Royalty rights investing offers a way to earn passive income through a percentage of revenue generated by an asset, contrasting with crowdfunding which pools small investments to fund projects or startups. Royalty rights involve less risk exposure due to ongoing revenue streams, while crowdfunding can provide higher returns but with greater uncertainty and longer payoff timelines. Explore detailed comparisons to determine which investment strategy aligns with your financial goals.

Why it is important

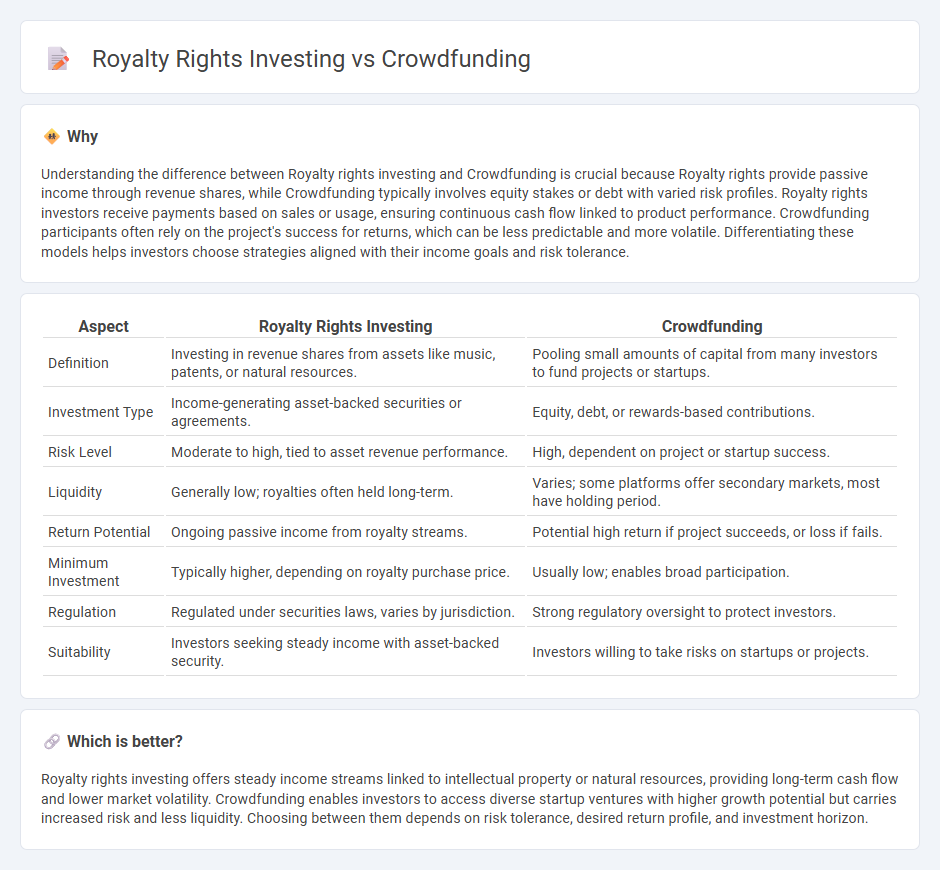

Understanding the difference between Royalty rights investing and Crowdfunding is crucial because Royalty rights provide passive income through revenue shares, while Crowdfunding typically involves equity stakes or debt with varied risk profiles. Royalty rights investors receive payments based on sales or usage, ensuring continuous cash flow linked to product performance. Crowdfunding participants often rely on the project's success for returns, which can be less predictable and more volatile. Differentiating these models helps investors choose strategies aligned with their income goals and risk tolerance.

Comparison Table

| Aspect | Royalty Rights Investing | Crowdfunding |

|---|---|---|

| Definition | Investing in revenue shares from assets like music, patents, or natural resources. | Pooling small amounts of capital from many investors to fund projects or startups. |

| Investment Type | Income-generating asset-backed securities or agreements. | Equity, debt, or rewards-based contributions. |

| Risk Level | Moderate to high, tied to asset revenue performance. | High, dependent on project or startup success. |

| Liquidity | Generally low; royalties often held long-term. | Varies; some platforms offer secondary markets, most have holding period. |

| Return Potential | Ongoing passive income from royalty streams. | Potential high return if project succeeds, or loss if fails. |

| Minimum Investment | Typically higher, depending on royalty purchase price. | Usually low; enables broad participation. |

| Regulation | Regulated under securities laws, varies by jurisdiction. | Strong regulatory oversight to protect investors. |

| Suitability | Investors seeking steady income with asset-backed security. | Investors willing to take risks on startups or projects. |

Which is better?

Royalty rights investing offers steady income streams linked to intellectual property or natural resources, providing long-term cash flow and lower market volatility. Crowdfunding enables investors to access diverse startup ventures with higher growth potential but carries increased risk and less liquidity. Choosing between them depends on risk tolerance, desired return profile, and investment horizon.

Connection

Royalty rights investing and crowdfunding intersect as innovative financing models allowing investors to pool capital into revenue-generating assets or projects. Crowdfunding platforms often facilitate royalty rights investments by enabling access to fractional ownership in intellectual property or natural resources, providing steady income streams. This connection democratizes investment opportunities, combining risk diversification with the appeal of passive revenue through shared royalties.

Key Terms

Equity Stake

Crowdfunding allows investors to purchase equity stakes in startups or small businesses, providing ownership shares and potential dividends as the company grows. Royalty rights investing involves acquiring rights to a portion of revenue generated by intellectual property or products, offering passive income without ownership. Explore the differences between equity stakes and royalty rights to determine the best investment strategy for your financial goals.

Revenue Share

Crowdfunding platforms allow multiple investors to fund a project in exchange for potential equity or rewards, whereas royalty rights investing involves purchasing a percentage of future revenue from intellectual property or assets, providing a direct share of income. Revenue share models in royalty rights investing offer predictable cash flow based on the success of the asset, contrasting with the higher risk and variability of returns typical in crowdfunding ventures. Explore detailed comparisons and strategies to optimize your revenue share investments for better financial growth.

Intellectual Property (IP)

Crowdfunding enables a broad audience to pool funds into creative projects or startups, often receiving rewards or equity, whereas royalty rights investing involves purchasing the rights to future income generated by Intellectual Property (IP) assets such as patents, trademarks, or copyrights. Investing in royalty rights offers a direct financial interest in IP-generated revenue streams, providing potentially passive income tied to the performance of the underlying intellectual property. Explore the distinctions between these funding methods to determine which aligns best with your investment strategy.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, functioning as an alternative finance method without traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows startups and projects to raise money online from a large pool of individual contributors, leveraging social media and crowdfunding platforms for wide reach and collaborative funding.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding is an online method to collect small amounts of money from many individuals, including donation, rewards, equity, and peer-to-peer lending models for financing projects or businesses.

dowidth.com

dowidth.com