Whale-watching shares offer investors exposure to the growing ecotourism market with the potential for higher returns, albeit with increased volatility compared to traditional bonds. Bonds provide steady income and lower risk through fixed interest payments, appealing to conservative investors seeking capital preservation. Explore the benefits and risks of each investment option to determine which aligns best with your financial goals.

Why it is important

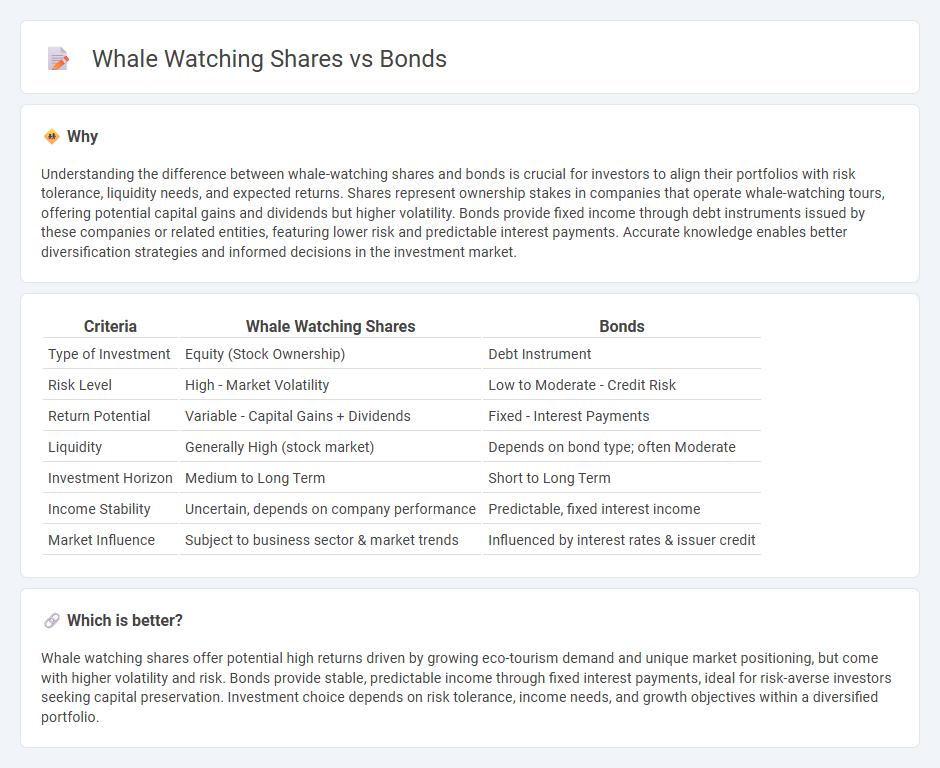

Understanding the difference between whale-watching shares and bonds is crucial for investors to align their portfolios with risk tolerance, liquidity needs, and expected returns. Shares represent ownership stakes in companies that operate whale-watching tours, offering potential capital gains and dividends but higher volatility. Bonds provide fixed income through debt instruments issued by these companies or related entities, featuring lower risk and predictable interest payments. Accurate knowledge enables better diversification strategies and informed decisions in the investment market.

Comparison Table

| Criteria | Whale Watching Shares | Bonds |

|---|---|---|

| Type of Investment | Equity (Stock Ownership) | Debt Instrument |

| Risk Level | High - Market Volatility | Low to Moderate - Credit Risk |

| Return Potential | Variable - Capital Gains + Dividends | Fixed - Interest Payments |

| Liquidity | Generally High (stock market) | Depends on bond type; often Moderate |

| Investment Horizon | Medium to Long Term | Short to Long Term |

| Income Stability | Uncertain, depends on company performance | Predictable, fixed interest income |

| Market Influence | Subject to business sector & market trends | Influenced by interest rates & issuer credit |

Which is better?

Whale watching shares offer potential high returns driven by growing eco-tourism demand and unique market positioning, but come with higher volatility and risk. Bonds provide stable, predictable income through fixed interest payments, ideal for risk-averse investors seeking capital preservation. Investment choice depends on risk tolerance, income needs, and growth objectives within a diversified portfolio.

Connection

Whale watching companies often issue shares and bonds to raise capital for expanding their fleet and eco-tourism operations. Shares represent ownership in these companies, allowing investors to benefit from profits and market growth, while bonds provide a fixed income through interest payments backed by the company's assets and revenues. The interconnectedness lies in their shared goal of financing sustainable tourism ventures, appealing to investors seeking both equity growth and stable returns in the environmental sector.

Key Terms

Fixed Income

Fixed income investments, such as bonds, offer predictable returns and lower risk compared to whale watching shares, which are influenced by tourism trends and environmental factors. Bonds provide steady interest payments and principal protection, making them attractive for risk-averse investors seeking consistent income. Explore how fixed income securities can balance your portfolio and enhance financial stability.

Equity Ownership

Bonds represent debt instruments that offer fixed interest payments without granting ownership rights, whereas whale watching shares provide equity ownership, giving investors a stake in the company's profits and voting power. Equity ownership in whale watching shares allows for potential capital appreciation aligned with the business's operational success in the eco-tourism sector. Discover how equity ownership in niche markets like whale watching can diversify your investment portfolio and enhance returns.

Risk Profile

Bonds typically offer lower risk with stable returns and fixed interest payments, making them suitable for conservative investors seeking capital preservation. Whale watching shares, by contrast, involve higher risk due to market volatility, operational challenges, and sensitivity to environmental factors, but they can provide substantial growth potential and dividend income. Explore the detailed risk profiles and investment opportunities of both to make an informed decision.

Source and External Links

Bonds | Investor.gov - Bonds are debt securities issued by governments, municipalities, or corporations to raise money, where investors lend money in exchange for regular interest payments and repayment of principal at maturity.

Bond (finance) - Wikipedia - Bonds provide external funds for long-term investments and are usually safer than stocks, with predictable interest payments and legal protections in bankruptcy situations.

What is a Bond and How do they Work? - Vanguard - Bonds pay a stated interest rate over a fixed term and provide income and reduced portfolio volatility, but do not give ownership rights like stocks do.

dowidth.com

dowidth.com