Art tokenization transforms physical artworks into digital tokens on blockchain platforms, enabling fractional ownership and increased liquidity in the art market. Securitization converts various financial assets into tradeable securities, providing diversified investment opportunities and improved capital flow. Explore how these innovative financial instruments reshape investment strategies and asset accessibility.

Why it is important

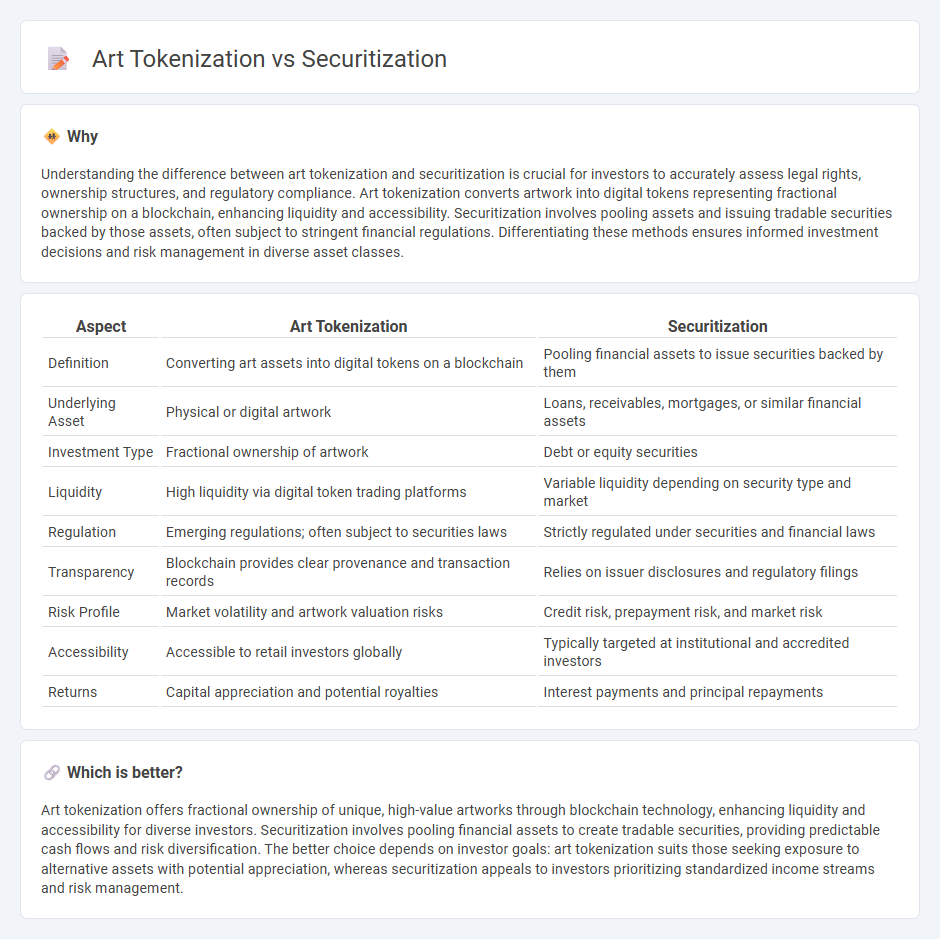

Understanding the difference between art tokenization and securitization is crucial for investors to accurately assess legal rights, ownership structures, and regulatory compliance. Art tokenization converts artwork into digital tokens representing fractional ownership on a blockchain, enhancing liquidity and accessibility. Securitization involves pooling assets and issuing tradable securities backed by those assets, often subject to stringent financial regulations. Differentiating these methods ensures informed investment decisions and risk management in diverse asset classes.

Comparison Table

| Aspect | Art Tokenization | Securitization |

|---|---|---|

| Definition | Converting art assets into digital tokens on a blockchain | Pooling financial assets to issue securities backed by them |

| Underlying Asset | Physical or digital artwork | Loans, receivables, mortgages, or similar financial assets |

| Investment Type | Fractional ownership of artwork | Debt or equity securities |

| Liquidity | High liquidity via digital token trading platforms | Variable liquidity depending on security type and market |

| Regulation | Emerging regulations; often subject to securities laws | Strictly regulated under securities and financial laws |

| Transparency | Blockchain provides clear provenance and transaction records | Relies on issuer disclosures and regulatory filings |

| Risk Profile | Market volatility and artwork valuation risks | Credit risk, prepayment risk, and market risk |

| Accessibility | Accessible to retail investors globally | Typically targeted at institutional and accredited investors |

| Returns | Capital appreciation and potential royalties | Interest payments and principal repayments |

Which is better?

Art tokenization offers fractional ownership of unique, high-value artworks through blockchain technology, enhancing liquidity and accessibility for diverse investors. Securitization involves pooling financial assets to create tradable securities, providing predictable cash flows and risk diversification. The better choice depends on investor goals: art tokenization suits those seeking exposure to alternative assets with potential appreciation, whereas securitization appeals to investors prioritizing standardized income streams and risk management.

Connection

Art tokenization and securitization are connected through their shared goal of transforming physical art assets into tradable digital securities on blockchain platforms. By converting art ownership into tokens, investors can buy, sell, and trade fractional shares, increasing liquidity and access to the art market. This process integrates legal frameworks of securitization, ensuring regulatory compliance and investor protections for tokenized art assets.

Key Terms

Asset-backed securities

Securitization involves pooling financial assets to create asset-backed securities (ABS) that provide investors with cash flows from these underlying assets, ensuring liquidity and risk diversification. Art tokenization transforms artworks into digital tokens on blockchain, enabling fractional ownership but often lacks the regulatory frameworks and traditional risk mitigation features inherent in ABS. Explore the nuances and benefits of both models to understand their impact on asset investment strategies.

Fractional ownership

Securitization transforms assets into tradable financial securities, enabling fractional ownership through regulated investment structures, while art tokenization leverages blockchain to divide artwork into digital tokens, offering transparent and accessible partial ownership. Fractional ownership in securitization often involves real estate or corporate assets, whereas art tokenization democratizes access to high-value art markets by lowering investment barriers. Explore how these innovative approaches reshape asset ownership and investment opportunities.

Blockchain technology

Blockchain technology revolutionizes securitization by enabling transparent, efficient asset-backed securities trading with immutable ledger records and reduced counterparty risk. Art tokenization leverages blockchain to fractionalize ownership of valuable artworks, enhancing liquidity and democratizing access through non-fungible tokens (NFTs). Explore how blockchain drives innovation in financial markets and digital art ownership today.

Source and External Links

Securitization - Securitization is the financial practice of pooling various types of debt and selling related cash flows as securities to investors.

Securitization (International Relations) - This refers to the process of transforming political issues into security concerns to justify extraordinary measures.

Asset Securitization - Asset securitization involves using securities markets to fund parts of a loan portfolio, offering benefits to originators, investors, and borrowers.

dowidth.com

dowidth.com