Secondaries in venture capital involve buying and selling pre-existing stakes in startup companies, often providing liquidity to early investors before traditional exit events, while private equity secondaries typically focus on mature companies with more established financial histories. Venture capital secondaries present unique opportunities and risks due to the high growth potential and volatility of startups compared to the typically lower risk profile of private equity investments. Discover how secondaries can diversify your portfolio and optimize investment timing in both venture capital and private equity sectors.

Why it is important

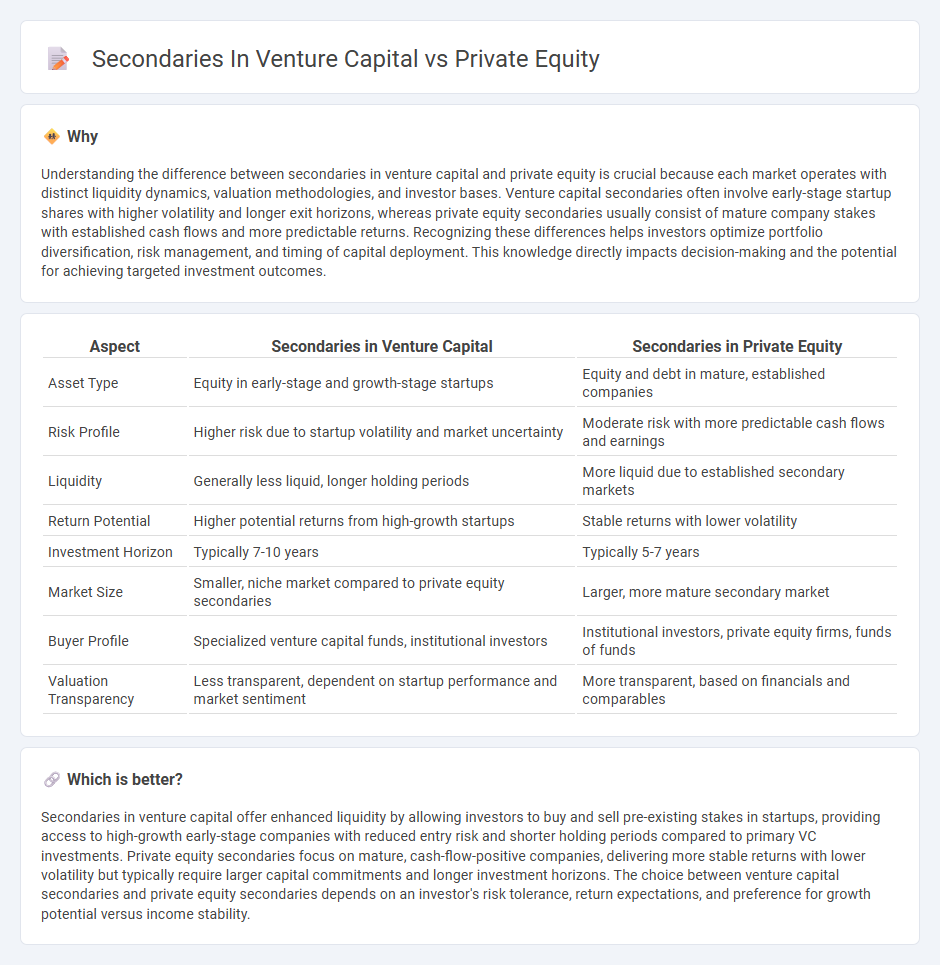

Understanding the difference between secondaries in venture capital and private equity is crucial because each market operates with distinct liquidity dynamics, valuation methodologies, and investor bases. Venture capital secondaries often involve early-stage startup shares with higher volatility and longer exit horizons, whereas private equity secondaries usually consist of mature company stakes with established cash flows and more predictable returns. Recognizing these differences helps investors optimize portfolio diversification, risk management, and timing of capital deployment. This knowledge directly impacts decision-making and the potential for achieving targeted investment outcomes.

Comparison Table

| Aspect | Secondaries in Venture Capital | Secondaries in Private Equity |

|---|---|---|

| Asset Type | Equity in early-stage and growth-stage startups | Equity and debt in mature, established companies |

| Risk Profile | Higher risk due to startup volatility and market uncertainty | Moderate risk with more predictable cash flows and earnings |

| Liquidity | Generally less liquid, longer holding periods | More liquid due to established secondary markets |

| Return Potential | Higher potential returns from high-growth startups | Stable returns with lower volatility |

| Investment Horizon | Typically 7-10 years | Typically 5-7 years |

| Market Size | Smaller, niche market compared to private equity secondaries | Larger, more mature secondary market |

| Buyer Profile | Specialized venture capital funds, institutional investors | Institutional investors, private equity firms, funds of funds |

| Valuation Transparency | Less transparent, dependent on startup performance and market sentiment | More transparent, based on financials and comparables |

Which is better?

Secondaries in venture capital offer enhanced liquidity by allowing investors to buy and sell pre-existing stakes in startups, providing access to high-growth early-stage companies with reduced entry risk and shorter holding periods compared to primary VC investments. Private equity secondaries focus on mature, cash-flow-positive companies, delivering more stable returns with lower volatility but typically require larger capital commitments and longer investment horizons. The choice between venture capital secondaries and private equity secondaries depends on an investor's risk tolerance, return expectations, and preference for growth potential versus income stability.

Connection

Secondaries in venture capital and private equity involve the buying and selling of existing investor stakes in funds or portfolios, providing liquidity to early investors while enabling new participants to access mature assets. These transactions facilitate portfolio rebalancing and risk mitigation in both asset classes by transferring ownership without disrupting the underlying companies. The growth of secondary markets reflects increased investor demand for flexibility and efficient capital deployment in private equity and venture capital investments.

Key Terms

Primary Investments

Private equity primarily involves direct investments in mature companies through buyouts or growth capital, while secondaries in venture capital refer to purchasing existing stakes in startup funds or companies from original investors. Primary investments in venture capital focus on funding early-stage startups by providing capital directly to new ventures in exchange for equity, which differs significantly from secondary transactions. Explore more to understand the strategic implications and risk profiles of these investment approaches.

Secondary Transactions

Secondary transactions in venture capital involve the purchase and sale of pre-existing investor stakes in private companies, providing liquidity to early investors and enabling portfolio rebalancing. Compared to primary private equity investments, secondaries offer reduced risk with historical performance data and shorter investment horizons, making them an attractive option for risk-averse investors. Explore the strategic benefits and market dynamics of secondary transactions to optimize your venture capital portfolio.

Liquidity

Private equity investments typically have longer lock-up periods, limiting liquidity for investors compared to secondaries in venture capital, which offer quicker access to capital by enabling the buying and selling of existing stakes. Secondary transactions provide enhanced liquidity options, often occurring in mature rounds or late-stage startups, reducing the time to exit. Explore more about how liquidity dynamics influence investment strategies and portfolio management in both private equity and venture capital secondaries.

Source and External Links

Private equity - Private equity involves investment managers raising money from institutional investors to buy equity stakes in private companies, focusing on value creation through growth, margin expansion, cash flow, and valuation improvements over 4-7 years.

What is Private Equity? - Private equity is medium to long-term equity financing in high-growth unquoted companies, with active ownership and close collaboration between PE managers and company leadership to drive growth and operational improvements.

Private Equity: What You Need to Know - Private equity funds invest in non-public companies by strengthening management, shaping strategy, improving operations, and optimizing capital structure to generate returns and diversify portfolios beyond public markets.

dowidth.com

dowidth.com