Sneakers flipping involves buying limited-edition or high-demand sneakers at retail prices and reselling them for a profit, capitalizing on trends and brand collaborations within the sneaker market. Watch flipping focuses on acquiring luxury timepieces, often from brands like Rolex or Patek Philippe, with the intention of selling them at an increased value driven by rarity and brand prestige. Discover more about the profitability and risks associated with sneakers flipping versus watch flipping to make informed investment decisions.

Why it is important

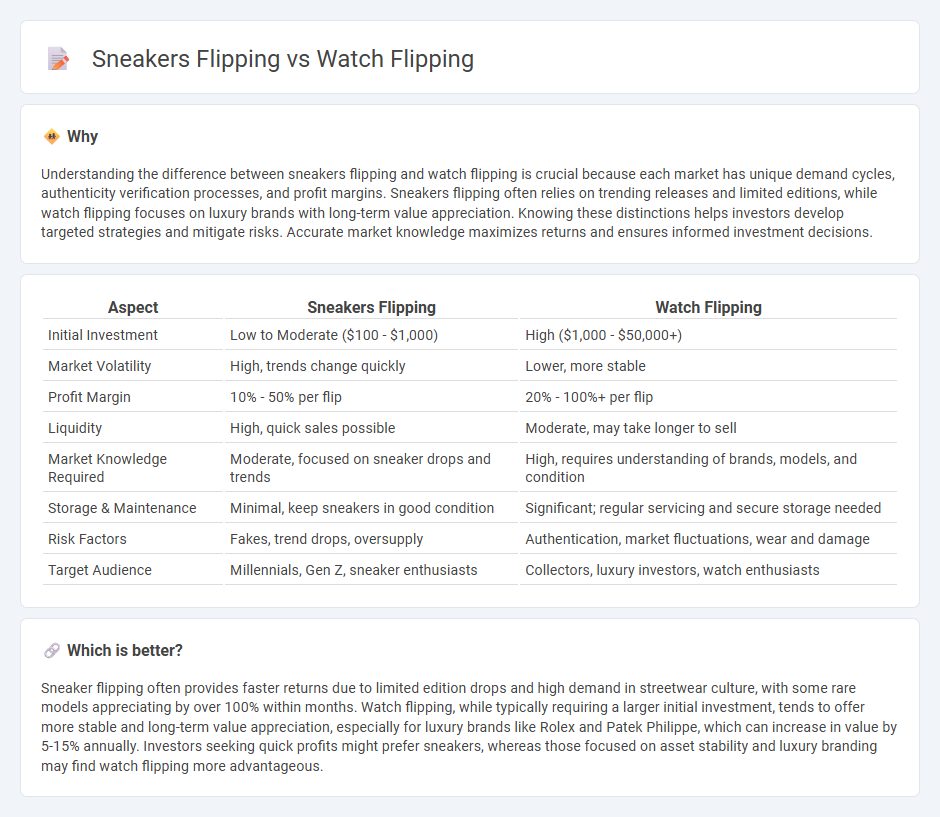

Understanding the difference between sneakers flipping and watch flipping is crucial because each market has unique demand cycles, authenticity verification processes, and profit margins. Sneakers flipping often relies on trending releases and limited editions, while watch flipping focuses on luxury brands with long-term value appreciation. Knowing these distinctions helps investors develop targeted strategies and mitigate risks. Accurate market knowledge maximizes returns and ensures informed investment decisions.

Comparison Table

| Aspect | Sneakers Flipping | Watch Flipping |

|---|---|---|

| Initial Investment | Low to Moderate ($100 - $1,000) | High ($1,000 - $50,000+) |

| Market Volatility | High, trends change quickly | Lower, more stable |

| Profit Margin | 10% - 50% per flip | 20% - 100%+ per flip |

| Liquidity | High, quick sales possible | Moderate, may take longer to sell |

| Market Knowledge Required | Moderate, focused on sneaker drops and trends | High, requires understanding of brands, models, and condition |

| Storage & Maintenance | Minimal, keep sneakers in good condition | Significant; regular servicing and secure storage needed |

| Risk Factors | Fakes, trend drops, oversupply | Authentication, market fluctuations, wear and damage |

| Target Audience | Millennials, Gen Z, sneaker enthusiasts | Collectors, luxury investors, watch enthusiasts |

Which is better?

Sneaker flipping often provides faster returns due to limited edition drops and high demand in streetwear culture, with some rare models appreciating by over 100% within months. Watch flipping, while typically requiring a larger initial investment, tends to offer more stable and long-term value appreciation, especially for luxury brands like Rolex and Patek Philippe, which can increase in value by 5-15% annually. Investors seeking quick profits might prefer sneakers, whereas those focused on asset stability and luxury branding may find watch flipping more advantageous.

Connection

Sneakers flipping and watch flipping are connected through their reliance on limited-edition releases and brand prestige that drive high resale values. Both markets leverage scarcity, hype culture, and authentication processes to maximize investment returns. Investors capitalize on fluctuating demand by buying low during drops and selling high in secondary markets, often using online platforms specialized in luxury goods.

Key Terms

Market Demand

Watch flipping targets a niche market of luxury timepiece enthusiasts with high demand for rare and limited-edition models, often resulting in significant profit margins. Sneakers flipping thrives on rapidly changing trends and large-scale consumer interest in exclusive collaborations and limited releases, driving frequent turnover and accessibility. Explore detailed market insights to optimize your flipping strategy.

Resale Value

Watch flipping often yields higher resale value due to the intrinsic craftsmanship, brand prestige, and limited edition releases, with luxury brands like Rolex and Patek Philippe holding significant appreciation potential. Sneakers flipping, driven by hype, collaborations, and limited drops from brands like Nike and Adidas, offers substantial profits but tends to have more volatile resale prices. Explore detailed market trends and expert tips to maximize your investment in both watch and sneaker flipping.

Authenticity Verification

Watch flipping requires rigorous authenticity verification through serial numbers, hallmark stamps, and movement inspection to avoid counterfeit luxury timepieces. Sneakers flipping demands scrutiny of materials, stitching, and exclusive release details to confirm genuine limited-edition footwear. Learn more about expert methods to master authenticity verification for profitable flipping.

Source and External Links

eBay Watch Flipping Made Easy: Repair, List, Profit - A step-by-step video guide showing how to repair, prepare, and photograph watches for resale on platforms like eBay, emphasizing practical tips for beginners.

How to flip watches for beginners: Turning timepieces into cash - An introductory article explaining that watch flipping involves buying watches--often luxury or limited edition--at retail or below and reselling them for profit, typically targeting high-demand brands and leveraging scarcity.

How To Start Flipping Watches For Profit - A practical guide focusing on spotting undervalued, older, or limited edition watches, using sites like eBay and Chrono24 to research prices, and sharing real examples of profitable flips with specific brands and models.

dowidth.com

dowidth.com