Carbon credits trading offers investors a direct approach to financing projects that reduce greenhouse gas emissions by purchasing and selling carbon offsets, while Environmental, Social, and Governance (ESG) funds focus on investing in companies with sustainable practices across multiple dimensions. The market for carbon credits has expanded rapidly, driven by regulatory frameworks and corporate commitments to net-zero targets, contrasting with ESG funds that prioritize overall corporate responsibility and risk management. Explore how these investment strategies align with your sustainable finance goals and impact portfolio diversification.

Why it is important

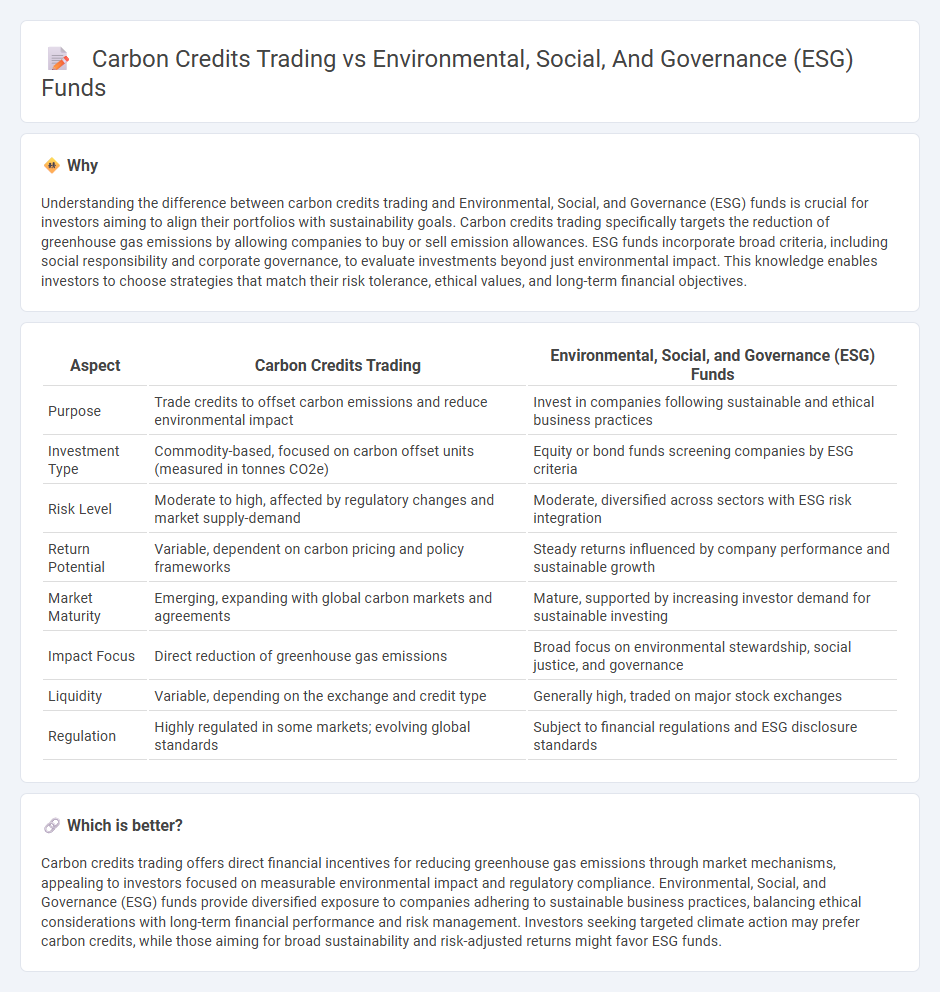

Understanding the difference between carbon credits trading and Environmental, Social, and Governance (ESG) funds is crucial for investors aiming to align their portfolios with sustainability goals. Carbon credits trading specifically targets the reduction of greenhouse gas emissions by allowing companies to buy or sell emission allowances. ESG funds incorporate broad criteria, including social responsibility and corporate governance, to evaluate investments beyond just environmental impact. This knowledge enables investors to choose strategies that match their risk tolerance, ethical values, and long-term financial objectives.

Comparison Table

| Aspect | Carbon Credits Trading | Environmental, Social, and Governance (ESG) Funds |

|---|---|---|

| Purpose | Trade credits to offset carbon emissions and reduce environmental impact | Invest in companies following sustainable and ethical business practices |

| Investment Type | Commodity-based, focused on carbon offset units (measured in tonnes CO2e) | Equity or bond funds screening companies by ESG criteria |

| Risk Level | Moderate to high, affected by regulatory changes and market supply-demand | Moderate, diversified across sectors with ESG risk integration |

| Return Potential | Variable, dependent on carbon pricing and policy frameworks | Steady returns influenced by company performance and sustainable growth |

| Market Maturity | Emerging, expanding with global carbon markets and agreements | Mature, supported by increasing investor demand for sustainable investing |

| Impact Focus | Direct reduction of greenhouse gas emissions | Broad focus on environmental stewardship, social justice, and governance |

| Liquidity | Variable, depending on the exchange and credit type | Generally high, traded on major stock exchanges |

| Regulation | Highly regulated in some markets; evolving global standards | Subject to financial regulations and ESG disclosure standards |

Which is better?

Carbon credits trading offers direct financial incentives for reducing greenhouse gas emissions through market mechanisms, appealing to investors focused on measurable environmental impact and regulatory compliance. Environmental, Social, and Governance (ESG) funds provide diversified exposure to companies adhering to sustainable business practices, balancing ethical considerations with long-term financial performance and risk management. Investors seeking targeted climate action may prefer carbon credits, while those aiming for broad sustainability and risk-adjusted returns might favor ESG funds.

Connection

Carbon credits trading directly influences Environmental, Social, and Governance (ESG) funds by providing measurable metrics for environmental impact, which enhances ESG criteria compliance. Investors increasingly allocate capital to ESG funds that integrate carbon credit strategies to mitigate climate risks and promote sustainability. This connection drives demand for transparent carbon markets and supports the transition towards low-carbon economies in investment portfolios.

Key Terms

ESG Ratings

ESG funds prioritize investments based on Environmental, Social, and Governance criteria, often relying on ESG ratings from agencies like MSCI and Sustainalytics to evaluate corporate sustainability performance. Carbon credits trading involves market-based mechanisms where companies buy and sell permits to emit a certain amount of CO2, directly targeting carbon reduction but not always reflecting broader ESG factors. Explore deeper insights to understand how ESG ratings influence fund strategies versus carbon credit markets.

Carbon Offset

ESG funds integrate environmental, social, and governance criteria into investment decisions, promoting sustainable business practices and driving long-term value, while carbon credits trading specifically targets carbon offsetting by allowing companies to buy and sell emission allowances to meet regulatory limits or voluntary goals. Carbon offset projects funded through carbon credits include reforestation, renewable energy, and methane capture, directly reducing or removing greenhouse gas emissions. Explore how each mechanism contributes uniquely to climate action and investment strategies for deeper insights.

Materiality

Environmental, Social, and Governance (ESG) funds prioritize investments based on a company's material sustainability factors, directly influencing long-term financial performance and risk management. Carbon credits trading centers on quantifiable emission reductions, allowing organizations to offset their carbon footprint but may lack comprehensive impact on broader environmental and social governance issues. Explore deeper insights on how materiality differentiates ESG investing from carbon credit mechanisms for more effective sustainability strategies.

Source and External Links

Environmental, social, and governance - ESG investing prioritizes environmental, social, and corporate governance issues in investment decisions, with over $18.4 trillion in ESG assets globally in 2021 and Europe holding 84% of the sustainable funds market as of 2023.

Environmental, Social and Governance (ESG) Investing - ESG investing evaluates companies based on their impact and policies on environment, social relations, and governance practices, often called sustainable or socially responsible investing.

Embracing Sustainable Investment Practices with ESG Investing - ESG investing is a popular strategy emphasizing environmental responsibility, social justice, and governance practices, shown to reduce risk and offer long-term growth, now representing an estimated $4 trillion in assets globally.

dowidth.com

dowidth.com