Social token investment revolves around community-driven digital currencies that represent membership, influence, or access within a specific group, often tied to creators or social platforms. Tokenized asset investment involves digital tokens backed by tangible assets such as real estate, commodities, or equity, providing investors with fractional ownership and increased liquidity. Explore the differences and potential benefits of each investment type to make informed decisions.

Why it is important

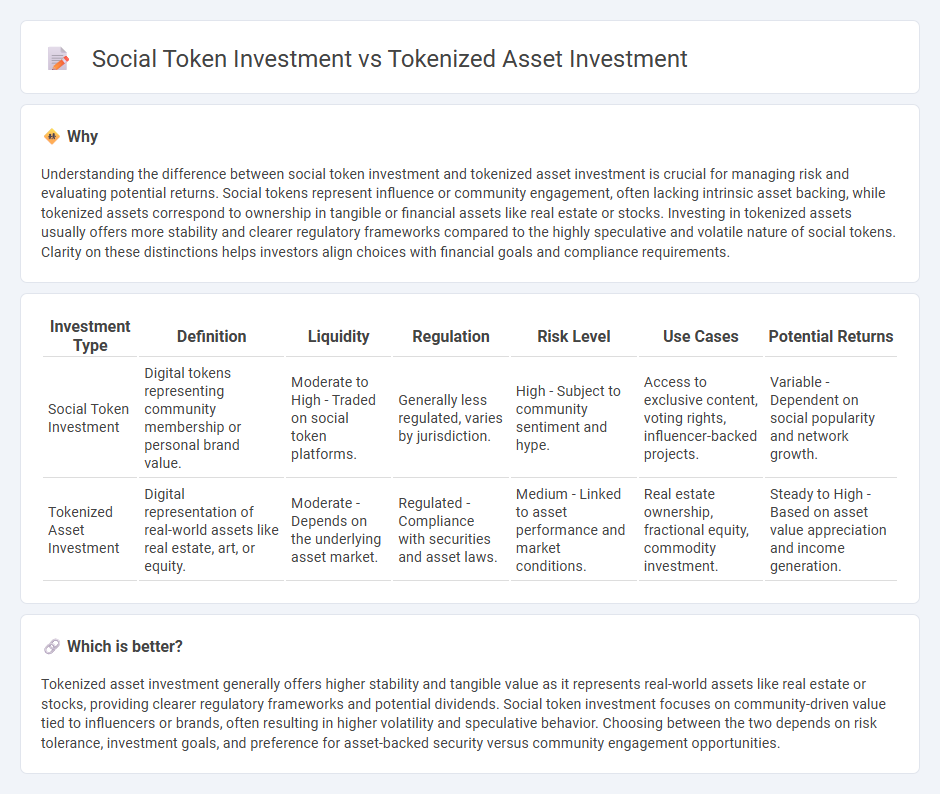

Understanding the difference between social token investment and tokenized asset investment is crucial for managing risk and evaluating potential returns. Social tokens represent influence or community engagement, often lacking intrinsic asset backing, while tokenized assets correspond to ownership in tangible or financial assets like real estate or stocks. Investing in tokenized assets usually offers more stability and clearer regulatory frameworks compared to the highly speculative and volatile nature of social tokens. Clarity on these distinctions helps investors align choices with financial goals and compliance requirements.

Comparison Table

| Investment Type | Definition | Liquidity | Regulation | Risk Level | Use Cases | Potential Returns |

|---|---|---|---|---|---|---|

| Social Token Investment | Digital tokens representing community membership or personal brand value. | Moderate to High - Traded on social token platforms. | Generally less regulated, varies by jurisdiction. | High - Subject to community sentiment and hype. | Access to exclusive content, voting rights, influencer-backed projects. | Variable - Dependent on social popularity and network growth. |

| Tokenized Asset Investment | Digital representation of real-world assets like real estate, art, or equity. | Moderate - Depends on the underlying asset market. | Regulated - Compliance with securities and asset laws. | Medium - Linked to asset performance and market conditions. | Real estate ownership, fractional equity, commodity investment. | Steady to High - Based on asset value appreciation and income generation. |

Which is better?

Tokenized asset investment generally offers higher stability and tangible value as it represents real-world assets like real estate or stocks, providing clearer regulatory frameworks and potential dividends. Social token investment focuses on community-driven value tied to influencers or brands, often resulting in higher volatility and speculative behavior. Choosing between the two depends on risk tolerance, investment goals, and preference for asset-backed security versus community engagement opportunities.

Connection

Social token investment and tokenized asset investment intersect through the blockchain technology that underpins both, enabling fractional ownership and increased liquidity. Social tokens represent personal brands or community value, while tokenized assets convert physical or financial assets into digital tokens, broadening investor access and diversification opportunities. Both investment types leverage decentralized finance (DeFi) to enhance transparency, security, and efficient market participation.

Key Terms

**Tokenized asset investment:**

Tokenized asset investment involves purchasing digital tokens representing ownership in real-world assets such as real estate, commodities, or equity shares, providing investors with increased liquidity and fractional ownership opportunities. These investments benefit from blockchain's transparency, security, and reduced transaction costs, making asset diversification more accessible than traditional methods. Explore the advantages and practical applications of tokenized asset investment to make informed decisions in the evolving digital economy.

Asset-backed tokens

Asset-backed tokens represent tangible or financial assets such as real estate, commodities, or equities, providing investors with intrinsic value and reduced volatility compared to purely speculative social tokens. Social tokens are typically community-driven, representing access, influence, or membership within a particular group, often lacking inherent asset value. Explore the distinctive benefits and risks of asset-backed tokens to make informed investment decisions.

Fractional ownership

Fractional ownership in tokenized asset investment allows investors to buy and hold a percentage of high-value physical assets such as real estate or art through blockchain-based tokens, offering increased liquidity and lower entry barriers. Social token investment, on the other hand, represents a digital asset tied to a community or individual's brand, granting holders exclusive access or influence rather than direct ownership of physical assets. Explore the unique benefits and risks of fractional ownership in both tokenized assets and social tokens to make informed investment decisions.

Source and External Links

Investment Opportunities with Tokenization - Sygnum Bank - Tokenized asset investment allows investors to access fractional ownership, real-time transparency, and diversified portfolios through blockchain-based platforms, expanding opportunities in private markets, traditional securities, and art & collectibles.

What is asset tokenization? - Hedera - Asset tokenization represents physical or digital assets as digital tokens, enabling fractional ownership, increased liquidity, and global accessibility for investors on distributed ledger platforms.

Asset Tokenization: Digital Assets Explained - Chainlink - Tokenized asset investment reduces costs, automates processes, and unlocks new liquidity for traditionally illiquid assets by integrating real-world assets into decentralized finance ecosystems.

dowidth.com

dowidth.com