Sneakers flipping involves buying limited-edition shoes at retail prices and reselling them for a profit in secondary markets, capitalizing on trends and brand hype. Gold investing offers a more stable option, serving as a hedge against inflation and economic uncertainty due to its intrinsic value and global demand. Explore the benefits and risks of each investment strategy to determine which aligns best with your financial goals.

Why it is important

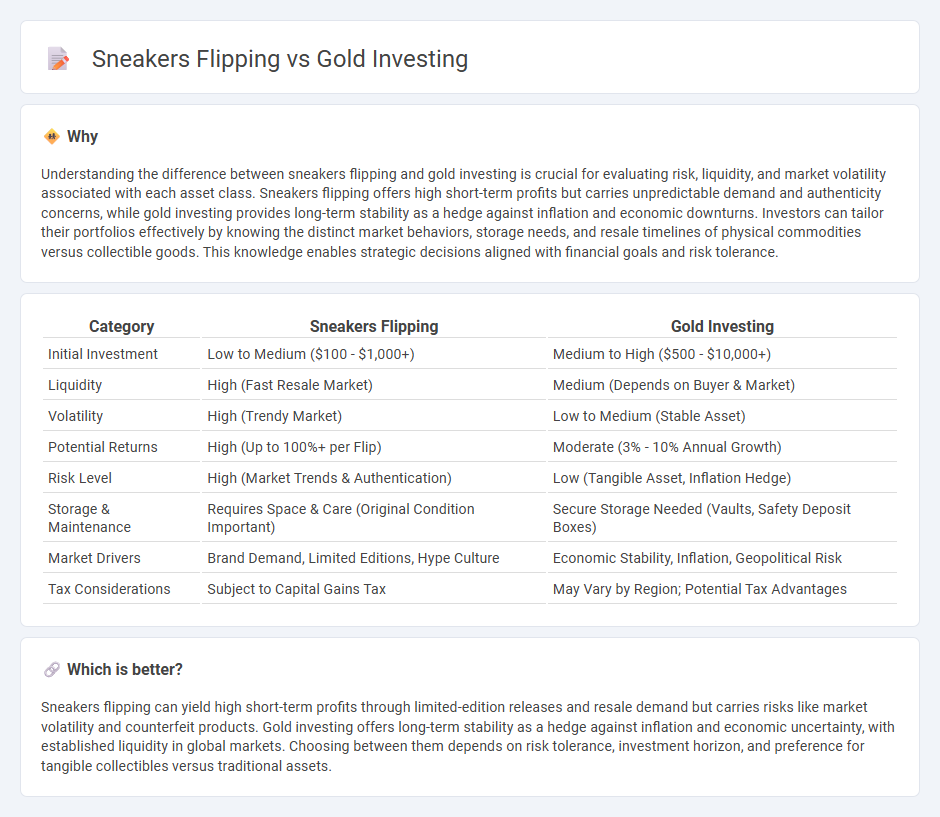

Understanding the difference between sneakers flipping and gold investing is crucial for evaluating risk, liquidity, and market volatility associated with each asset class. Sneakers flipping offers high short-term profits but carries unpredictable demand and authenticity concerns, while gold investing provides long-term stability as a hedge against inflation and economic downturns. Investors can tailor their portfolios effectively by knowing the distinct market behaviors, storage needs, and resale timelines of physical commodities versus collectible goods. This knowledge enables strategic decisions aligned with financial goals and risk tolerance.

Comparison Table

| Category | Sneakers Flipping | Gold Investing |

|---|---|---|

| Initial Investment | Low to Medium ($100 - $1,000+) | Medium to High ($500 - $10,000+) |

| Liquidity | High (Fast Resale Market) | Medium (Depends on Buyer & Market) |

| Volatility | High (Trendy Market) | Low to Medium (Stable Asset) |

| Potential Returns | High (Up to 100%+ per Flip) | Moderate (3% - 10% Annual Growth) |

| Risk Level | High (Market Trends & Authentication) | Low (Tangible Asset, Inflation Hedge) |

| Storage & Maintenance | Requires Space & Care (Original Condition Important) | Secure Storage Needed (Vaults, Safety Deposit Boxes) |

| Market Drivers | Brand Demand, Limited Editions, Hype Culture | Economic Stability, Inflation, Geopolitical Risk |

| Tax Considerations | Subject to Capital Gains Tax | May Vary by Region; Potential Tax Advantages |

Which is better?

Sneakers flipping can yield high short-term profits through limited-edition releases and resale demand but carries risks like market volatility and counterfeit products. Gold investing offers long-term stability as a hedge against inflation and economic uncertainty, with established liquidity in global markets. Choosing between them depends on risk tolerance, investment horizon, and preference for tangible collectibles versus traditional assets.

Connection

Sneakers flipping and gold investing are connected through their shared principle of asset appreciation driven by market demand and rarity. Both markets rely on identifying undervalued items--limited-edition sneakers or gold bullion--then capitalizing on price increases over time. Understanding trends, authenticity, and market liquidity is crucial for maximizing returns in these alternative investment strategies.

Key Terms

Liquidity

Gold investing offers high liquidity with the ability to quickly buy or sell in global markets, making it a preferred asset for preserving wealth during economic uncertainty. Sneakers flipping, while potentially lucrative, generally involves longer holding periods and market demand fluctuations, resulting in less predictable liquidity. Explore the detailed advantages and risks of each to determine the best fit for your investment strategy.

Market Volatility

Gold investing provides a stable hedge against market volatility, maintaining value during economic downturns due to its intrinsic worth. Sneakers flipping involves higher risk, as resale values fluctuate with trends, brand releases, and consumer demand, making it more susceptible to rapid market changes. Explore further to understand how market volatility impacts these investment strategies uniquely.

Asset Authentication

Gold investing requires rigorous asset authentication through certified assays and hallmarks to ensure purity and authenticity, making it a stable store of value. Sneakers flipping relies heavily on verifying limited-edition releases, brand collaborations, and original packaging to authenticate rare and high-demand models. Explore detailed strategies to master asset authentication in both markets and maximize your investment potential.

Source and External Links

How to Buy Gold to Diversify Your Portfolio | Charles Schwab - Gold can diversify your portfolio due to its low correlation with stocks and bonds and may act as a hedge during market stress, but diversification does not eliminate risk of loss.

How to buy gold: 2 ways to invest in gold | Fidelity - Gold investing options include purchasing physical gold (bars, coins) and financial products like gold ETFs, mutual funds, futures, and stocks, each with distinct characteristics and risks.

An Introduction to Gold Investment | The Royal Mint - Physical gold investments (coins, bars) offer tangible assets but require secure storage, while digital platforms now provide easier access to gold markets.

dowidth.com

dowidth.com