Blue economy funds focus on sustainable investments in marine and ocean resources, targeting sectors like fisheries, renewable energy, and maritime transportation to promote environmental stewardship and economic growth. Venture capital typically invests in high-growth startups across various industries, emphasizing innovation and rapid scalability, with a higher risk-reward profile. Explore the distinctions between blue economy funds and venture capital to optimize your investment strategy.

Why it is important

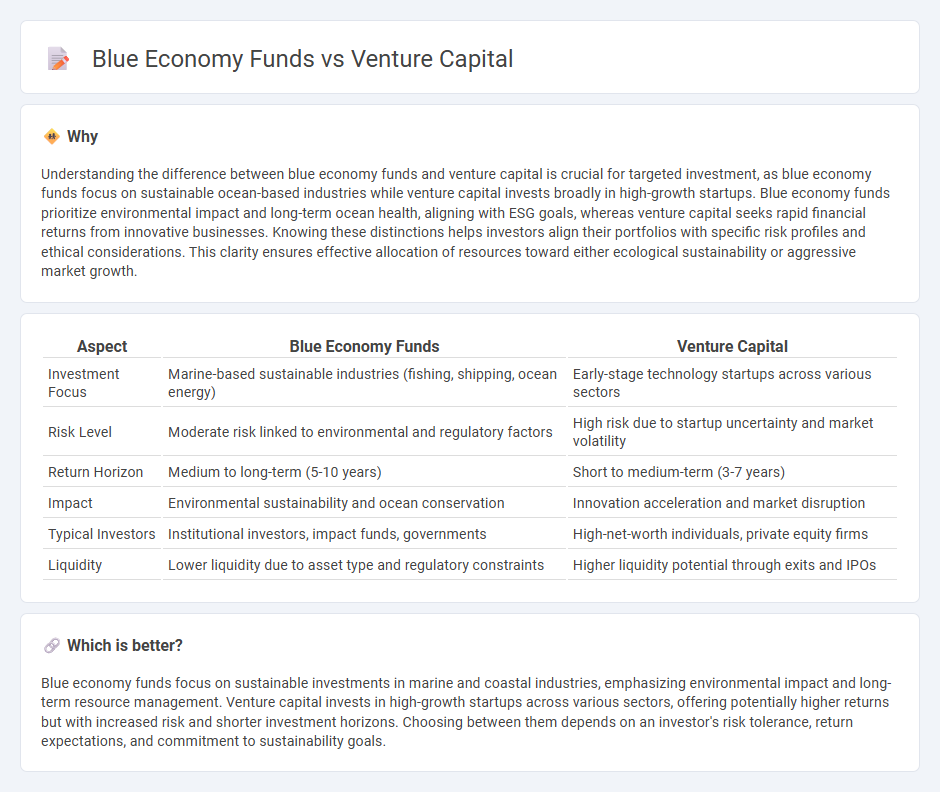

Understanding the difference between blue economy funds and venture capital is crucial for targeted investment, as blue economy funds focus on sustainable ocean-based industries while venture capital invests broadly in high-growth startups. Blue economy funds prioritize environmental impact and long-term ocean health, aligning with ESG goals, whereas venture capital seeks rapid financial returns from innovative businesses. Knowing these distinctions helps investors align their portfolios with specific risk profiles and ethical considerations. This clarity ensures effective allocation of resources toward either ecological sustainability or aggressive market growth.

Comparison Table

| Aspect | Blue Economy Funds | Venture Capital |

|---|---|---|

| Investment Focus | Marine-based sustainable industries (fishing, shipping, ocean energy) | Early-stage technology startups across various sectors |

| Risk Level | Moderate risk linked to environmental and regulatory factors | High risk due to startup uncertainty and market volatility |

| Return Horizon | Medium to long-term (5-10 years) | Short to medium-term (3-7 years) |

| Impact | Environmental sustainability and ocean conservation | Innovation acceleration and market disruption |

| Typical Investors | Institutional investors, impact funds, governments | High-net-worth individuals, private equity firms |

| Liquidity | Lower liquidity due to asset type and regulatory constraints | Higher liquidity potential through exits and IPOs |

Which is better?

Blue economy funds focus on sustainable investments in marine and coastal industries, emphasizing environmental impact and long-term resource management. Venture capital invests in high-growth startups across various sectors, offering potentially higher returns but with increased risk and shorter investment horizons. Choosing between them depends on an investor's risk tolerance, return expectations, and commitment to sustainability goals.

Connection

Blue economy funds leverage venture capital to drive sustainable investments in marine and ocean-based industries, promoting innovation in sectors like renewable energy, fisheries, and aquaculture. Venture capital provides critical early-stage funding that accelerates the development of technologies aimed at ocean conservation and resource efficiency. This synergy fosters economic growth while addressing environmental challenges within the blue economy.

Key Terms

Equity Stake

Venture capital funds typically acquire significant equity stakes in high-growth startups, aiming for substantial returns through business scaling and eventual exits. Blue economy funds focus on investments in sustainable ocean-based industries, often balancing equity stakes with environmental impact objectives and regulatory considerations. Explore the detailed differences in equity allocation and strategic goals between these fund types to better understand their distinct investment approaches.

Sustainability Metrics

Venture capital funds targeting sustainability prioritize innovative startups driving renewable energy, waste reduction, and carbon footprint minimization, using metrics like carbon emissions saved and energy efficiency gains to evaluate impact. Blue economy funds focus specifically on ocean-based sustainability projects, measuring success through indicators such as marine biodiversity preservation, sustainable fishing practices, and pollution reduction in marine ecosystems. Explore comprehensive sustainability metrics unique to these funding approaches for a deeper understanding of their environmental impact.

Risk Profile

Venture capital funds typically exhibit a high-risk profile, investing in early-stage startups with the potential for substantial returns but significant uncertainty. Blue economy funds focus on sustainable ocean-related projects, balancing moderate risk with environmental impact goals and steady long-term growth. Explore the nuances of these investment strategies to align risk tolerance with your portfolio objectives.

Source and External Links

What is Venture Capital? - Venture capital transforms ideas into products by investing in high-growth companies, creating jobs, and shaping the economy.

Fund your business | U.S. Small Business Administration - Venture capital is offered to high-growth companies in exchange for equity, providing funding without loans.

What is venture capital? - Venture capital supports startups with potential for rapid growth by providing funding in exchange for equity, often aiming for long-term returns.

dowidth.com

dowidth.com