Music royalties investing offers a unique revenue stream through passive income earned from song plays and licensing, providing diversification beyond traditional markets. Angel investing involves funding startups in exchange for equity, carrying higher risk but potential for significant returns through business growth and exit opportunities. Explore the benefits and risks of both to determine which investment aligns best with your financial goals.

Why it is important

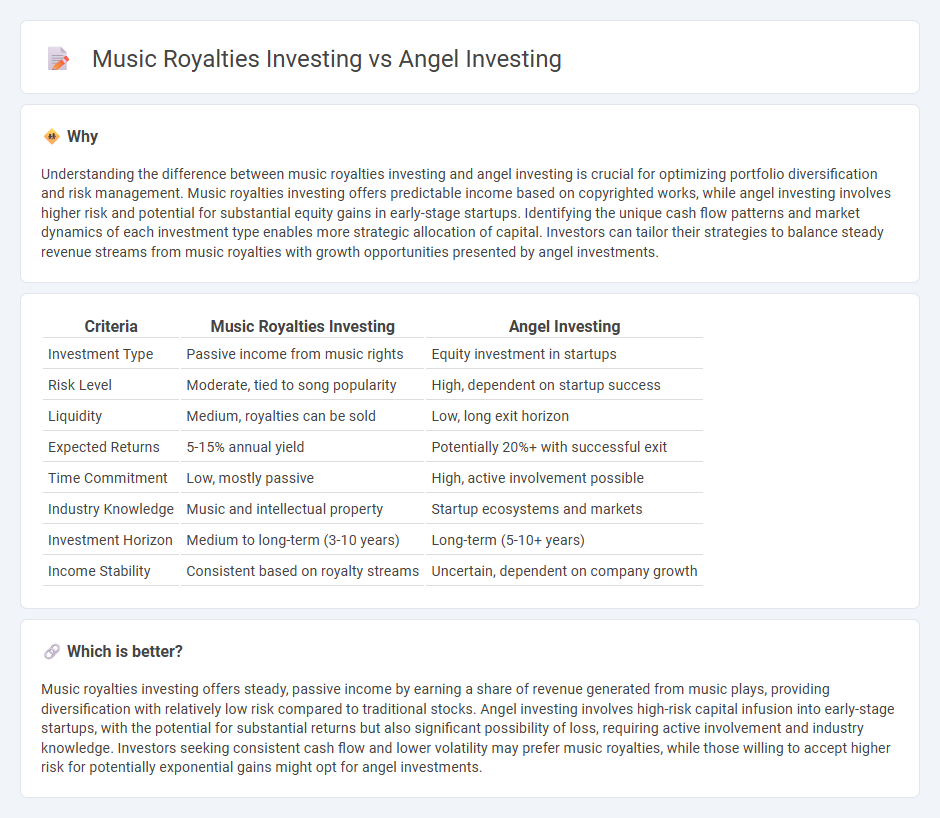

Understanding the difference between music royalties investing and angel investing is crucial for optimizing portfolio diversification and risk management. Music royalties investing offers predictable income based on copyrighted works, while angel investing involves higher risk and potential for substantial equity gains in early-stage startups. Identifying the unique cash flow patterns and market dynamics of each investment type enables more strategic allocation of capital. Investors can tailor their strategies to balance steady revenue streams from music royalties with growth opportunities presented by angel investments.

Comparison Table

| Criteria | Music Royalties Investing | Angel Investing |

|---|---|---|

| Investment Type | Passive income from music rights | Equity investment in startups |

| Risk Level | Moderate, tied to song popularity | High, dependent on startup success |

| Liquidity | Medium, royalties can be sold | Low, long exit horizon |

| Expected Returns | 5-15% annual yield | Potentially 20%+ with successful exit |

| Time Commitment | Low, mostly passive | High, active involvement possible |

| Industry Knowledge | Music and intellectual property | Startup ecosystems and markets |

| Investment Horizon | Medium to long-term (3-10 years) | Long-term (5-10+ years) |

| Income Stability | Consistent based on royalty streams | Uncertain, dependent on company growth |

Which is better?

Music royalties investing offers steady, passive income by earning a share of revenue generated from music plays, providing diversification with relatively low risk compared to traditional stocks. Angel investing involves high-risk capital infusion into early-stage startups, with the potential for substantial returns but also significant possibility of loss, requiring active involvement and industry knowledge. Investors seeking consistent cash flow and lower volatility may prefer music royalties, while those willing to accept higher risk for potentially exponential gains might opt for angel investments.

Connection

Music royalties investing and angel investing are connected through their focus on alternative asset classes that offer diversification and passive income opportunities. Both investment types involve funding creative or early-stage ventures, often within the entertainment or tech sectors, leveraging intellectual property or innovation for long-term returns. This hybrid investment approach appeals to investors seeking to combine financial growth with involvement in cultural or disruptive market segments.

Key Terms

Angel investing:

Angel investing involves providing capital to early-stage startups in exchange for equity, often resulting in high-risk, high-reward opportunities with potential for significant returns if the company succeeds. Investors benefit from direct involvement in business growth, strategic guidance, and equity stakes that can appreciate substantially. Discover deeper insights into angel investing strategies and opportunities to maximize your portfolio.

Equity

Angel investing involves acquiring equity stakes in early-stage startups, providing high growth potential but with significant risk and less liquidity. Music royalties investing grants rights to future income streams without equity ownership, offering steady cash flow but limited control and upside. Explore the detailed differences to determine which investment aligns best with your financial goals.

Valuation

Angel investing valuation commonly relies on equity stake percentages, projected revenue growth, and market potential of startups, often assessed through methods like discounted cash flow or comparable company analysis. Music royalties investing valuation centers on historical royalty income, streaming data, and long-term earnings stability, with financial models focusing on present value of expected cash flows from intellectual property rights. Explore the nuances of these valuation strategies to better understand investment opportunities in each domain.

Source and External Links

Understanding angel financing and investing - Angel investing involves wealthy individuals providing capital to startups in exchange for equity or convertible debt, often helping founders bridge the gap from early personal funding to professional rounds, offering not only money but mentorship and valuable networks.

Demystifying Angel Investing - Angel investors aim to generate financial returns by funding startups, with added benefits including contributing to regional economic growth and accessing favorable tax incentives, while supported by resources and communities such as the Angel Capital Association.

Angel Investors - Angel investors are private individuals who use their own wealth to finance startups in exchange for ownership shares, often showing patience and offering mentorship to help the business succeed, with investments geared toward early-stage companies with promising profit potential.

dowidth.com

dowidth.com