Fractional ownership allows investors to buy a percentage of high-value assets, reducing upfront capital requirements while diversifying risk across multiple properties or items. Whole-asset purchase involves acquiring full ownership, granting complete control and decision-making power over the asset but requiring significant investment and higher financial commitment. Explore the benefits and considerations of each approach to determine the best investment strategy for your goals.

Why it is important

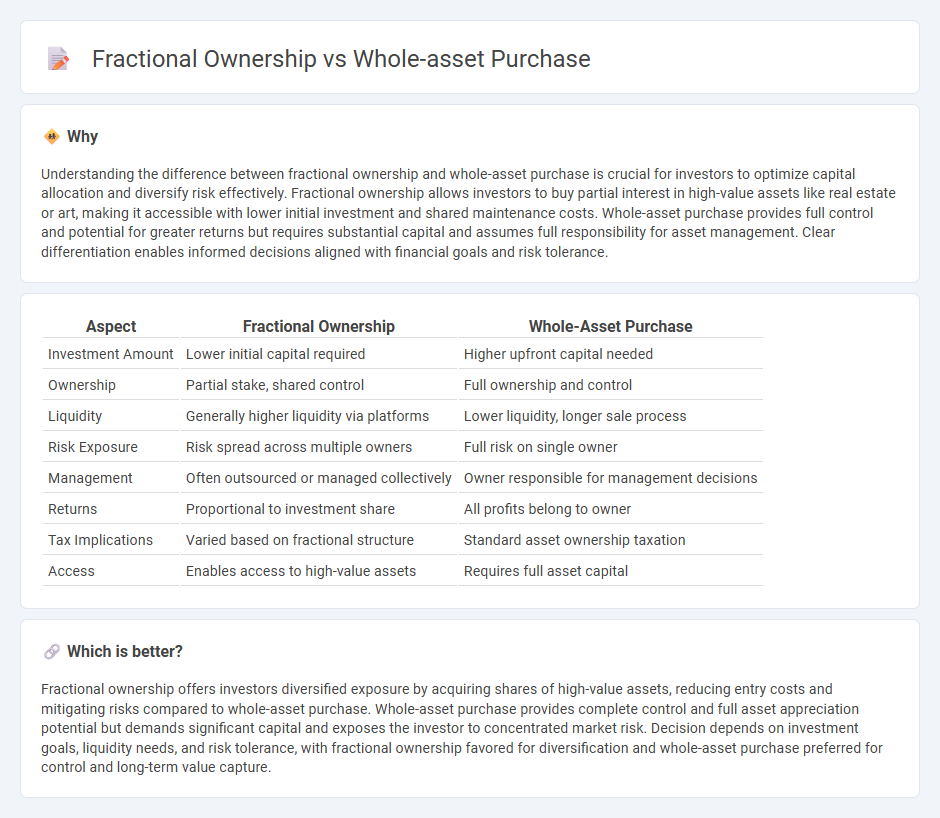

Understanding the difference between fractional ownership and whole-asset purchase is crucial for investors to optimize capital allocation and diversify risk effectively. Fractional ownership allows investors to buy partial interest in high-value assets like real estate or art, making it accessible with lower initial investment and shared maintenance costs. Whole-asset purchase provides full control and potential for greater returns but requires substantial capital and assumes full responsibility for asset management. Clear differentiation enables informed decisions aligned with financial goals and risk tolerance.

Comparison Table

| Aspect | Fractional Ownership | Whole-Asset Purchase |

|---|---|---|

| Investment Amount | Lower initial capital required | Higher upfront capital needed |

| Ownership | Partial stake, shared control | Full ownership and control |

| Liquidity | Generally higher liquidity via platforms | Lower liquidity, longer sale process |

| Risk Exposure | Risk spread across multiple owners | Full risk on single owner |

| Management | Often outsourced or managed collectively | Owner responsible for management decisions |

| Returns | Proportional to investment share | All profits belong to owner |

| Tax Implications | Varied based on fractional structure | Standard asset ownership taxation |

| Access | Enables access to high-value assets | Requires full asset capital |

Which is better?

Fractional ownership offers investors diversified exposure by acquiring shares of high-value assets, reducing entry costs and mitigating risks compared to whole-asset purchase. Whole-asset purchase provides complete control and full asset appreciation potential but demands significant capital and exposes the investor to concentrated market risk. Decision depends on investment goals, liquidity needs, and risk tolerance, with fractional ownership favored for diversification and whole-asset purchase preferred for control and long-term value capture.

Connection

Fractional ownership and whole-asset purchase both represent methods of acquiring equity in an investment, with fractional ownership allowing investors to buy a percentage share of an asset rather than the entire property. This approach reduces capital requirements and risk exposure while providing proportional returns, mimicking the benefits of whole-asset ownership on a smaller scale. Investors leverage fractional ownership platforms to diversify portfolios and access high-value assets that would otherwise be cost-prohibitive through traditional whole-asset purchases.

Key Terms

Title Deed

Whole-asset purchases grant exclusive ownership recorded on the Title Deed, providing full control and responsibility for the property. Fractional ownership divides the Title Deed among multiple parties, each holding a specific share and usage rights without complete control. Explore the nuances of Title Deed implications in these ownership models to make informed investment decisions.

Fractional Shares

Fractional shares allow investors to buy a portion of an asset, enabling diversified portfolios without the need for substantial capital required in whole-asset purchases. This approach offers greater flexibility and accessibility in markets such as real estate, stocks, and luxury goods, facilitating exposure to high-value assets at a fraction of the cost. Explore the benefits and strategies of fractional ownership to optimize your investment opportunities.

Co-ownership Agreement

Whole-asset purchase grants exclusive ownership and full control of the property, eliminating the need for a Co-ownership Agreement, whereas fractional ownership involves multiple investors sharing rights and responsibilities through a detailed Co-ownership Agreement that outlines usage, expenses, and maintenance. A Co-ownership Agreement is essential in fractional ownership to prevent conflicts and ensure clear governance among co-owners. Explore the key clauses and legal frameworks of Co-ownership Agreements for a deeper understanding.

Source and External Links

Foundations of Law - Purchase of All Assets - A whole-asset purchase occurs when a company sells all or substantially all of its assets to another firm, transferring everything that made the company what it was, often resulting in the selling corporation dissolving after the transaction.

I Thought I Bought The Whole Company - No Just The Assets - In a whole-asset purchase, the buyer acquires specific assets and sometimes liabilities, but not the company itself or its stock, allowing selective acquisition and limited liability for the buyer.

Asset Acquisition - Corporate Finance Institute - A whole-asset purchase involves buying a company's assets rather than its stock, enabling the buyer to choose which assets and liabilities to acquire, providing flexibility and risk mitigation compared to stock purchases.

dowidth.com

dowidth.com