Investment communities offer diverse perspectives and collective insights from individual investors, fostering a collaborative environment focused on shared strategies and emerging trends. Hedge funds operate with concentrated capital, employing advanced algorithms and expert management to optimize returns through sophisticated risk models and market analysis. Discover the distinctive advantages and dynamics of both to enhance your investment knowledge.

Why it is important

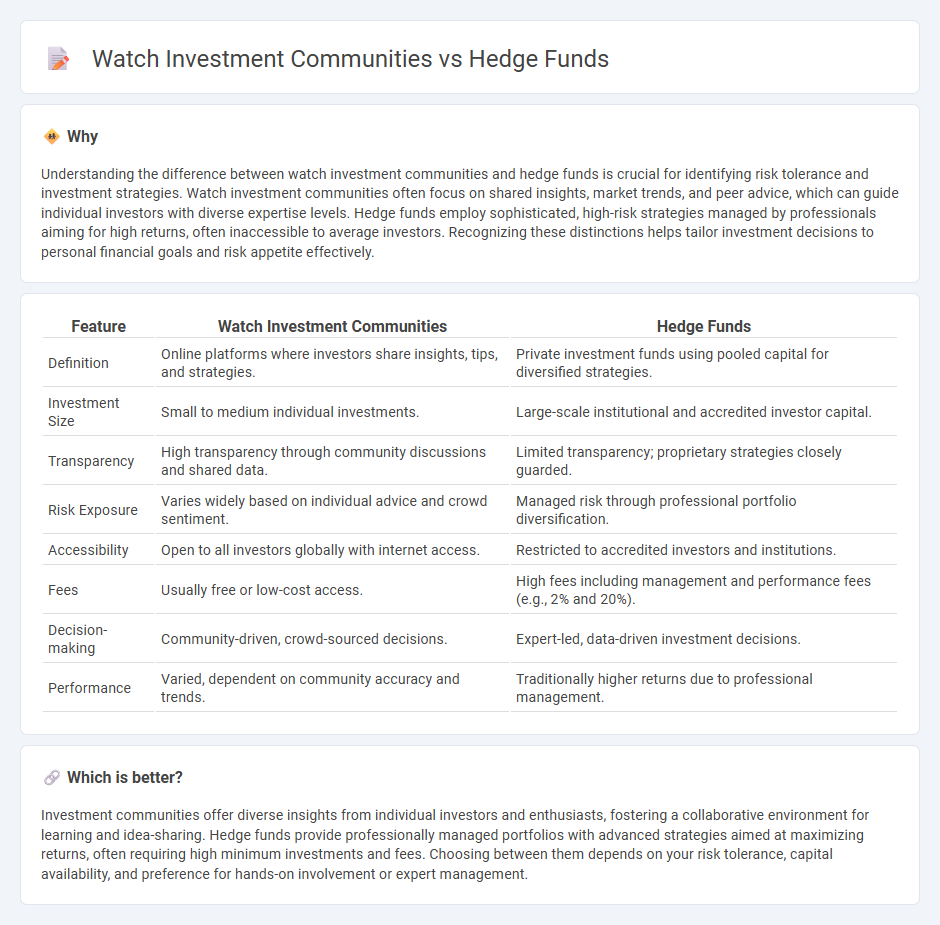

Understanding the difference between watch investment communities and hedge funds is crucial for identifying risk tolerance and investment strategies. Watch investment communities often focus on shared insights, market trends, and peer advice, which can guide individual investors with diverse expertise levels. Hedge funds employ sophisticated, high-risk strategies managed by professionals aiming for high returns, often inaccessible to average investors. Recognizing these distinctions helps tailor investment decisions to personal financial goals and risk appetite effectively.

Comparison Table

| Feature | Watch Investment Communities | Hedge Funds |

|---|---|---|

| Definition | Online platforms where investors share insights, tips, and strategies. | Private investment funds using pooled capital for diversified strategies. |

| Investment Size | Small to medium individual investments. | Large-scale institutional and accredited investor capital. |

| Transparency | High transparency through community discussions and shared data. | Limited transparency; proprietary strategies closely guarded. |

| Risk Exposure | Varies widely based on individual advice and crowd sentiment. | Managed risk through professional portfolio diversification. |

| Accessibility | Open to all investors globally with internet access. | Restricted to accredited investors and institutions. |

| Fees | Usually free or low-cost access. | High fees including management and performance fees (e.g., 2% and 20%). |

| Decision-making | Community-driven, crowd-sourced decisions. | Expert-led, data-driven investment decisions. |

| Performance | Varied, dependent on community accuracy and trends. | Traditionally higher returns due to professional management. |

Which is better?

Investment communities offer diverse insights from individual investors and enthusiasts, fostering a collaborative environment for learning and idea-sharing. Hedge funds provide professionally managed portfolios with advanced strategies aimed at maximizing returns, often requiring high minimum investments and fees. Choosing between them depends on your risk tolerance, capital availability, and preference for hands-on involvement or expert management.

Connection

Investment communities and hedge funds are connected through the dynamic exchange of market insights, strategies, and real-time data that influence trading decisions. Hedge funds leverage collective intelligence from online investment forums, social media sentiment, and crowd-sourced analysis to identify emerging trends and mitigate risks. This symbiotic relationship enhances asset allocation efficiency, portfolio diversification, and alpha generation within competitive financial markets.

Key Terms

Leverage

Hedge funds utilize leverage extensively to amplify their investment returns, often employing derivatives, margin trading, and borrowing to increase market exposure beyond their capital base. Watch investment communities typically adopt a more conservative approach to leverage, prioritizing asset preservation and long-term value appreciation over speculative growth. Discover how leverage strategies impact risk and reward dynamics in these distinct investment spheres.

Due diligence

Hedge funds conduct rigorous due diligence by analyzing market trends, financial statements, and risk management strategies to optimize investment returns. Watch investment communities perform due diligence through detailed research on brand history, model rarity, condition, and resale value to identify watches with strong appreciation potential. Discover how thorough due diligence differentiates hedge fund strategies from watch investment approaches.

Transparency

Hedge funds often operate with limited transparency, disclosing minimal information about their strategies and holdings, which can obscure risk assessment for investors. In contrast, watch investment communities emphasize transparency by openly sharing detailed investment rationales, market insights, and performance metrics. Explore more to understand how transparency impacts investment decisions and trust in these two distinct approaches.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that raise capital from accredited investors and use diverse strategies like short-selling and derivatives to seek absolute returns, differing from mutual funds that target relative returns.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment pools for sophisticated investors, using flexible strategies and less regulation than mutual funds, which may increase investment risk.

Hedge fund - Wikipedia - Hedge funds are pooled investment funds employing complex trading and risk management techniques, charging management and performance fees, and generally aiming to manage risk and generate returns through diverse strategies.

dowidth.com

dowidth.com