Wine investing platforms offer access to a niche asset class with potential for high returns through the appreciation of fine wines, often benefiting from market exclusivity and expert curation. Real estate crowdfunding provides diversified property investment opportunities by pooling capital from multiple investors, enabling participation in large-scale developments with relatively low entry costs. Explore the unique advantages and risks of these innovative investment vehicles to determine which aligns best with your financial goals.

Why it is important

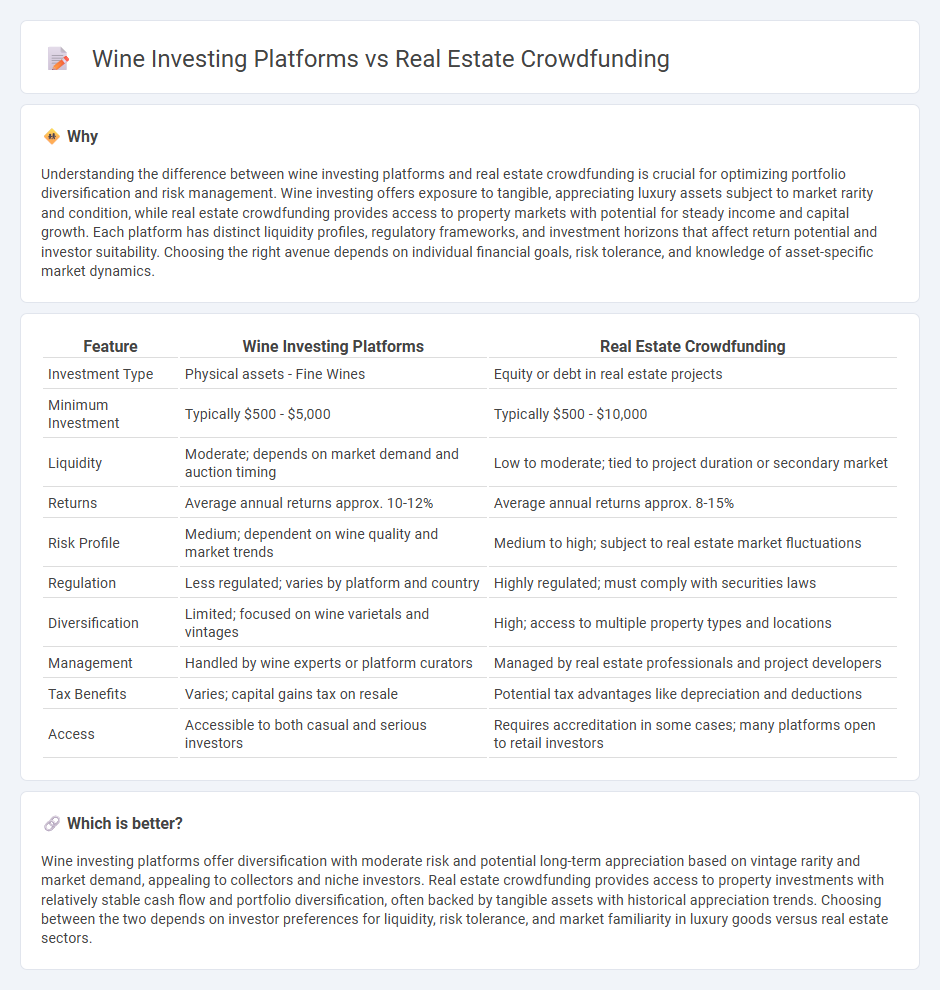

Understanding the difference between wine investing platforms and real estate crowdfunding is crucial for optimizing portfolio diversification and risk management. Wine investing offers exposure to tangible, appreciating luxury assets subject to market rarity and condition, while real estate crowdfunding provides access to property markets with potential for steady income and capital growth. Each platform has distinct liquidity profiles, regulatory frameworks, and investment horizons that affect return potential and investor suitability. Choosing the right avenue depends on individual financial goals, risk tolerance, and knowledge of asset-specific market dynamics.

Comparison Table

| Feature | Wine Investing Platforms | Real Estate Crowdfunding |

|---|---|---|

| Investment Type | Physical assets - Fine Wines | Equity or debt in real estate projects |

| Minimum Investment | Typically $500 - $5,000 | Typically $500 - $10,000 |

| Liquidity | Moderate; depends on market demand and auction timing | Low to moderate; tied to project duration or secondary market |

| Returns | Average annual returns approx. 10-12% | Average annual returns approx. 8-15% |

| Risk Profile | Medium; dependent on wine quality and market trends | Medium to high; subject to real estate market fluctuations |

| Regulation | Less regulated; varies by platform and country | Highly regulated; must comply with securities laws |

| Diversification | Limited; focused on wine varietals and vintages | High; access to multiple property types and locations |

| Management | Handled by wine experts or platform curators | Managed by real estate professionals and project developers |

| Tax Benefits | Varies; capital gains tax on resale | Potential tax advantages like depreciation and deductions |

| Access | Accessible to both casual and serious investors | Requires accreditation in some cases; many platforms open to retail investors |

Which is better?

Wine investing platforms offer diversification with moderate risk and potential long-term appreciation based on vintage rarity and market demand, appealing to collectors and niche investors. Real estate crowdfunding provides access to property investments with relatively stable cash flow and portfolio diversification, often backed by tangible assets with historical appreciation trends. Choosing between the two depends on investor preferences for liquidity, risk tolerance, and market familiarity in luxury goods versus real estate sectors.

Connection

Wine investing platforms and real estate crowdfunding both leverage the power of online marketplaces to democratize access to traditionally exclusive asset classes. These platforms utilize fractional ownership models, allowing investors to diversify portfolios by pooling capital for tangible assets like collectible wine and real estate properties. The integration of blockchain technology in both sectors enhances transparency, liquidity, and secure transaction recording for investors.

Key Terms

Real estate crowdfunding:

Real estate crowdfunding allows investors to pool funds to finance property projects, offering access to commercial and residential real estate with lower capital requirements than traditional property investment. Platforms like Fundrise and RealtyMogul provide diversified portfolios and potential passive income through rental yields and property appreciation. Explore how real estate crowdfunding can enhance your investment strategy with detailed insights and platform comparisons.

Equity ownership

Real estate crowdfunding platforms offer investors equity ownership by purchasing shares in property projects, allowing for potential rental income and property appreciation. Wine investing platforms provide fractional ownership in rare bottles or collections, with value appreciating based on scarcity and market demand. Explore the key factors in equity ownership to determine which investment aligns with your portfolio goals.

Syndication

Real estate crowdfunding platforms utilize syndication to pool capital from multiple investors, offering access to large-scale property projects with shared ownership and potential rental income. Wine investing platforms, while occasionally syndicating rare wine purchases, primarily focus on individual bottle or collection investments driven by market rarity and aging potential. Explore the nuances of syndication methods in both sectors to make informed investment decisions.

Source and External Links

Crowdfunding real estate: What to know - Rocket Mortgage - Real estate crowdfunding lets investors pool money via online platforms to buy or share property investments, offering easier access and portfolio diversification for both accredited and nonaccredited investors.

Crowdfunding - National Association of REALTORS(r) - Crowdfunding in real estate is a method where multiple investors pool funds to finance a property project and earn passive income, simplifying investment and portfolio building without property management duties.

Arrived | Easily Invest in Real Estate - Arrived enables easy real estate investing starting at $100, providing access to vetted rental properties with potential for rental income and appreciation while managing properties on behalf of investors.

dowidth.com

dowidth.com