Sports team ownership shares provide investors with a unique opportunity to own a piece of a franchise, often combining passion with potential financial returns, while mutual funds offer diversified exposure to various assets managed by professionals, reducing risk through broad market participation. The valuation of sports teams can be influenced by factors like team performance, fan loyalty, and media rights, whereas mutual funds are driven by market trends, economic indicators, and portfolio management strategies. Discover more about how these distinct investment avenues can align with your financial goals.

Why it is important

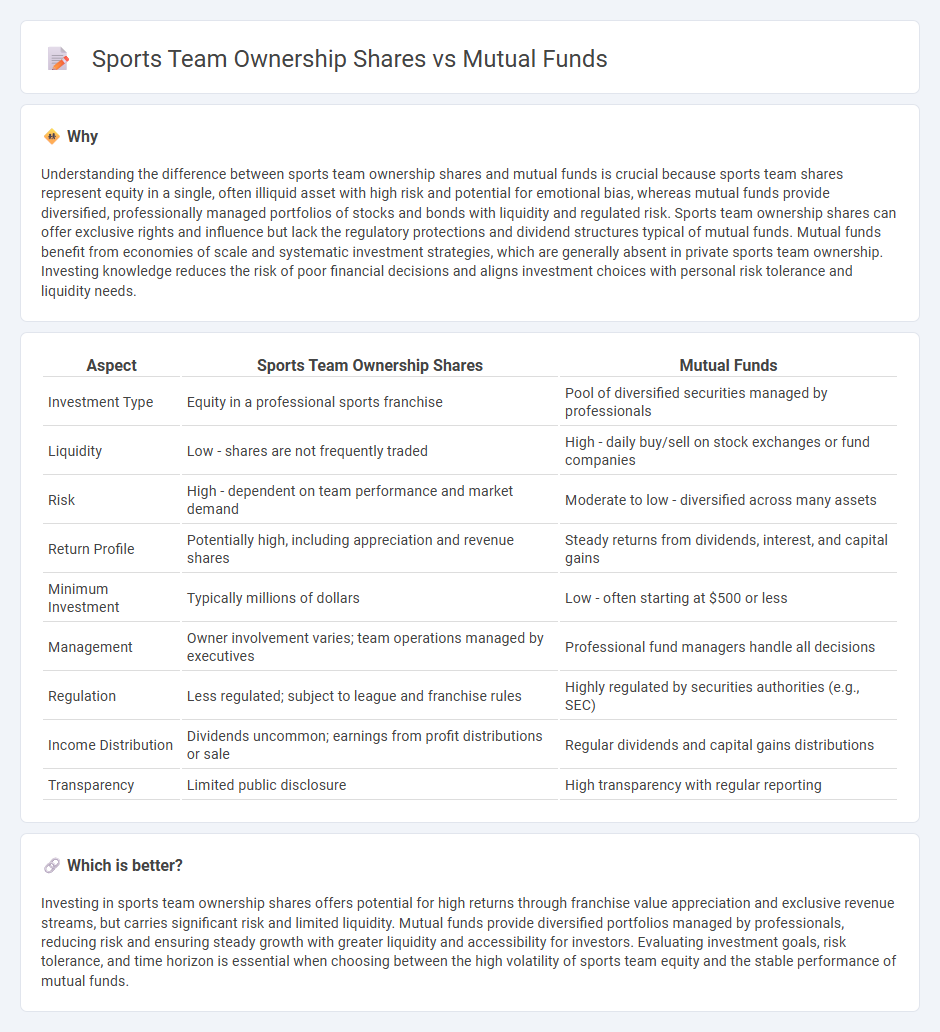

Understanding the difference between sports team ownership shares and mutual funds is crucial because sports team shares represent equity in a single, often illiquid asset with high risk and potential for emotional bias, whereas mutual funds provide diversified, professionally managed portfolios of stocks and bonds with liquidity and regulated risk. Sports team ownership shares can offer exclusive rights and influence but lack the regulatory protections and dividend structures typical of mutual funds. Mutual funds benefit from economies of scale and systematic investment strategies, which are generally absent in private sports team ownership. Investing knowledge reduces the risk of poor financial decisions and aligns investment choices with personal risk tolerance and liquidity needs.

Comparison Table

| Aspect | Sports Team Ownership Shares | Mutual Funds |

|---|---|---|

| Investment Type | Equity in a professional sports franchise | Pool of diversified securities managed by professionals |

| Liquidity | Low - shares are not frequently traded | High - daily buy/sell on stock exchanges or fund companies |

| Risk | High - dependent on team performance and market demand | Moderate to low - diversified across many assets |

| Return Profile | Potentially high, including appreciation and revenue shares | Steady returns from dividends, interest, and capital gains |

| Minimum Investment | Typically millions of dollars | Low - often starting at $500 or less |

| Management | Owner involvement varies; team operations managed by executives | Professional fund managers handle all decisions |

| Regulation | Less regulated; subject to league and franchise rules | Highly regulated by securities authorities (e.g., SEC) |

| Income Distribution | Dividends uncommon; earnings from profit distributions or sale | Regular dividends and capital gains distributions |

| Transparency | Limited public disclosure | High transparency with regular reporting |

Which is better?

Investing in sports team ownership shares offers potential for high returns through franchise value appreciation and exclusive revenue streams, but carries significant risk and limited liquidity. Mutual funds provide diversified portfolios managed by professionals, reducing risk and ensuring steady growth with greater liquidity and accessibility for investors. Evaluating investment goals, risk tolerance, and time horizon is essential when choosing between the high volatility of sports team equity and the stable performance of mutual funds.

Connection

Sports team ownership shares and mutual funds are connected through the investment vehicles that allow individuals to participate in the financial performance of sports franchises without direct ownership. Mutual funds may include shares of publicly traded sports teams or related companies within their portfolios, providing diversified exposure to the sports industry. This connection creates opportunities for investors to capitalize on the growth and profitability of the sports sector through professionally managed investment funds.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investments across various sectors, reducing risk through exposure to multiple assets. Sports team ownership shares typically involve concentrated investment in a single asset, potentially leading to higher volatility and less risk mitigation. Discover how diversification impacts returns and risk profiles between these investment types by exploring detailed comparisons.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares easily on trading days with minimal transaction costs. In contrast, sports team ownership shares are typically illiquid assets, often requiring lengthy negotiations and significant time to find a buyer, coupled with restrictions imposed by league rules. Explore more about the liquidity differences and investment implications of these assets to make informed decisions.

Valuation

Mutual funds are valued based on their net asset value (NAV), which reflects the total market value of the underlying assets divided by the number of shares outstanding, providing a transparent and frequently updated valuation metric. Sports team ownership shares lack standardized market valuations and are often appraised through complex measures including franchise revenue, market size, brand strength, and profitability, making their valuation inherently subjective and volatile. Explore detailed comparisons to understand the nuances behind these valuation methods.

Source and External Links

Mutual Funds - A mutual fund is an SEC-registered investment company that pools money from investors to invest in stocks, bonds, and other securities, offering benefits like professional management and diversification.

Mutual Fund - Mutual funds are investment vehicles that pool money from multiple investors to purchase a variety of securities, often categorized by their investment strategies as actively or passively managed.

Understanding Mutual Funds - Mutual funds provide an affordable way for investors to diversify their portfolios by pooling resources to buy stocks, bonds, and other investments, managed by professional money managers.

dowidth.com

dowidth.com