Crowdlending platforms enable investors to fund loans directly to businesses or individuals, offering diversified portfolios with potentially higher yields and shorter investment horizons. REITs (Real Estate Investment Trusts) focus on income-generating real estate assets, providing liquidity and regular dividend income through publicly traded shares. Explore the key differences and benefits of crowdlending platforms versus REITs to optimize your investment strategy.

Why it is important

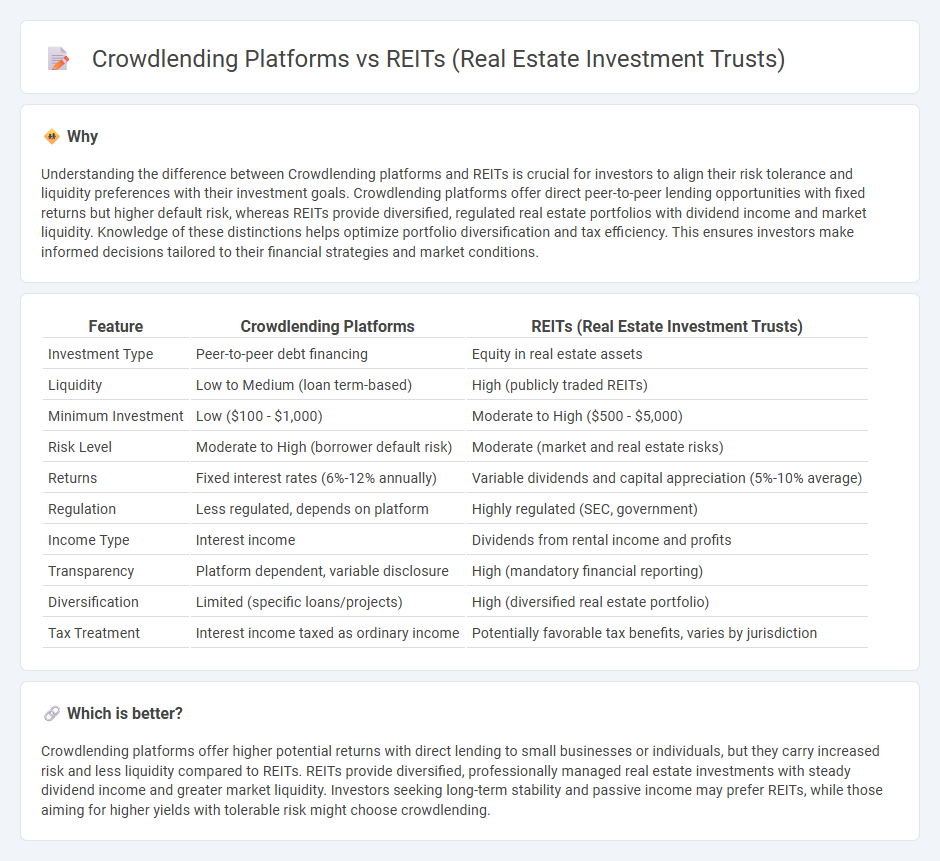

Understanding the difference between Crowdlending platforms and REITs is crucial for investors to align their risk tolerance and liquidity preferences with their investment goals. Crowdlending platforms offer direct peer-to-peer lending opportunities with fixed returns but higher default risk, whereas REITs provide diversified, regulated real estate portfolios with dividend income and market liquidity. Knowledge of these distinctions helps optimize portfolio diversification and tax efficiency. This ensures investors make informed decisions tailored to their financial strategies and market conditions.

Comparison Table

| Feature | Crowdlending Platforms | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Investment Type | Peer-to-peer debt financing | Equity in real estate assets |

| Liquidity | Low to Medium (loan term-based) | High (publicly traded REITs) |

| Minimum Investment | Low ($100 - $1,000) | Moderate to High ($500 - $5,000) |

| Risk Level | Moderate to High (borrower default risk) | Moderate (market and real estate risks) |

| Returns | Fixed interest rates (6%-12% annually) | Variable dividends and capital appreciation (5%-10% average) |

| Regulation | Less regulated, depends on platform | Highly regulated (SEC, government) |

| Income Type | Interest income | Dividends from rental income and profits |

| Transparency | Platform dependent, variable disclosure | High (mandatory financial reporting) |

| Diversification | Limited (specific loans/projects) | High (diversified real estate portfolio) |

| Tax Treatment | Interest income taxed as ordinary income | Potentially favorable tax benefits, varies by jurisdiction |

Which is better?

Crowdlending platforms offer higher potential returns with direct lending to small businesses or individuals, but they carry increased risk and less liquidity compared to REITs. REITs provide diversified, professionally managed real estate investments with steady dividend income and greater market liquidity. Investors seeking long-term stability and passive income may prefer REITs, while those aiming for higher yields with tolerable risk might choose crowdlending.

Connection

Crowdlending platforms and REITs (Real Estate Investment Trusts) both enable investors to pool capital for real estate projects, providing diversified exposure to property markets without direct ownership. Crowdlending platforms often finance real estate development, allowing investors to earn fixed interest by lending to property developers, while REITs offer equity stakes and dividend income from rental properties. The connection lies in their shared goal to democratize real estate investment, making it accessible and scalable through collective funding mechanisms.

Key Terms

Liquidity

REITs (Real Estate Investment Trusts) provide higher liquidity compared to crowdlending platforms by allowing investors to buy and sell shares on major stock exchanges with daily trading options. Crowdlending platforms typically involve longer lock-in periods, often ranging from 6 months to several years, limiting immediate access to invested capital. Explore detailed comparisons on liquidity benefits and investment strategies for both options.

Diversification

REITs offer diversification by investing in a broad portfolio of income-generating real estate properties, spreading risk across various sectors and locations. Crowdlending platforms provide access to multiple real estate loans or projects, allowing investors to diversify by funding different development or refinancing deals. Explore how each investment type can enhance your portfolio diversification strategies.

Ownership structure

REITs offer investors direct ownership in income-generating real estate assets, typically structured as publicly traded companies or private trusts, providing liquidity and regulatory oversight. Crowdlending platforms connect multiple investors to real estate projects through debt financing without granting ownership rights, focusing on fixed income returns rather than equity participation. Explore the distinct benefits and risks of these investment models to determine which aligns best with your financial goals.

Source and External Links

Real estate investment trust - A REIT is a company that owns and operates income-producing real estate, offering investors a way to gain exposure to real estate assets without direct property ownership, while typically providing regular dividends and potential capital appreciation.

What's a REIT (Real Estate Investment Trust)? - REITs are investment vehicles modeled after mutual funds, owning or financing a diverse range of income-generating real estate properties and historically offering investors steady income, diversification, and long-term growth.

Real Estate Investment Trusts (REITs) - REITs allow individuals to invest in large-scale commercial real estate, such as offices, shopping malls, and apartments, through publicly traded or non-traded shares, without the need to directly purchase or manage properties.

dowidth.com

dowidth.com