Hedge fund replication leverages quantitative models and alternative data to mimic hedge fund returns with lower fees and enhanced transparency compared to traditional active management, which relies on discretionary stock picking and analyst insights. While traditional active management often struggles with high costs and inconsistent performance, hedge fund replication aims to deliver systematic exposure to hedge fund strategies through liquid, low-cost instruments. Discover how these innovative approaches reshape investment portfolios and risk management.

Why it is important

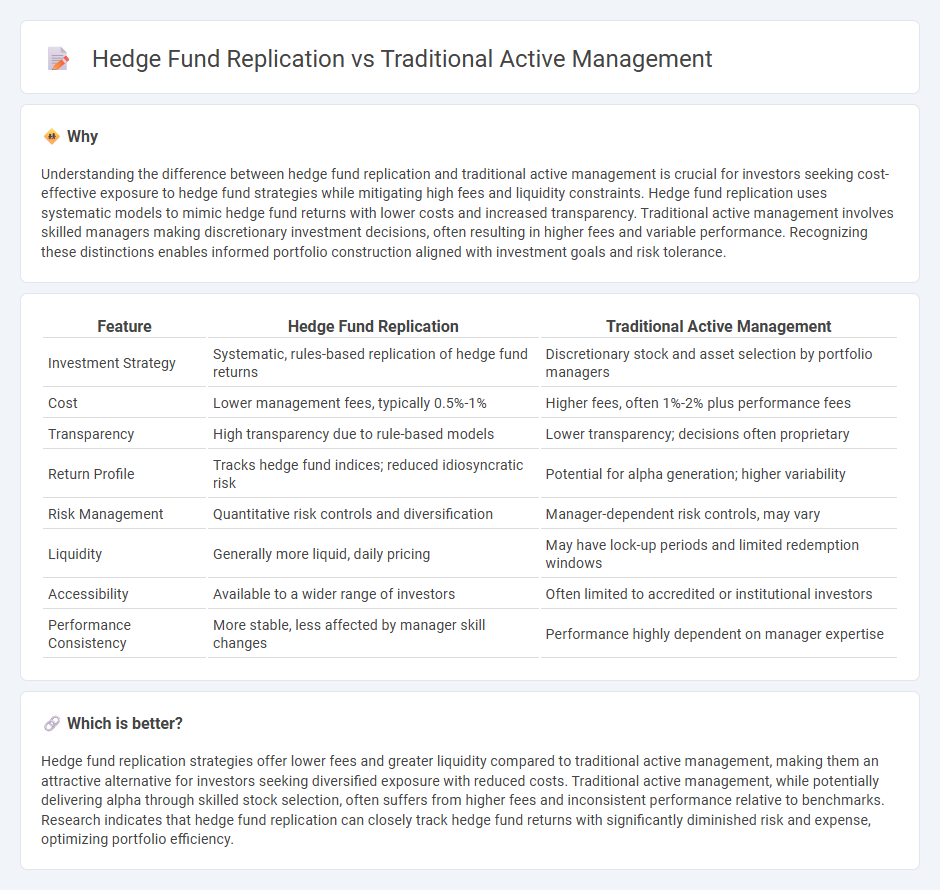

Understanding the difference between hedge fund replication and traditional active management is crucial for investors seeking cost-effective exposure to hedge fund strategies while mitigating high fees and liquidity constraints. Hedge fund replication uses systematic models to mimic hedge fund returns with lower costs and increased transparency. Traditional active management involves skilled managers making discretionary investment decisions, often resulting in higher fees and variable performance. Recognizing these distinctions enables informed portfolio construction aligned with investment goals and risk tolerance.

Comparison Table

| Feature | Hedge Fund Replication | Traditional Active Management |

|---|---|---|

| Investment Strategy | Systematic, rules-based replication of hedge fund returns | Discretionary stock and asset selection by portfolio managers |

| Cost | Lower management fees, typically 0.5%-1% | Higher fees, often 1%-2% plus performance fees |

| Transparency | High transparency due to rule-based models | Lower transparency; decisions often proprietary |

| Return Profile | Tracks hedge fund indices; reduced idiosyncratic risk | Potential for alpha generation; higher variability |

| Risk Management | Quantitative risk controls and diversification | Manager-dependent risk controls, may vary |

| Liquidity | Generally more liquid, daily pricing | May have lock-up periods and limited redemption windows |

| Accessibility | Available to a wider range of investors | Often limited to accredited or institutional investors |

| Performance Consistency | More stable, less affected by manager skill changes | Performance highly dependent on manager expertise |

Which is better?

Hedge fund replication strategies offer lower fees and greater liquidity compared to traditional active management, making them an attractive alternative for investors seeking diversified exposure with reduced costs. Traditional active management, while potentially delivering alpha through skilled stock selection, often suffers from higher fees and inconsistent performance relative to benchmarks. Research indicates that hedge fund replication can closely track hedge fund returns with significantly diminished risk and expense, optimizing portfolio efficiency.

Connection

Hedge fund replication uses quantitative models to mimic the risk and return profiles of traditional active management strategies, offering investors lower fees and improved liquidity. Both approaches aim to generate alpha by exploiting market inefficiencies, but replication strategies rely on systematic factor exposures instead of discretionary stock picking. This connection enables broader access to hedge fund-like returns while maintaining the core principles of active portfolio management.

Key Terms

Alpha

Traditional active management seeks to generate alpha by selecting securities that outperform the market through rigorous fundamental analysis and manager expertise, often incurring higher fees and variable performance. Hedge fund replication aims to capture alpha by systematically mimicking hedge fund strategies using liquid instruments and quantitative models, offering cost efficiency and transparency. Explore the nuances and empirical performance data to understand which approach aligns best with your investment objectives.

Factor exposure

Traditional active management often relies on discretionary investment decisions aiming to outperform benchmarks through stock selection and market timing. Hedge fund replication strategies utilize systematic factor exposure--such as value, momentum, and low volatility--to mimic hedge fund returns at lower costs and with greater transparency. Discover how factor-based approaches can enhance portfolio construction and risk management compared to traditional active management.

Fee structure

Traditional active management typically charges a management fee around 1-2% of assets under management (AUM) plus a performance fee of 20% on profits, reflecting higher costs linked to active stock selection and portfolio management. Hedge fund replication strategies aim to mimic hedge fund returns at significantly lower fees, often around 0.3-0.5% management fees with minimal or no performance fees, providing cost-effective exposure to hedge fund-like returns. Explore more about how fee structures impact net investment performance and accessibility in different management approaches.

Source and External Links

Hedge Funds and the Active Management Industry - Traditional active managers focus on delivering both beta and alpha while managing scale and cost, which are crucial factors in their success.

Active & Passive Fund Management - Traditional active management involves a hands-on approach where managers make strategic buy and sell decisions based on thorough research and analysis.

Factor-Based Investing Redefines Active Management - Traditional active management is contrasted with quantitative active strategies, which involve factor-based alpha rather than purely skill-based alpha.

dowidth.com

dowidth.com