Carbon credit arbitrage leverages price differences between carbon markets to maximize returns by buying low and selling high, benefiting from regulatory and voluntary market fluctuations. Blue carbon investments focus on preserving and restoring coastal ecosystems like mangroves and seagrasses, generating carbon credits through natural carbon sequestration processes. Explore the specifics and comparative advantages of these investment strategies to enhance your portfolio's sustainability impact.

Why it is important

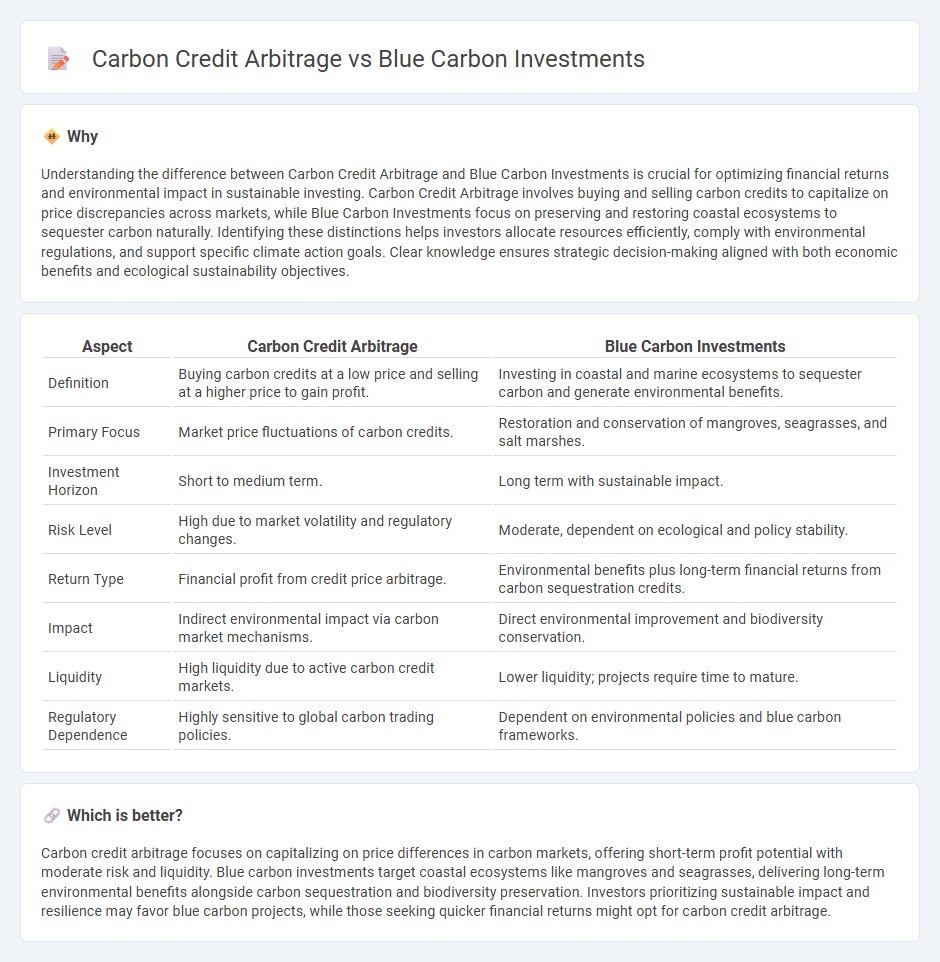

Understanding the difference between Carbon Credit Arbitrage and Blue Carbon Investments is crucial for optimizing financial returns and environmental impact in sustainable investing. Carbon Credit Arbitrage involves buying and selling carbon credits to capitalize on price discrepancies across markets, while Blue Carbon Investments focus on preserving and restoring coastal ecosystems to sequester carbon naturally. Identifying these distinctions helps investors allocate resources efficiently, comply with environmental regulations, and support specific climate action goals. Clear knowledge ensures strategic decision-making aligned with both economic benefits and ecological sustainability objectives.

Comparison Table

| Aspect | Carbon Credit Arbitrage | Blue Carbon Investments |

|---|---|---|

| Definition | Buying carbon credits at a low price and selling at a higher price to gain profit. | Investing in coastal and marine ecosystems to sequester carbon and generate environmental benefits. |

| Primary Focus | Market price fluctuations of carbon credits. | Restoration and conservation of mangroves, seagrasses, and salt marshes. |

| Investment Horizon | Short to medium term. | Long term with sustainable impact. |

| Risk Level | High due to market volatility and regulatory changes. | Moderate, dependent on ecological and policy stability. |

| Return Type | Financial profit from credit price arbitrage. | Environmental benefits plus long-term financial returns from carbon sequestration credits. |

| Impact | Indirect environmental impact via carbon market mechanisms. | Direct environmental improvement and biodiversity conservation. |

| Liquidity | High liquidity due to active carbon credit markets. | Lower liquidity; projects require time to mature. |

| Regulatory Dependence | Highly sensitive to global carbon trading policies. | Dependent on environmental policies and blue carbon frameworks. |

Which is better?

Carbon credit arbitrage focuses on capitalizing on price differences in carbon markets, offering short-term profit potential with moderate risk and liquidity. Blue carbon investments target coastal ecosystems like mangroves and seagrasses, delivering long-term environmental benefits alongside carbon sequestration and biodiversity preservation. Investors prioritizing sustainable impact and resilience may favor blue carbon projects, while those seeking quicker financial returns might opt for carbon credit arbitrage.

Connection

Carbon credit arbitrage leverages price differences between carbon markets to maximize returns, while blue carbon investments focus on preserving coastal ecosystems that sequester carbon, generating tradable credits. Both strategies capitalize on the monetization of carbon sequestration, with blue carbon projects offering sustainable sources of high-quality carbon credits that fuel arbitrage opportunities. Integrating these approaches enhances portfolio diversification and aligns financial gains with environmental impact.

Key Terms

Blue carbon investments:

Blue carbon investments target the sequestration of CO2 in coastal and marine ecosystems like mangroves, seagrasses, and salt marshes, offering high carbon storage capacity and biodiversity benefits. These investments support ecosystem restoration and resilience while generating verified carbon credits, often with co-benefits for fisheries and coastal protection. Explore how blue carbon projects can deliver sustainable returns and climate impact by learning more about their unique environmental and economic advantages.

Coastal ecosystems

Blue carbon investments in coastal ecosystems focus on preserving and restoring mangroves, salt marshes, and seagrasses to enhance carbon sequestration and support biodiversity. Carbon credit arbitrage exploits price disparities between carbon markets, potentially leveraging coastal carbon offsets but often lacking direct ecosystem benefits. Explore further to understand how blue carbon strategies can drive sustainable climate action and economic opportunities.

Sequestration

Blue carbon investments harness coastal and marine ecosystems such as mangroves, salt marshes, and seagrasses to capture and store atmospheric CO2, offering significant long-term sequestration benefits. Carbon credit arbitrage involves exploiting price differences between carbon markets to maximize financial returns but may not always guarantee enhanced sequestration outcomes. Discover how strategic investment choices can optimize environmental impact and financial value in carbon management.

Source and External Links

What are Blue Carbon Credits? Everything You Need to Know - Blue carbon investments involve supporting projects that protect or restore coastal ecosystems such as mangroves, seagrasses, and saltmarshes, which generate tradable carbon credits that companies like Microsoft, Airbnb, and Shell are investing in to offset emissions and contribute to conservation, with investment returns tied to project success but carrying natural and regulatory risks.

Opportunities for BLUE CARBON FINANCE in coastal ecosystems - Blue carbon projects offer cost-effective nature-based solutions for climate mitigation with carbon credit prices expected to rise to $40-$65 by 2040, driven by corporate demand for net-zero targets, making them a promising investment opportunity compared to generic land-based credits priced lower.

Blue Resilience: The Next Strategic Asset Class for Private Investment. - Institutional investment programs like the M40 Mangrove Program are developing global pipelines of blue carbon projects, including mangrove bond innovations, to attract private sector finance, integrate blue carbon into ESG strategies, and scale blue carbon as a strategic asset class for climate risk adaptation and green finance.

dowidth.com

dowidth.com