Music royalties generate passive income by allowing investors to earn a share of an artist's revenue streams from song plays and licensing. Collectibles, such as rare art, vintage toys, or limited-edition items, appreciate in value based on rarity, demand, and condition. Discover the key differences and potential benefits of investing in music royalties versus collectibles to enhance your portfolio.

Why it is important

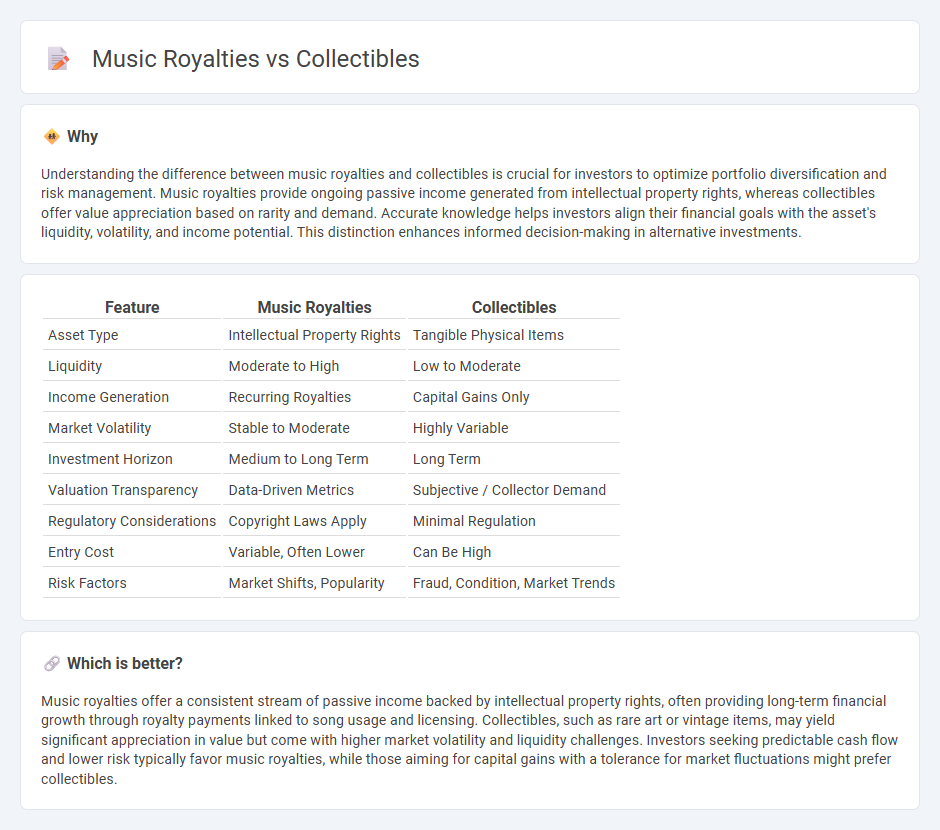

Understanding the difference between music royalties and collectibles is crucial for investors to optimize portfolio diversification and risk management. Music royalties provide ongoing passive income generated from intellectual property rights, whereas collectibles offer value appreciation based on rarity and demand. Accurate knowledge helps investors align their financial goals with the asset's liquidity, volatility, and income potential. This distinction enhances informed decision-making in alternative investments.

Comparison Table

| Feature | Music Royalties | Collectibles |

|---|---|---|

| Asset Type | Intellectual Property Rights | Tangible Physical Items |

| Liquidity | Moderate to High | Low to Moderate |

| Income Generation | Recurring Royalties | Capital Gains Only |

| Market Volatility | Stable to Moderate | Highly Variable |

| Investment Horizon | Medium to Long Term | Long Term |

| Valuation Transparency | Data-Driven Metrics | Subjective / Collector Demand |

| Regulatory Considerations | Copyright Laws Apply | Minimal Regulation |

| Entry Cost | Variable, Often Lower | Can Be High |

| Risk Factors | Market Shifts, Popularity | Fraud, Condition, Market Trends |

Which is better?

Music royalties offer a consistent stream of passive income backed by intellectual property rights, often providing long-term financial growth through royalty payments linked to song usage and licensing. Collectibles, such as rare art or vintage items, may yield significant appreciation in value but come with higher market volatility and liquidity challenges. Investors seeking predictable cash flow and lower risk typically favor music royalties, while those aiming for capital gains with a tolerance for market fluctuations might prefer collectibles.

Connection

Music royalties generate ongoing revenue streams by monetizing intellectual property rights, while collectibles such as rare vinyl records or limited-edition music memorabilia represent tangible assets that appreciate in value over time. Both investment types leverage scarcity and demand within the music industry, offering diversified portfolio options through intangible royalties and physical collectibles. Investors benefit from the dual income potential of royalties and capital gains on collectibles, creating a synergistic financial strategy linked to music's cultural and economic significance.

Key Terms

Asset Liquidity

Collectibles often face lower asset liquidity due to niche markets and limited buyers, making quick sales difficult. Music royalties provide higher liquidity through structured platforms and ongoing revenue streams, attracting investors seeking more fluid asset management. Explore how asset liquidity influences investment choices in collectibles and music royalties for smarter portfolio diversification.

Valuation Method

Valuation of collectibles typically relies on factors such as rarity, condition, provenance, and market demand, often assessed through expert appraisals and recent auction results. Music royalties valuation depends on the analysis of projected income streams, historical revenue, contract terms, and catalog performance metrics, utilizing discounted cash flow (DCF) models and industry benchmarks. Explore further to understand how these distinct valuation methods impact investment strategies and asset management.

Income Generation

Collectibles generate income primarily through asset appreciation and rare item sales, often providing passive profits triggered by market demand and scarcity. Music royalties produce consistent income streams from licensing, public performances, and digital streaming platforms, leveraging intellectual property rights tied to song ownership and composition. Explore deeper insights on maximizing returns from these distinct income-generating assets.

Source and External Links

Collectibles | Home Decor - Gump's - Gump's offers a refined selection of collectibles including elegant Limoges boxes, Baccarat crystal pieces, and charming Steiff teddy bears and plush animals.

Collectibles - Walmart.com - Walmart features a wide variety of collectibles from popular franchises such as Star Wars, Marvel, WWE, and Pokemon, including action figures, vinyl collectibles, trading cards, and exclusive preorders.

Toys, Games & Collectibles - Best Buy - Best Buy offers collectibles centered around pop culture and hobbies with items like LEGO F1 sets, Pokemon trading cards, Squishmallows plush, and DC Multiverse action figures.

dowidth.com

dowidth.com