Carbon credit trading primarily focuses on offsetting greenhouse gas emissions through projects that reduce carbon dioxide in the atmosphere, such as reforestation and renewable energy initiatives. Blue carbon markets specifically target carbon sequestration in coastal and marine ecosystems like mangroves, seagrasses, and salt marshes, offering unique environmental benefits and investment opportunities. Explore more to understand the distinct advantages and growth potential of both carbon credit trading and blue carbon markets.

Why it is important

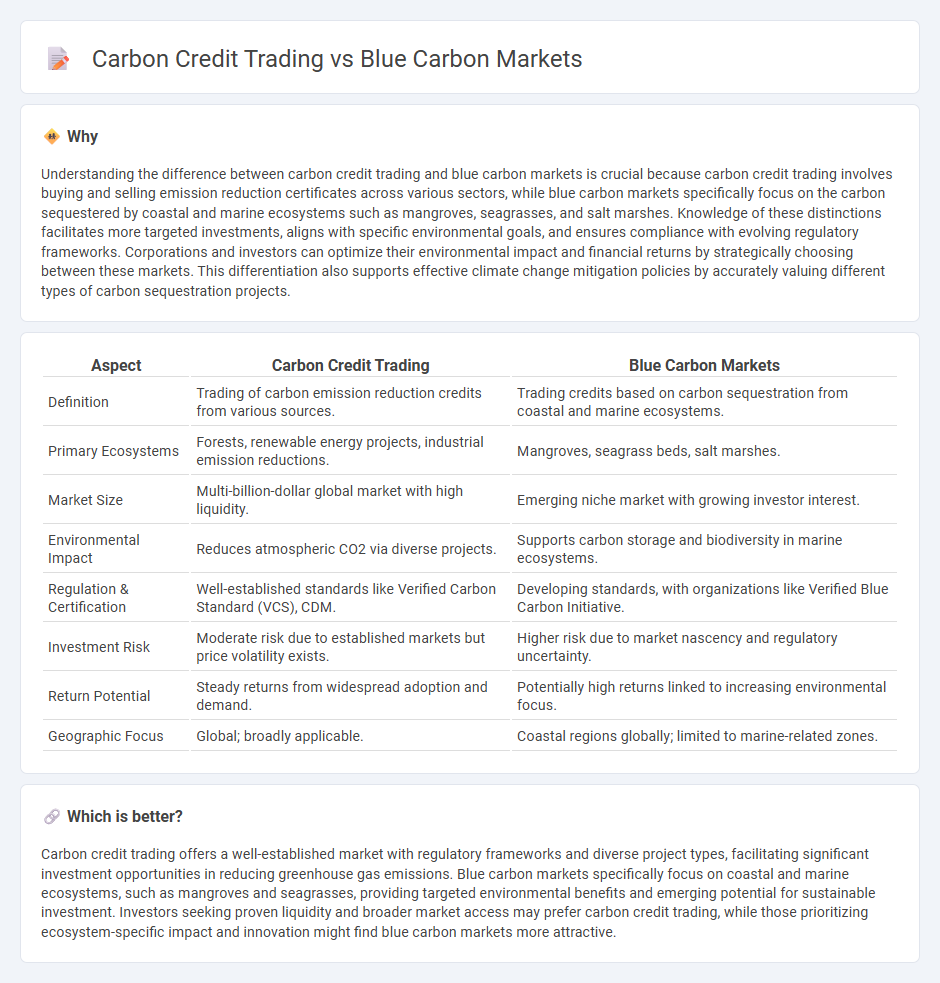

Understanding the difference between carbon credit trading and blue carbon markets is crucial because carbon credit trading involves buying and selling emission reduction certificates across various sectors, while blue carbon markets specifically focus on the carbon sequestered by coastal and marine ecosystems such as mangroves, seagrasses, and salt marshes. Knowledge of these distinctions facilitates more targeted investments, aligns with specific environmental goals, and ensures compliance with evolving regulatory frameworks. Corporations and investors can optimize their environmental impact and financial returns by strategically choosing between these markets. This differentiation also supports effective climate change mitigation policies by accurately valuing different types of carbon sequestration projects.

Comparison Table

| Aspect | Carbon Credit Trading | Blue Carbon Markets |

|---|---|---|

| Definition | Trading of carbon emission reduction credits from various sources. | Trading credits based on carbon sequestration from coastal and marine ecosystems. |

| Primary Ecosystems | Forests, renewable energy projects, industrial emission reductions. | Mangroves, seagrass beds, salt marshes. |

| Market Size | Multi-billion-dollar global market with high liquidity. | Emerging niche market with growing investor interest. |

| Environmental Impact | Reduces atmospheric CO2 via diverse projects. | Supports carbon storage and biodiversity in marine ecosystems. |

| Regulation & Certification | Well-established standards like Verified Carbon Standard (VCS), CDM. | Developing standards, with organizations like Verified Blue Carbon Initiative. |

| Investment Risk | Moderate risk due to established markets but price volatility exists. | Higher risk due to market nascency and regulatory uncertainty. |

| Return Potential | Steady returns from widespread adoption and demand. | Potentially high returns linked to increasing environmental focus. |

| Geographic Focus | Global; broadly applicable. | Coastal regions globally; limited to marine-related zones. |

Which is better?

Carbon credit trading offers a well-established market with regulatory frameworks and diverse project types, facilitating significant investment opportunities in reducing greenhouse gas emissions. Blue carbon markets specifically focus on coastal and marine ecosystems, such as mangroves and seagrasses, providing targeted environmental benefits and emerging potential for sustainable investment. Investors seeking proven liquidity and broader market access may prefer carbon credit trading, while those prioritizing ecosystem-specific impact and innovation might find blue carbon markets more attractive.

Connection

Carbon credit trading and blue carbon markets are interconnected through their shared goal of reducing greenhouse gas emissions by leveraging natural carbon sequestration processes. Blue carbon markets specifically focus on coastal and marine ecosystems, such as mangroves, salt marshes, and seagrasses, which capture and store significant amounts of carbon dioxide. Investment in blue carbon projects generates tradable carbon credits, integrating these ecosystem services into broader carbon credit trading systems and enhancing climate finance opportunities.

Key Terms

Sequestration

Blue carbon markets specifically target the sequestration of carbon dioxide through coastal and marine ecosystems like mangroves, salt marshes, and seagrasses, recognizing their unique capacity to capture and store carbon long-term. Carbon credit trading broadly encompasses emissions reductions across various sectors, including industrial, forestry, and energy projects, where carbon offsets may arise from activities beyond sequestration alone. Explore the distinctions and benefits of blue carbon markets compared to traditional carbon credit systems to understand their roles in climate mitigation.

Additionality

Blue carbon markets specifically target the sequestration of carbon in coastal and marine ecosystems such as mangroves, seagrasses, and salt marshes, emphasizing measurable additionality through the protection and restoration of these habitats. Carbon credit trading encompasses a broader range of activities, including industrial emission reductions and reforestation projects, with additionality criteria ensuring that credits represent real, verifiable emission reductions beyond business-as-usual scenarios. Explore how additionality frameworks differ between blue carbon markets and traditional carbon credit trading to optimize environmental impact.

Verification

Blue carbon markets specialize in carbon credits generated from coastal and marine ecosystems, emphasizing precise verification of carbon sequestration in mangroves, salt marshes, and seagrass beds. Rigorous monitoring, reporting, and verification (MRV) protocols ensure the authenticity and permanence of blue carbon credits compared to broader carbon credit trading schemes that may encompass diverse emission reduction projects. Explore the differences in verification methodologies to better understand the impact and reliability of carbon market solutions.

Source and External Links

Blue carbon: The potential of coastal and oceanic climate action - Blue carbon markets involve trading carbon credits generated from protecting or restoring coastal and ocean ecosystems, with blue carbon solutions currently in early stages but offering significant potential for climate mitigation and co-benefits for biodiversity and coastal communities.

What You Need to Know About Blue Carbon - Blue carbon markets enable the generation and sale of carbon credits from carbon stored in coastal ecosystems like mangroves, saltmarshes, and seagrasses, providing climate benefits and funding opportunities for coastal community resilience and economic development.

Deep Blue: Opportunities for Blue Carbon Finance in Coastal Ecosystems - Financial institutions can support emerging blue carbon markets by funding projects conserving tidal wetlands, which sequester high levels of carbon relative to land ecosystems, helping companies and governments meet climate targets through carbon credit trading.

dowidth.com

dowidth.com