Patent monetization involves generating revenue through licensing or selling intellectual property rights, enabling inventors and companies to capitalize on innovations without dilution of ownership. Equity financing, by contrast, raises capital by issuing shares to investors, trading partial ownership for funds to accelerate growth and development. Explore further to understand which strategy aligns best with your investment goals.

Why it is important

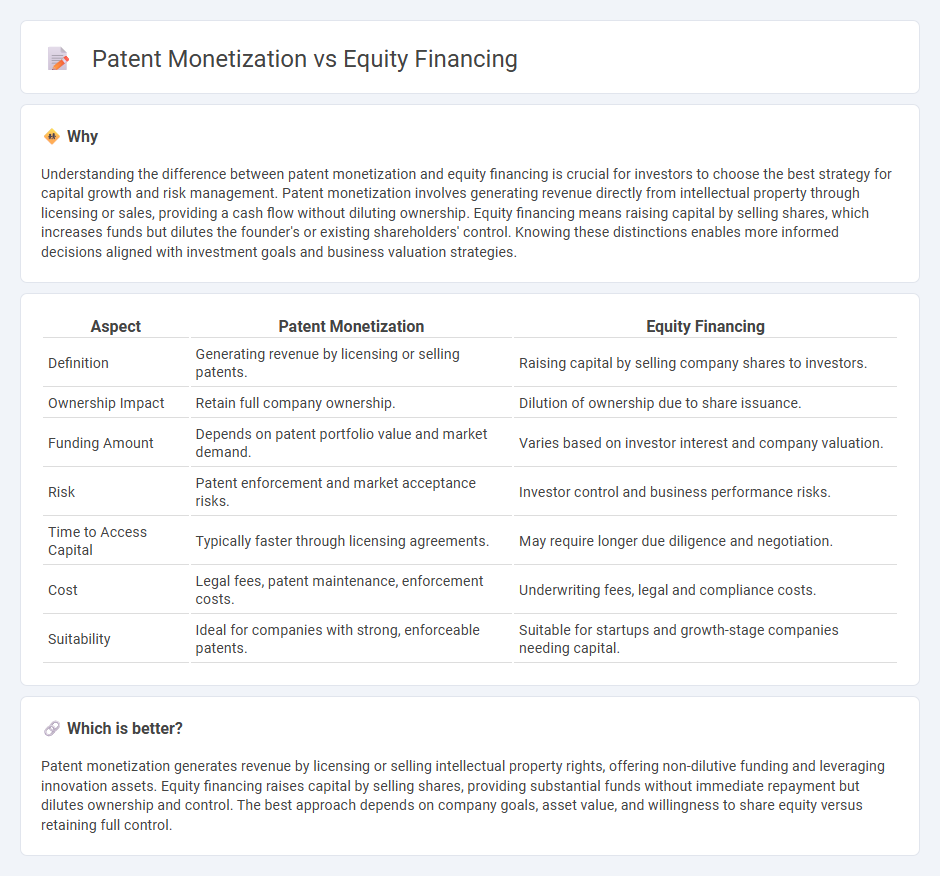

Understanding the difference between patent monetization and equity financing is crucial for investors to choose the best strategy for capital growth and risk management. Patent monetization involves generating revenue directly from intellectual property through licensing or sales, providing a cash flow without diluting ownership. Equity financing means raising capital by selling shares, which increases funds but dilutes the founder's or existing shareholders' control. Knowing these distinctions enables more informed decisions aligned with investment goals and business valuation strategies.

Comparison Table

| Aspect | Patent Monetization | Equity Financing |

|---|---|---|

| Definition | Generating revenue by licensing or selling patents. | Raising capital by selling company shares to investors. |

| Ownership Impact | Retain full company ownership. | Dilution of ownership due to share issuance. |

| Funding Amount | Depends on patent portfolio value and market demand. | Varies based on investor interest and company valuation. |

| Risk | Patent enforcement and market acceptance risks. | Investor control and business performance risks. |

| Time to Access Capital | Typically faster through licensing agreements. | May require longer due diligence and negotiation. |

| Cost | Legal fees, patent maintenance, enforcement costs. | Underwriting fees, legal and compliance costs. |

| Suitability | Ideal for companies with strong, enforceable patents. | Suitable for startups and growth-stage companies needing capital. |

Which is better?

Patent monetization generates revenue by licensing or selling intellectual property rights, offering non-dilutive funding and leveraging innovation assets. Equity financing raises capital by selling shares, providing substantial funds without immediate repayment but dilutes ownership and control. The best approach depends on company goals, asset value, and willingness to share equity versus retaining full control.

Connection

Patent monetization and equity financing are interconnected as companies leverage patented innovations to attract investors by showcasing proprietary technology with high market potential. Monetizing patents through licensing or sales generates immediate capital, enhancing financial flexibility and valuation, which strengthens a company's position during equity financing rounds. This symbiotic relationship drives growth by combining intellectual property assets with investment capital, fueling scalability and competitive advantage.

Key Terms

Ownership dilution

Equity financing involves raising capital by selling shares of ownership, which results in ownership dilution as new investors gain equity stakes. Patent monetization generates revenue through licensing or selling intellectual property without affecting company ownership or control. Discover the strategic benefits of choosing between equity financing and patent monetization for your business growth.

Intellectual property rights

Equity financing leverages ownership stakes to raise capital, often diluting founders' control but aligning investor interests with company growth, while patent monetization directly capitalizes on intellectual property rights through licensing or sales without giving up equity. Intellectual property rights protection is critical for maximizing value in patent monetization, ensuring enforceability and competitive advantage. Explore these strategies deeper to optimize funding using your patent portfolio effectively.

Royalty income

Equity financing involves raising capital by selling shares, which can dilute ownership but provides upfront funds without recurring obligations, while patent monetization through royalty income leverages intellectual property to generate ongoing revenue streams based on usage or licensing agreements. Royalty income offers a predictable cash flow without impacting equity structure, making it an attractive option for companies with valuable patents seeking sustainable funding. Explore further to understand which strategy aligns best with your long-term financial goals.

Source and External Links

How equity financing works for startups - J.P. Morgan - Equity financing involves raising capital by selling ownership stakes in a company to investors who become long-term partners sharing the company's success without repayment obligations like debt financing.

Equity Financing - Definition, How it Works, Pros, Cons - Equity financing is the sale of company shares--such as common or preferred stock--to raise capital, commonly used in startups and private companies via angel investors, crowdfunding, or venture capital before potentially going public.

Advantages and Disadvantages of Equity Financing - Equity financing offers benefits like no repayment obligation and access to investor expertise but requires relinquishing ownership and may lead to investor involvement in business decisions.

dowidth.com

dowidth.com