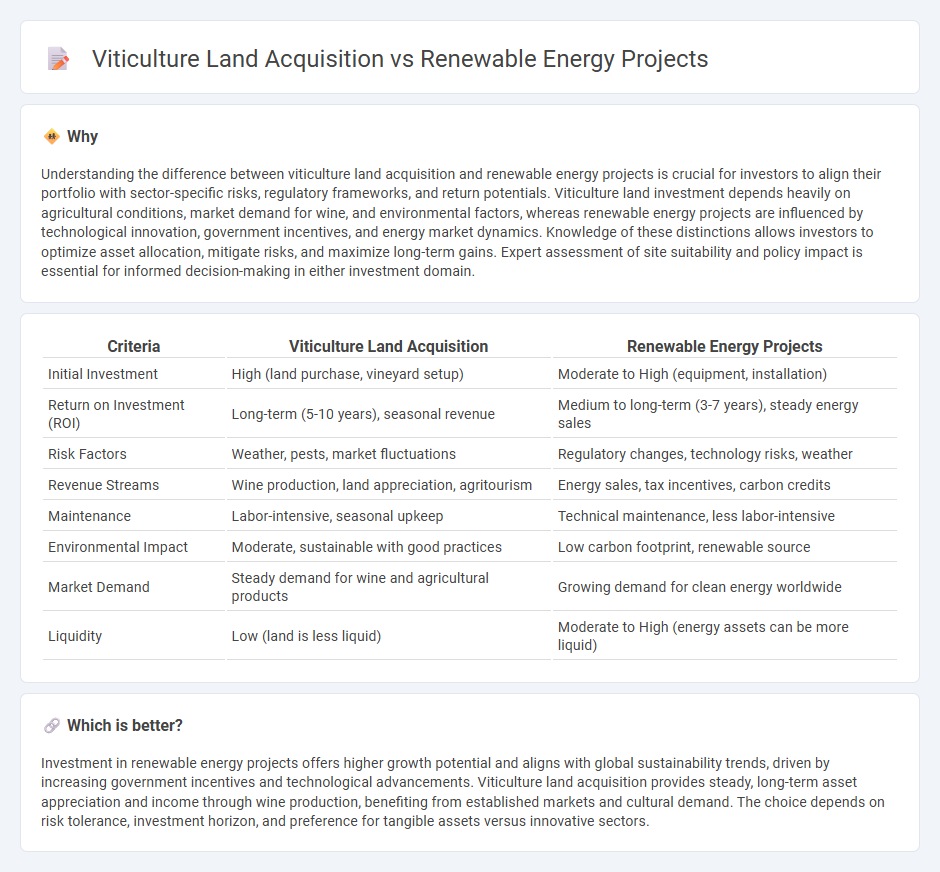

Understanding the difference between viticulture land acquisition and renewable energy projects is crucial for investors to align their portfolio with sector-specific risks, regulatory frameworks, and return potentials. Viticulture land investment depends heavily on agricultural conditions, market demand for wine, and environmental factors, whereas renewable energy projects are influenced by technological innovation, government incentives, and energy market dynamics. Knowledge of these distinctions allows investors to optimize asset allocation, mitigate risks, and maximize long-term gains. Expert assessment of site suitability and policy impact is essential for informed decision-making in either investment domain.

Comparison Table

| Criteria | Viticulture Land Acquisition | Renewable Energy Projects |

|---|---|---|

| Initial Investment | High (land purchase, vineyard setup) | Moderate to High (equipment, installation) |

| Return on Investment (ROI) | Long-term (5-10 years), seasonal revenue | Medium to long-term (3-7 years), steady energy sales |

| Risk Factors | Weather, pests, market fluctuations | Regulatory changes, technology risks, weather |

| Revenue Streams | Wine production, land appreciation, agritourism | Energy sales, tax incentives, carbon credits |

| Maintenance | Labor-intensive, seasonal upkeep | Technical maintenance, less labor-intensive |

| Environmental Impact | Moderate, sustainable with good practices | Low carbon footprint, renewable source |

| Market Demand | Steady demand for wine and agricultural products | Growing demand for clean energy worldwide |

| Liquidity | Low (land is less liquid) | Moderate to High (energy assets can be more liquid) |

Which is better?

Investment in renewable energy projects offers higher growth potential and aligns with global sustainability trends, driven by increasing government incentives and technological advancements. Viticulture land acquisition provides steady, long-term asset appreciation and income through wine production, benefiting from established markets and cultural demand. The choice depends on risk tolerance, investment horizon, and preference for tangible assets versus innovative sectors.

Connection

Investment in viticulture land acquisition often aligns with renewable energy projects by leveraging sustainable practices to enhance vineyard productivity while reducing carbon footprints. Integrating solar panels or wind turbines on or near vineyards generates clean energy, lowering operational costs and increasing land value. This synergy attracts investors seeking long-term returns through eco-friendly agriculture and green energy infrastructure.

Key Terms

**Renewable energy projects:**

Renewable energy projects prioritize the development of solar farms, wind turbines, and bioenergy facilities to reduce carbon emissions and promote sustainable power generation. These initiatives often require large areas of land with high solar irradiance or consistent wind patterns, offering significant long-term economic and environmental benefits. Explore how renewable energy advancements are transforming land use and supporting energy resilience today.

Power Purchase Agreement (PPA)

Power Purchase Agreements (PPAs) are pivotal in renewable energy projects, securing long-term electricity sales and financing by locking fixed rates and ensuring project viability. In contrast, viticulture land acquisitions prioritize agricultural value, terroir characteristics, and crop sustainability rather than energy output stabilization. Explore how PPAs dictate financial stability in energy sectors compared to land investment strategies in viticulture.

Feed-in Tariff (FiT)

Renewable energy projects leveraging Feed-in Tariff (FiT) incentives offer stable revenue streams by guaranteeing fixed payments for generated power, making them attractive compared to viticulture land acquisition which involves higher land management costs and uncertain agricultural yields. FiT schemes promote investment in solar, wind, and biomass projects, accelerating sustainability goals and energy independence while preserving land value appreciate potential. Explore how FiT policies impact land allocation decisions between renewable developments and viticulture ventures for optimized economic and environmental benefits.

Source and External Links

Megaprojects Driving Renewable Energy in the U.S. in 2024 - Highlights major US projects like the SunZia Wind Project with over 900 turbines generating 3,000 MW and the Champlain Hudson Power Express delivering 1,250 MW of clean hydroelectric power to New York City.

Top 10: Largest Renewable Energy Projects - Features global megaprojects including the 3 GW Alta Wind Energy Centre in California and the 3.5 GW Urumqi Solar Farm in China, showcasing large-scale wind and solar developments.

Top 5 Renewable Energy Projects in The U.S. - NES Fircroft - Details key US initiatives such as the High Noon Solar Energy Center in Wisconsin with 388 MW solar capacity plus 165 MW battery storage, spanning 4,000 acres and powering roughly 90,000 homes.

dowidth.com

dowidth.com