Royalty stream investing generates passive income by purchasing rights to future revenue from assets like music, patents, or natural resources, offering predictable cash flow with lower correlation to market volatility. Hedge fund investing involves pooled funds managed with diverse strategies aimed at high returns, often accompanied by higher risk and less liquidity. Explore the detailed differences and benefits of royalty stream versus hedge fund investing to find the best fit for your portfolio goals.

Why it is important

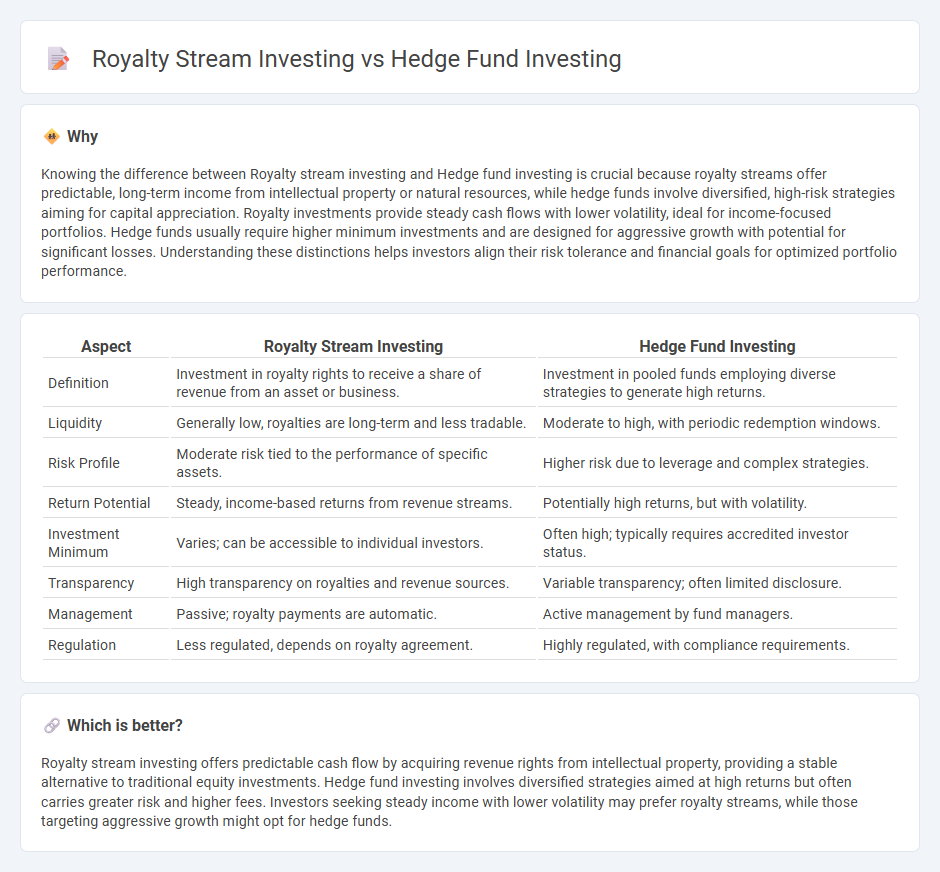

Knowing the difference between Royalty stream investing and Hedge fund investing is crucial because royalty streams offer predictable, long-term income from intellectual property or natural resources, while hedge funds involve diversified, high-risk strategies aiming for capital appreciation. Royalty investments provide steady cash flows with lower volatility, ideal for income-focused portfolios. Hedge funds usually require higher minimum investments and are designed for aggressive growth with potential for significant losses. Understanding these distinctions helps investors align their risk tolerance and financial goals for optimized portfolio performance.

Comparison Table

| Aspect | Royalty Stream Investing | Hedge Fund Investing |

|---|---|---|

| Definition | Investment in royalty rights to receive a share of revenue from an asset or business. | Investment in pooled funds employing diverse strategies to generate high returns. |

| Liquidity | Generally low, royalties are long-term and less tradable. | Moderate to high, with periodic redemption windows. |

| Risk Profile | Moderate risk tied to the performance of specific assets. | Higher risk due to leverage and complex strategies. |

| Return Potential | Steady, income-based returns from revenue streams. | Potentially high returns, but with volatility. |

| Investment Minimum | Varies; can be accessible to individual investors. | Often high; typically requires accredited investor status. |

| Transparency | High transparency on royalties and revenue sources. | Variable transparency; often limited disclosure. |

| Management | Passive; royalty payments are automatic. | Active management by fund managers. |

| Regulation | Less regulated, depends on royalty agreement. | Highly regulated, with compliance requirements. |

Which is better?

Royalty stream investing offers predictable cash flow by acquiring revenue rights from intellectual property, providing a stable alternative to traditional equity investments. Hedge fund investing involves diversified strategies aimed at high returns but often carries greater risk and higher fees. Investors seeking steady income with lower volatility may prefer royalty streams, while those targeting aggressive growth might opt for hedge funds.

Connection

Royalty stream investing generates consistent cash flows from intellectual property or natural resources, offering predictable returns attractive to hedge funds seeking diversified income streams. Hedge funds integrate royalty streams to balance portfolio volatility and enhance risk-adjusted returns through non-correlated assets. This strategic allocation aligns hedge funds' emphasis on alternative investments with royalty revenue's stable, long-term cash flow characteristics.

Key Terms

Leverage

Hedge fund investing typically employs high leverage to amplify returns by borrowing capital and using complex financial instruments, increasing both potential gains and risks. Royalty stream investing involves acquiring future income rights from intellectual property or natural resources, utilizing moderate leverage structures to maximize cash flow stability while limiting downside exposure. Explore the distinct leverage strategies and risk profiles of hedge funds and royalty streams to determine the optimal investment approach for your portfolio.

Passive income

Hedge fund investing typically involves pooled capital managed by professionals aiming for high returns through diversified strategies, often requiring active involvement or higher risk tolerance. Royalty stream investing provides passive income by acquiring rights to ongoing revenue from intellectual property, such as patents, music, or natural resources, with more predictable cash flow. Explore the benefits and risks of these passive income sources to determine which aligns best with your financial goals.

Liquidity

Hedge fund investing typically offers higher liquidity with the ability to redeem shares quarterly or annually, depending on the fund's structure, whereas royalty stream investing often involves longer lock-up periods due to contract durations tied to revenue-generating assets. Royalty streams provide steady income based on the underlying asset's performance but may lack the quick exit options characteristic of hedge funds. Explore the nuances of liquidity in these investment strategies to optimize your portfolio configuration.

Source and External Links

Hedge Funds Management Services - HSBC - HSBC offers tailored access to a wide range of sophisticated hedge fund strategies, emphasizing diversification, active management, and alignment of interests between managers and investors.

Hedge fund - Wikipedia - Hedge funds are pooled investment vehicles that employ complex, flexible strategies--including short selling, leverage, and derivatives--across multiple asset classes to target absolute returns, often with limited correlation to traditional markets.

Hedge Funds - Investor.gov - Hedge funds are private, lightly regulated investment pools that typically cater to accredited or institutional investors, pursue aggressive strategies for higher returns, and carry significantly greater risks compared to conventional investment funds.

dowidth.com

dowidth.com