Patent monetization leverages intellectual property to generate revenue through licensing or sales, providing a flexible funding source without diluting ownership. Initial public offerings (IPOs) enable companies to raise significant capital by selling shares to the public, enhancing market visibility and liquidity but involving regulatory scrutiny. Explore deeper insights to understand which strategy aligns best with your investment goals.

Why it is important

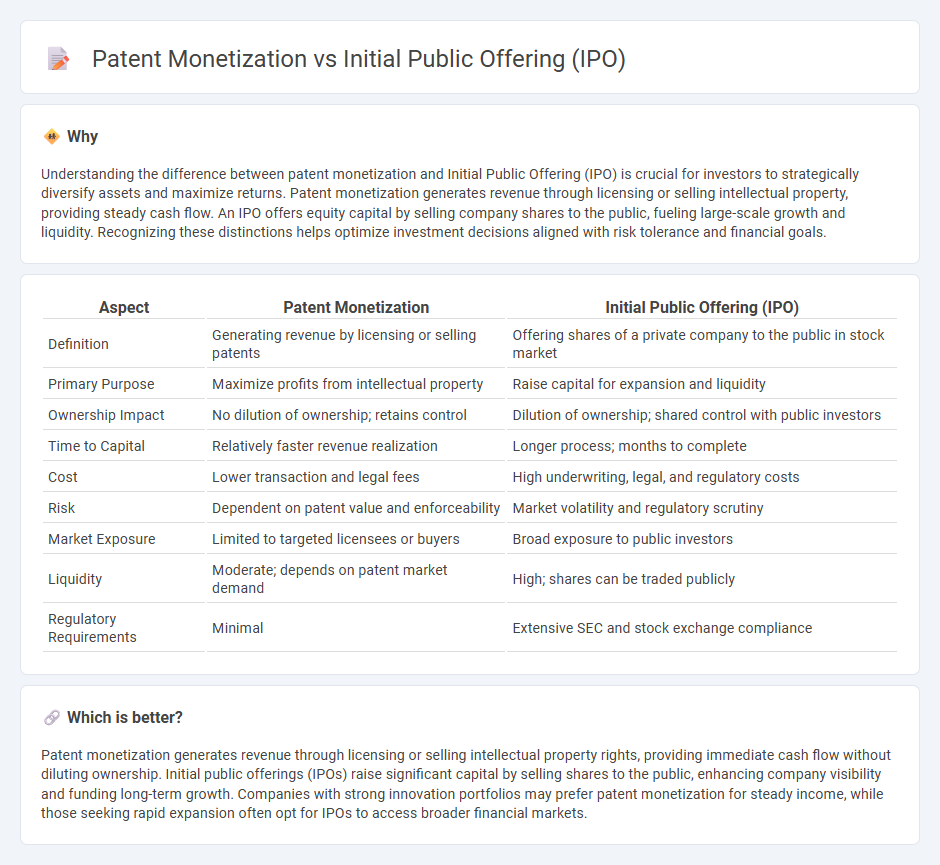

Understanding the difference between patent monetization and Initial Public Offering (IPO) is crucial for investors to strategically diversify assets and maximize returns. Patent monetization generates revenue through licensing or selling intellectual property, providing steady cash flow. An IPO offers equity capital by selling company shares to the public, fueling large-scale growth and liquidity. Recognizing these distinctions helps optimize investment decisions aligned with risk tolerance and financial goals.

Comparison Table

| Aspect | Patent Monetization | Initial Public Offering (IPO) |

|---|---|---|

| Definition | Generating revenue by licensing or selling patents | Offering shares of a private company to the public in stock market |

| Primary Purpose | Maximize profits from intellectual property | Raise capital for expansion and liquidity |

| Ownership Impact | No dilution of ownership; retains control | Dilution of ownership; shared control with public investors |

| Time to Capital | Relatively faster revenue realization | Longer process; months to complete |

| Cost | Lower transaction and legal fees | High underwriting, legal, and regulatory costs |

| Risk | Dependent on patent value and enforceability | Market volatility and regulatory scrutiny |

| Market Exposure | Limited to targeted licensees or buyers | Broad exposure to public investors |

| Liquidity | Moderate; depends on patent market demand | High; shares can be traded publicly |

| Regulatory Requirements | Minimal | Extensive SEC and stock exchange compliance |

Which is better?

Patent monetization generates revenue through licensing or selling intellectual property rights, providing immediate cash flow without diluting ownership. Initial public offerings (IPOs) raise significant capital by selling shares to the public, enhancing company visibility and funding long-term growth. Companies with strong innovation portfolios may prefer patent monetization for steady income, while those seeking rapid expansion often opt for IPOs to access broader financial markets.

Connection

Patent monetization generates significant revenue streams and enhances a company's valuation, making it more attractive for investors during an Initial Public Offering (IPO). Firms with robust patent portfolios demonstrate innovation potential and competitive advantage, which can lead to higher IPO pricing and investor confidence. This strategic alignment between patent assets and market offering supports capital raising efforts essential for business growth.

Key Terms

Underwriting (IPO)

Underwriting in an Initial Public Offering (IPO) involves investment banks assessing, pricing, and guaranteeing the sale of new stock to public investors, which ensures capital inflow and risk mitigation for the issuing company. Patent monetization, by contrast, typically bypasses underwriting and relies on licensing agreements, sales, or securitization of intellectual property rights to generate revenue streams. Explore how underwriting strategies impact capital markets and patent valuation by learning more about these distinct financial mechanisms.

Licensing Agreements (Patent Monetization)

IPO involves raising capital by offering company shares to the public, while patent monetization through licensing agreements generates revenue by allowing others to use patented technology. Licensing agreements create ongoing income streams by granting rights to manufacturers or service providers, often with royalties based on product sales or usage. Explore detailed strategies to leverage patent portfolios for sustained business growth and competitive advantage.

Valuation

Initial public offerings (IPOs) often lead to market-driven company valuations based on future earnings projections and investor demand, whereas patent monetization derives value from licensing revenues or sale of intellectual property assets. IPO valuations hinge on factors such as revenue growth, market potential, and competitive positioning, while patent monetization depends on patent quality, enforceability, and market applicability. Discover more about how these distinct valuation methods impact corporate financial strategy and asset utilization.

Source and External Links

Initial public offering - Wikipedia - An IPO is the first time a company sells shares to the public, typically underwritten by investment banks, transforming a private company into a public one and enabling easy trading of shares.

What is an Initial public offering (IPO)? - British Business Bank - An IPO is when a business raises finance publicly for the first time, allowing it to access large sums of capital by listing on public markets like the London Stock Exchange.

Understanding and Planning an Initial Public Offering (IPO) - The IPO process involves registering shares with the SEC, drafting a prospectus, and listing on a stock exchange, requiring careful planning, due diligence, and underwriting to become a public company.

dowidth.com

dowidth.com