Investment in song catalog purchases offers a unique avenue for portfolio diversification by generating steady royalty income derived from music rights, often with lower volatility compared to traditional assets. Private equity investments involve acquiring ownership stakes in private companies, targeting significant capital appreciation through active management and operational improvements. Explore more to understand which strategy aligns best with your financial goals and risk tolerance.

Why it is important

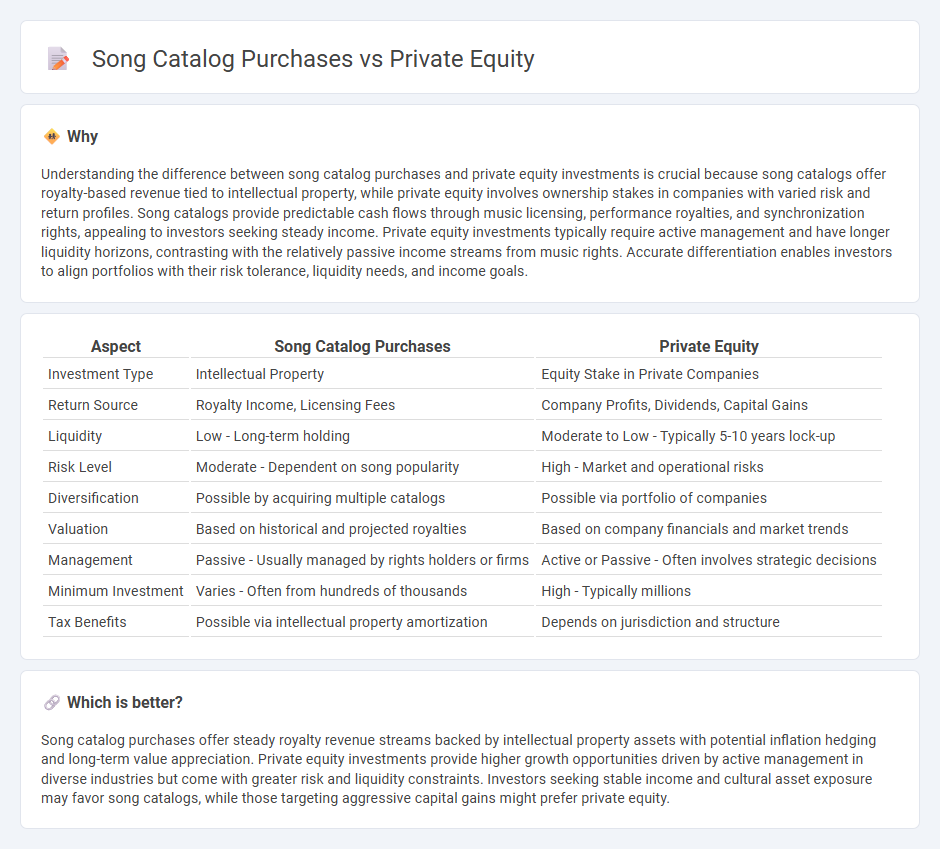

Understanding the difference between song catalog purchases and private equity investments is crucial because song catalogs offer royalty-based revenue tied to intellectual property, while private equity involves ownership stakes in companies with varied risk and return profiles. Song catalogs provide predictable cash flows through music licensing, performance royalties, and synchronization rights, appealing to investors seeking steady income. Private equity investments typically require active management and have longer liquidity horizons, contrasting with the relatively passive income streams from music rights. Accurate differentiation enables investors to align portfolios with their risk tolerance, liquidity needs, and income goals.

Comparison Table

| Aspect | Song Catalog Purchases | Private Equity |

|---|---|---|

| Investment Type | Intellectual Property | Equity Stake in Private Companies |

| Return Source | Royalty Income, Licensing Fees | Company Profits, Dividends, Capital Gains |

| Liquidity | Low - Long-term holding | Moderate to Low - Typically 5-10 years lock-up |

| Risk Level | Moderate - Dependent on song popularity | High - Market and operational risks |

| Diversification | Possible by acquiring multiple catalogs | Possible via portfolio of companies |

| Valuation | Based on historical and projected royalties | Based on company financials and market trends |

| Management | Passive - Usually managed by rights holders or firms | Active or Passive - Often involves strategic decisions |

| Minimum Investment | Varies - Often from hundreds of thousands | High - Typically millions |

| Tax Benefits | Possible via intellectual property amortization | Depends on jurisdiction and structure |

Which is better?

Song catalog purchases offer steady royalty revenue streams backed by intellectual property assets with potential inflation hedging and long-term value appreciation. Private equity investments provide higher growth opportunities driven by active management in diverse industries but come with greater risk and liquidity constraints. Investors seeking stable income and cultural asset exposure may favor song catalogs, while those targeting aggressive capital gains might prefer private equity.

Connection

Song catalog purchases have become a lucrative investment strategy within private equity due to their steady royalty income and increasing valuation trends in the music industry. Private equity firms leverage their capital to acquire music rights, capitalizing on streaming growth and the shift towards digital consumption. This intersection allows investors to diversify portfolios with stable, long-term cash flows tied to intellectual property assets.

Key Terms

Equity Ownership

Private equity investments typically involve acquiring majority stakes or full ownership in companies to drive strategic growth and generate returns, emphasizing control and equity appreciation. In contrast, song catalog purchases focus on acquiring the rights to music royalties, often as minority or non-controlling interests, prioritizing steady income streams over operational control. Explore more to understand how equity ownership differs fundamentally between these two investment approaches.

Royalties

Private equity firms increasingly invest in song catalogs, recognizing royalty streams as stable, long-term assets with high yield potential. Song catalog purchases offer consistent income through mechanical, performance, and synchronization royalties, differentiating them from traditional asset classes. Explore how leveraging royalty data transforms investment strategies and maximizes returns in this evolving market.

Intellectual Property

Private equity investments often target diversified asset portfolios, emphasizing financial returns and operational control, while song catalog purchases specifically focus on acquiring intellectual property rights that generate consistent royalty income. Song catalogs represent unique revenue streams through licensing, streaming, and performance royalties, making them valuable intangible assets in the entertainment industry. Explore how intellectual property strategies differ in private equity and song catalog acquisitions to optimize investment outcomes.

Source and External Links

Private equity - Wikipedia - Private equity involves investment managers raising capital from institutional investors to buy ownership stakes in private companies, aiming to generate returns through various value-creation strategies like revenue growth, margin expansion, and debt paydown over 4-7 years.

What is Private Equity? - BVCA - Private equity is medium to long-term financing in unquoted companies that supports managing buyouts and growth through active ownership and close collaboration with management, typically held for 4 to 7 years before exit.

Private Equity: What You Need to Know - KKR - Private equity fund managers invest in non-public companies, seeking to enhance value by improving management, expanding operations, optimizing capital structure, and driving growth to achieve returns and diversification benefits.

dowidth.com

dowidth.com