Watch investment communities focus on collective insights and shared experiences to evaluate luxury timepieces, enabling enthusiasts to make informed decisions based on market trends and authenticity. Angel investors, in contrast, provide early-stage capital to startups and often bring strategic guidance and networking opportunities to accelerate growth. Explore the distinct approaches and benefits of watch investment communities versus angel investors to enhance your investment strategy.

Why it is important

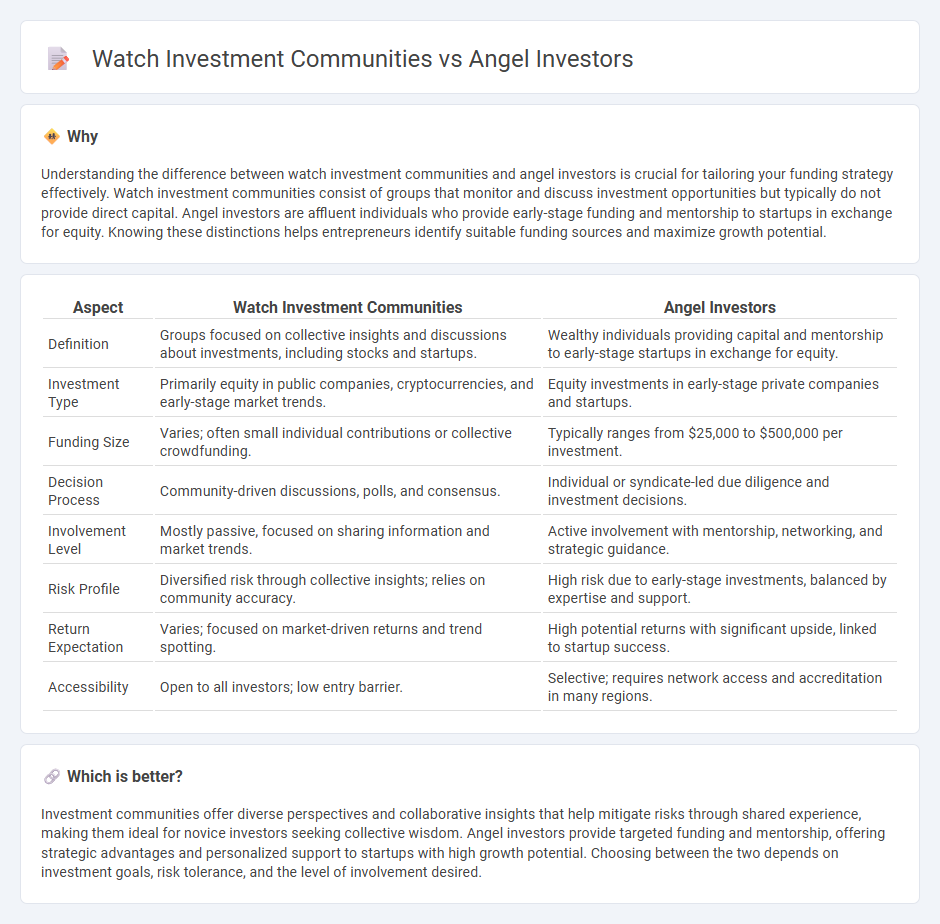

Understanding the difference between watch investment communities and angel investors is crucial for tailoring your funding strategy effectively. Watch investment communities consist of groups that monitor and discuss investment opportunities but typically do not provide direct capital. Angel investors are affluent individuals who provide early-stage funding and mentorship to startups in exchange for equity. Knowing these distinctions helps entrepreneurs identify suitable funding sources and maximize growth potential.

Comparison Table

| Aspect | Watch Investment Communities | Angel Investors |

|---|---|---|

| Definition | Groups focused on collective insights and discussions about investments, including stocks and startups. | Wealthy individuals providing capital and mentorship to early-stage startups in exchange for equity. |

| Investment Type | Primarily equity in public companies, cryptocurrencies, and early-stage market trends. | Equity investments in early-stage private companies and startups. |

| Funding Size | Varies; often small individual contributions or collective crowdfunding. | Typically ranges from $25,000 to $500,000 per investment. |

| Decision Process | Community-driven discussions, polls, and consensus. | Individual or syndicate-led due diligence and investment decisions. |

| Involvement Level | Mostly passive, focused on sharing information and market trends. | Active involvement with mentorship, networking, and strategic guidance. |

| Risk Profile | Diversified risk through collective insights; relies on community accuracy. | High risk due to early-stage investments, balanced by expertise and support. |

| Return Expectation | Varies; focused on market-driven returns and trend spotting. | High potential returns with significant upside, linked to startup success. |

| Accessibility | Open to all investors; low entry barrier. | Selective; requires network access and accreditation in many regions. |

Which is better?

Investment communities offer diverse perspectives and collaborative insights that help mitigate risks through shared experience, making them ideal for novice investors seeking collective wisdom. Angel investors provide targeted funding and mentorship, offering strategic advantages and personalized support to startups with high growth potential. Choosing between the two depends on investment goals, risk tolerance, and the level of involvement desired.

Connection

Watch investment communities provide a dynamic platform where angel investors share insights, evaluate startups, and pool resources to identify promising investment opportunities. These communities enhance angel investors' ability to access diverse deals, perform thorough due diligence, and leverage collective expertise to mitigate risks. Engagement in such networks accelerates funding decisions while expanding the scope and scale of angel investment portfolios.

Key Terms

Equity stake

Angel investors typically provide early-stage funding in exchange for equity stakes, gaining ownership shares and potential influence in startup companies. Watch investment communities often facilitate collective investments and share insights but may not directly acquire equity or hold ownership in startups. Explore how equity stakes shape investment strategies and returns in both models to understand their impact fully.

Due diligence

Angel investors conduct thorough due diligence by evaluating startup business models, market potential, financial projections, and the founding team's track record to mitigate investment risks and increase success rates. Watch investment communities often rely on crowd insights, shared experiences, and aggregated data, but their due diligence can be less rigorous and more informal compared to individual angel investors. Explore detailed comparisons to better understand each approach's effectiveness in assessing investment opportunities.

Asset appreciation

Angel investors typically focus on early-stage startups with high growth potential, aiming for significant asset appreciation through equity stakes. Investment communities, however, diversify across multiple assets, balancing risk while seeking steady long-term value increases from shared insights and pooled capital. Discover how these approaches impact your portfolio's growth strategy.

Source and External Links

Angel Investors - The Hartford Insurance - Angel investors are wealthy individuals who provide capital to early-stage startups in exchange for equity, often offering mentorship and management support beyond just funding.

100 Top Angel Investors List for Startups (2025) - Eqvista - Top angel investors like Mark Cuban and Naval Ravikant are sought after by startups for their combination of financial investment, industry expertise, and valuable networking opportunities.

Learn how to find and work with angel investors - Silicon Valley Bank - Angel investors typically seek a 10%-30% equity stake and provide strategic value through connections, guidance, and access to future funding rounds.

dowidth.com

dowidth.com