Collectibles investment offers unique tangible assets like art, antiques, and rare items that often appreciate based on rarity and market demand, contrasting with bonds, which provide fixed income through government or corporate debt instruments. Bonds are considered lower risk with predictable returns and liquidity features, while collectibles carry higher volatility and lower market liquidity but potential for significant value growth. Explore detailed comparisons to understand investment suitability for your financial goals.

Why it is important

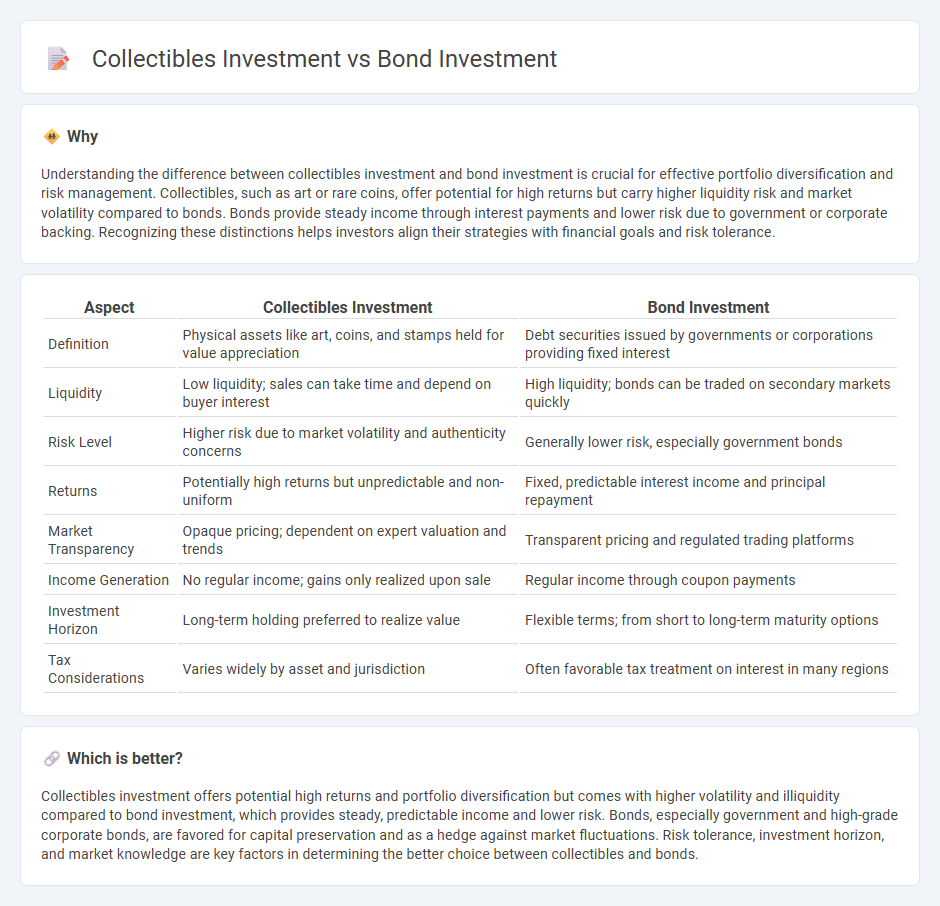

Understanding the difference between collectibles investment and bond investment is crucial for effective portfolio diversification and risk management. Collectibles, such as art or rare coins, offer potential for high returns but carry higher liquidity risk and market volatility compared to bonds. Bonds provide steady income through interest payments and lower risk due to government or corporate backing. Recognizing these distinctions helps investors align their strategies with financial goals and risk tolerance.

Comparison Table

| Aspect | Collectibles Investment | Bond Investment |

|---|---|---|

| Definition | Physical assets like art, coins, and stamps held for value appreciation | Debt securities issued by governments or corporations providing fixed interest |

| Liquidity | Low liquidity; sales can take time and depend on buyer interest | High liquidity; bonds can be traded on secondary markets quickly |

| Risk Level | Higher risk due to market volatility and authenticity concerns | Generally lower risk, especially government bonds |

| Returns | Potentially high returns but unpredictable and non-uniform | Fixed, predictable interest income and principal repayment |

| Market Transparency | Opaque pricing; dependent on expert valuation and trends | Transparent pricing and regulated trading platforms |

| Income Generation | No regular income; gains only realized upon sale | Regular income through coupon payments |

| Investment Horizon | Long-term holding preferred to realize value | Flexible terms; from short to long-term maturity options |

| Tax Considerations | Varies widely by asset and jurisdiction | Often favorable tax treatment on interest in many regions |

Which is better?

Collectibles investment offers potential high returns and portfolio diversification but comes with higher volatility and illiquidity compared to bond investment, which provides steady, predictable income and lower risk. Bonds, especially government and high-grade corporate bonds, are favored for capital preservation and as a hedge against market fluctuations. Risk tolerance, investment horizon, and market knowledge are key factors in determining the better choice between collectibles and bonds.

Connection

Collectibles investment and bond investment both serve as alternative assets that diversify investment portfolios and manage risk. While bond investments provide fixed income through government or corporate debt securities, collectibles such as art, rare coins, or vintage items offer potential capital appreciation driven by market demand and rarity. Both asset classes respond differently to economic cycles, making them complementary tools for balancing portfolio volatility and preserving wealth.

Key Terms

**Bond Investment:**

Bond investment offers a stable income stream through fixed interest payments and lower risk compared to collectibles, making it a preferred choice for conservative investors seeking predictable returns. Government and corporate bonds provide varying levels of credit risk and maturity options, allowing investors to tailor portfolios based on their risk tolerance and financial goals. Explore the advantages of bond investment to enhance your portfolio stability and income potential.

Yield

Bond investments typically offer predictable yields through fixed interest payments, making them a stable income source with lower risk. Collectibles' yields are less consistent, largely dependent on market demand, rarity, and condition, which can result in higher volatility and speculative gains. Explore how these investment vehicles align with your income goals and risk tolerance.

Credit Rating

Bond investment relies heavily on credit ratings from agencies like Moody's, S&P, and Fitch to assess default risk and determine yield spreads. Collectibles investment lacks standardized credit ratings, making valuation highly subjective and dependent on market demand and rarity. Explore more about how credit ratings impact the risk-return profile in bond versus collectibles investment strategies.

Source and External Links

Bonds | Investor.gov - This webpage provides an introduction to bonds, explaining how they work as debt securities where borrowers raise money from investors in exchange for regular interest payments and principal repayment at maturity.

The Basics of Investing In Bonds - This article covers the basics of bonds, including how they operate and how their prices can fluctuate based on market interest rates.

Bonds | FINRA.org - This webpage offers information on bonds as a type of debt security, including different types such as high-yield bonds and investment-grade bonds, and key terms like indenture.

dowidth.com

dowidth.com