NFT domain names offer a unique investment avenue by combining blockchain technology with digital asset ownership, providing potential for increased security and liquidity compared to traditional assets. Stocks represent ownership in companies with established market valuations and regulatory oversight, offering dividends and long-term growth potential. Explore the distinct advantages and risks of NFT domain names and stocks to optimize your investment strategy.

Why it is important

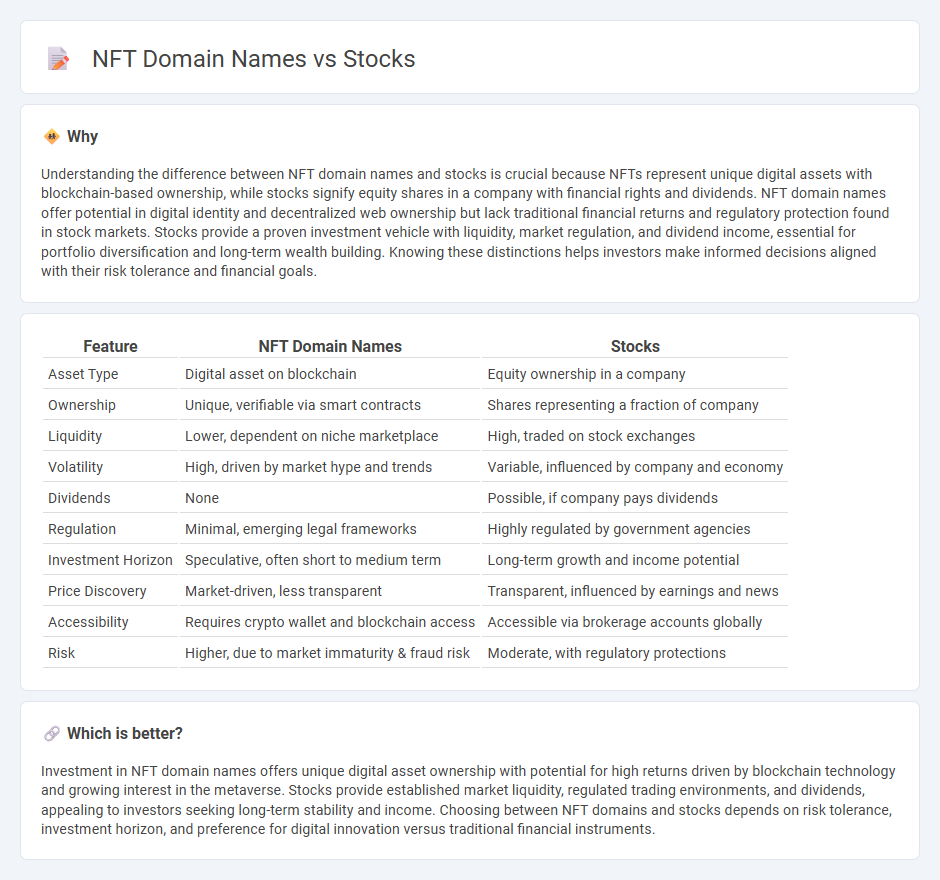

Understanding the difference between NFT domain names and stocks is crucial because NFTs represent unique digital assets with blockchain-based ownership, while stocks signify equity shares in a company with financial rights and dividends. NFT domain names offer potential in digital identity and decentralized web ownership but lack traditional financial returns and regulatory protection found in stock markets. Stocks provide a proven investment vehicle with liquidity, market regulation, and dividend income, essential for portfolio diversification and long-term wealth building. Knowing these distinctions helps investors make informed decisions aligned with their risk tolerance and financial goals.

Comparison Table

| Feature | NFT Domain Names | Stocks |

|---|---|---|

| Asset Type | Digital asset on blockchain | Equity ownership in a company |

| Ownership | Unique, verifiable via smart contracts | Shares representing a fraction of company |

| Liquidity | Lower, dependent on niche marketplace | High, traded on stock exchanges |

| Volatility | High, driven by market hype and trends | Variable, influenced by company and economy |

| Dividends | None | Possible, if company pays dividends |

| Regulation | Minimal, emerging legal frameworks | Highly regulated by government agencies |

| Investment Horizon | Speculative, often short to medium term | Long-term growth and income potential |

| Price Discovery | Market-driven, less transparent | Transparent, influenced by earnings and news |

| Accessibility | Requires crypto wallet and blockchain access | Accessible via brokerage accounts globally |

| Risk | Higher, due to market immaturity & fraud risk | Moderate, with regulatory protections |

Which is better?

Investment in NFT domain names offers unique digital asset ownership with potential for high returns driven by blockchain technology and growing interest in the metaverse. Stocks provide established market liquidity, regulated trading environments, and dividends, appealing to investors seeking long-term stability and income. Choosing between NFT domains and stocks depends on risk tolerance, investment horizon, and preference for digital innovation versus traditional financial instruments.

Connection

NFT domain names and stocks intersect through their shared role as investment assets that offer ownership and potential value appreciation. NFT domains provide unique, blockchain-verified digital property rights, enhancing digital identity and branding opportunities, while stocks represent equity in publicly traded companies with dividends and capital gains. Both enable investors to diversify portfolios with digital and traditional assets, driven by market demand and speculative trends.

Key Terms

Ownership

Stock ownership grants investors equity shares, representing partial ownership in a company, with rights to dividends and voting in corporate decisions. NFT domain names offer decentralized ownership on blockchain networks, ensuring unique control, transferability, and resistance to censorship without intermediaries. Explore the distinctions and benefits of these asset types to understand which aligns better with your investment goals.

Liquidity

Stocks typically offer high liquidity due to active trading on established exchanges, enabling quick buying and selling with transparent pricing. NFT domain names, while growing in popularity, often face limited liquidity because transactions occur on niche marketplaces with fewer participants. Explore how liquidity impacts investment strategies in both markets to make informed decisions.

Regulation

Stock investments are heavily regulated by entities such as the U.S. Securities and Exchange Commission (SEC), ensuring investor protection through strict disclosure and compliance requirements. NFT domain names currently face limited regulatory oversight, creating a dynamically evolving legal landscape that raises concerns about intellectual property rights and consumer safeguards. Explore the complexities of regulatory frameworks shaping stocks and NFT domain names to better navigate these investment options.

Source and External Links

Stocks | Investor.gov - This webpage explains what stocks are, the different types of stocks, and how they function as a form of equity ownership in companies.

What are Stocks? | Charles Schwab - This page provides an overview of what stocks are, how they work, and their role in investment strategies, including potential for growth and income.

Stock Market Outlook | Business Insider - This article discusses the current state of the stock market, highlighting potential risks and vulnerabilities, such as comparisons to historical market peaks.

dowidth.com

dowidth.com