Tax lien certificates offer investors a secured interest in property tax debts, often providing high-yield returns with lower upfront costs compared to rental properties, which require ongoing management and maintenance. Rental properties generate consistent cash flow through tenant rent payments but involve active property management and potential vacancies. Explore the advantages and risks of tax lien certificates versus rental properties to determine the best investment strategy for your financial goals.

Why it is important

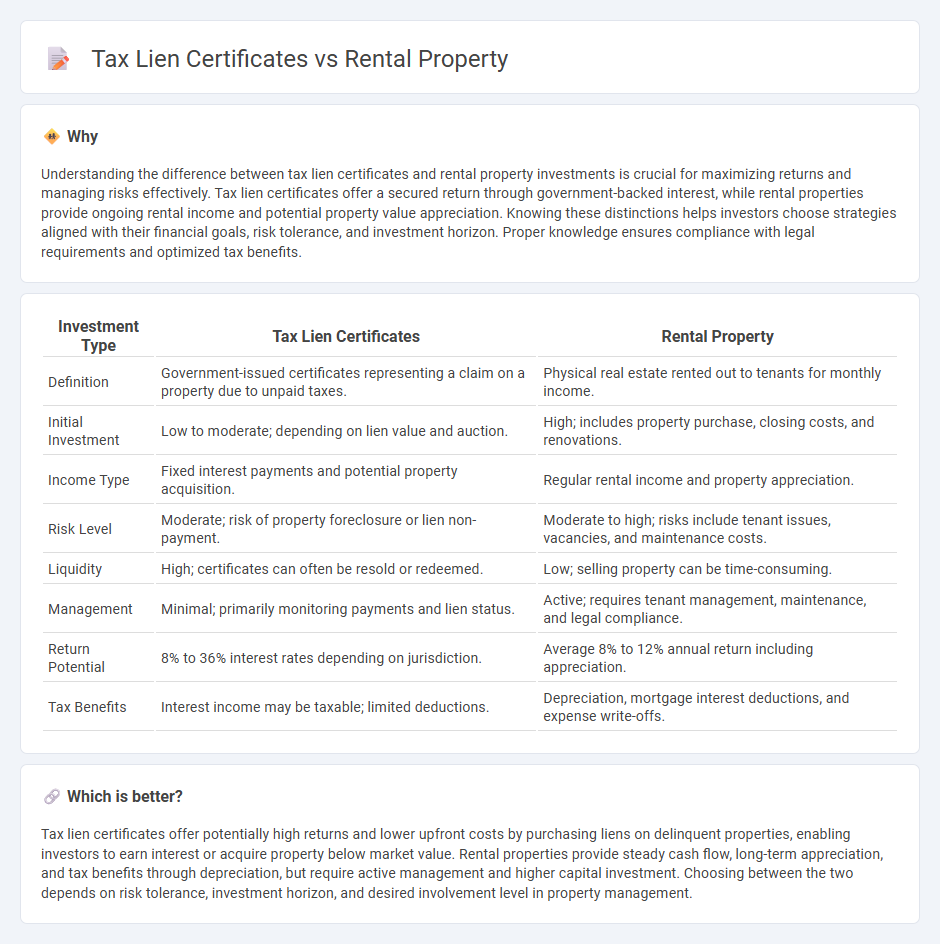

Understanding the difference between tax lien certificates and rental property investments is crucial for maximizing returns and managing risks effectively. Tax lien certificates offer a secured return through government-backed interest, while rental properties provide ongoing rental income and potential property value appreciation. Knowing these distinctions helps investors choose strategies aligned with their financial goals, risk tolerance, and investment horizon. Proper knowledge ensures compliance with legal requirements and optimized tax benefits.

Comparison Table

| Investment Type | Tax Lien Certificates | Rental Property |

|---|---|---|

| Definition | Government-issued certificates representing a claim on a property due to unpaid taxes. | Physical real estate rented out to tenants for monthly income. |

| Initial Investment | Low to moderate; depending on lien value and auction. | High; includes property purchase, closing costs, and renovations. |

| Income Type | Fixed interest payments and potential property acquisition. | Regular rental income and property appreciation. |

| Risk Level | Moderate; risk of property foreclosure or lien non-payment. | Moderate to high; risks include tenant issues, vacancies, and maintenance costs. |

| Liquidity | High; certificates can often be resold or redeemed. | Low; selling property can be time-consuming. |

| Management | Minimal; primarily monitoring payments and lien status. | Active; requires tenant management, maintenance, and legal compliance. |

| Return Potential | 8% to 36% interest rates depending on jurisdiction. | Average 8% to 12% annual return including appreciation. |

| Tax Benefits | Interest income may be taxable; limited deductions. | Depreciation, mortgage interest deductions, and expense write-offs. |

Which is better?

Tax lien certificates offer potentially high returns and lower upfront costs by purchasing liens on delinquent properties, enabling investors to earn interest or acquire property below market value. Rental properties provide steady cash flow, long-term appreciation, and tax benefits through depreciation, but require active management and higher capital investment. Choosing between the two depends on risk tolerance, investment horizon, and desired involvement level in property management.

Connection

Tax lien certificates provide investors with a legal claim against properties with unpaid taxes, often leading to opportunities for acquiring rental properties at a reduced cost. Purchasing tax lien certificates can result in ownership if the lien is not redeemed, allowing investors to convert the property into a rental asset generating passive income. This strategy connects tax lien investing with rental property ownership by combining tax debt resolution and real estate portfolio growth.

Key Terms

Cash Flow

Rental properties generate consistent cash flow through monthly tenant rent payments, providing a dependable income stream with potential property appreciation benefits. Tax lien certificates yield returns from interest and penalties on overdue property taxes, often offering high returns but with greater risk and less regular income. Explore the advantages and risks of each investment to determine which best suits your cash flow goals.

Return on Investment (ROI)

Rental properties generate ROI through monthly rental income and property appreciation, offering steady cash flow and long-term capital gains, with average annual returns typically ranging from 8% to 12%. Tax lien certificates deliver ROI by earning interest from delinquent property taxes, boasting returns between 10% and 18%, but involve higher risk and variable payout timelines. Explore detailed comparisons and investment strategies to maximize your ROI in real estate and tax lien certificates.

Foreclosure

Rental property investments offer steady cash flow and potential property appreciation, but foreclosure risks arise if mortgage payments are missed. Tax lien certificates represent a secured claim against a property due to unpaid taxes, granting investors the right to collect the debt or initiate foreclosure after a redemption period. Explore how foreclosure processes differ between rental properties and tax lien certificates to optimize your real estate investment strategy.

Source and External Links

Tips on rental real estate income, deductions and recordkeeping - All rental income must be reported on your tax return, and associated expenses can generally be deducted from that income, including rules on advance rent and security deposits.

Rental Listings in Your Neighborhood | Trulia.com - Trulia offers a large selection of rental homes and apartments with extensive filters and neighborhood insights to help renters find a place they will love to live.

Zillow Rental Manager - Online Property Management Tools - Zillow Rental Manager provides landlords with tools to post listings, create and sign leases, screen tenants, collect rent online, and manage property tours efficiently.

dowidth.com

dowidth.com