The secondaries market allows investors to buy and sell pre-existing stakes in private equity funds, offering enhanced liquidity and quicker access to returns compared to primary investments. Fund of funds aggregates multiple private equity funds, providing broad diversification and professional management but often involves higher fees and longer lock-up periods. Explore the unique advantages and strategies of secondaries versus fund of funds to optimize your investment portfolio.

Why it is important

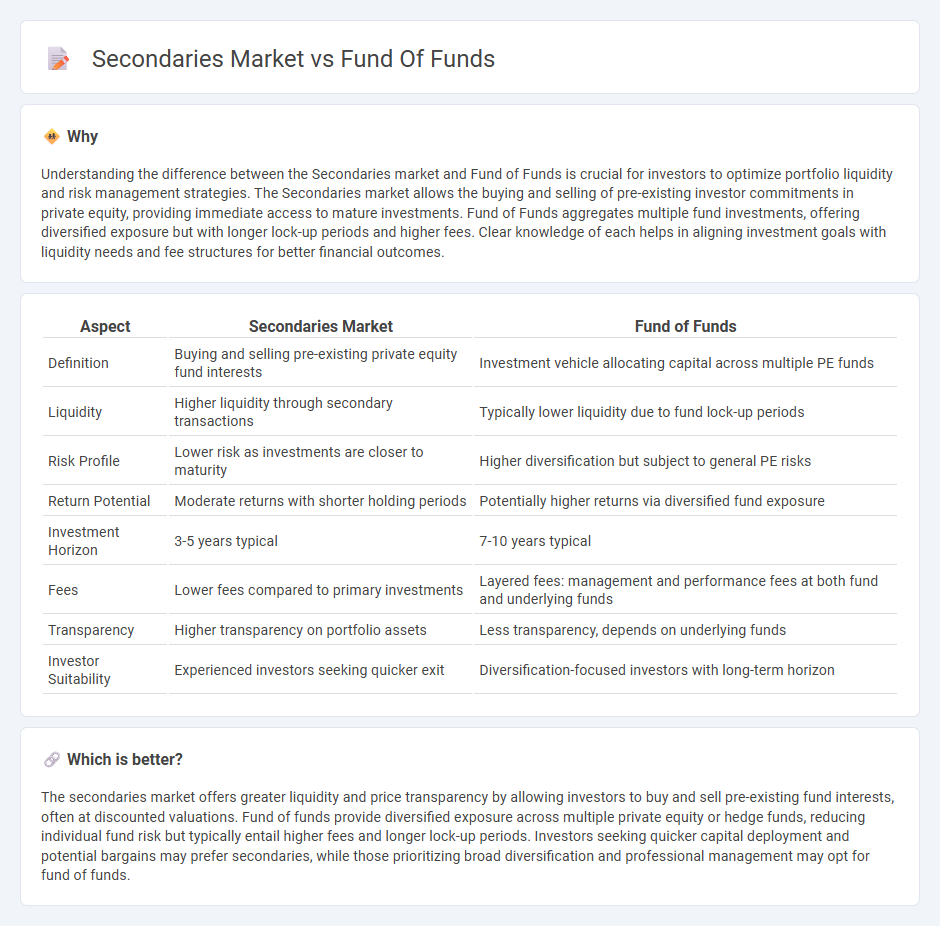

Understanding the difference between the Secondaries market and Fund of Funds is crucial for investors to optimize portfolio liquidity and risk management strategies. The Secondaries market allows the buying and selling of pre-existing investor commitments in private equity, providing immediate access to mature investments. Fund of Funds aggregates multiple fund investments, offering diversified exposure but with longer lock-up periods and higher fees. Clear knowledge of each helps in aligning investment goals with liquidity needs and fee structures for better financial outcomes.

Comparison Table

| Aspect | Secondaries Market | Fund of Funds |

|---|---|---|

| Definition | Buying and selling pre-existing private equity fund interests | Investment vehicle allocating capital across multiple PE funds |

| Liquidity | Higher liquidity through secondary transactions | Typically lower liquidity due to fund lock-up periods |

| Risk Profile | Lower risk as investments are closer to maturity | Higher diversification but subject to general PE risks |

| Return Potential | Moderate returns with shorter holding periods | Potentially higher returns via diversified fund exposure |

| Investment Horizon | 3-5 years typical | 7-10 years typical |

| Fees | Lower fees compared to primary investments | Layered fees: management and performance fees at both fund and underlying funds |

| Transparency | Higher transparency on portfolio assets | Less transparency, depends on underlying funds |

| Investor Suitability | Experienced investors seeking quicker exit | Diversification-focused investors with long-term horizon |

Which is better?

The secondaries market offers greater liquidity and price transparency by allowing investors to buy and sell pre-existing fund interests, often at discounted valuations. Fund of funds provide diversified exposure across multiple private equity or hedge funds, reducing individual fund risk but typically entail higher fees and longer lock-up periods. Investors seeking quicker capital deployment and potential bargains may prefer secondaries, while those prioritizing broad diversification and professional management may opt for fund of funds.

Connection

The Secondaries market provides liquidity by allowing investors to buy and sell pre-existing stakes in private equity funds, which often include Fund of Funds portfolios. Fund of Funds invest in multiple primary funds, creating diversified exposure, and their stakes can be actively traded in the Secondaries market to optimize portfolio allocation and manage risk. This connection enhances market efficiency by improving capital recycling and enabling investors to adjust their fund exposure without waiting for the primary fund lifecycle.

Key Terms

Diversification

Fund of funds provides extensive diversification by investing in a portfolio of multiple private equity funds, spreading risk across various strategies and managers. The secondaries market offers diversification through acquiring existing stakes in private equity assets, enabling access to mature investments with varied vintages and sectors. Explore how these approaches enhance portfolio diversity and manage investment risk effectively.

Liquidity

Liquidity in fund of funds typically involves longer lock-up periods due to commitments in underlying private equity funds, leading to limited opportunities for early exits. The secondaries market offers enhanced liquidity by enabling investors to buy and sell pre-existing fund interests, often at discounted prices, allowing for quicker capital redeployment. Explore the nuances of liquidity in both structures to make informed investment decisions.

Underlying Assets

Fund of funds primarily invests in a diversified portfolio of underlying assets by acquiring stakes in multiple primary funds, providing broad market exposure and risk mitigation. The secondaries market focuses on purchasing existing limited partnership interests from investors, allowing access to more mature and often discounted underlying assets with clearer performance histories. Explore further to understand strategic benefits and risk profiles between these investment approaches.

Source and External Links

Fund of funds - Wikipedia - A fund of funds (FOF) is an investment strategy that holds a portfolio of other investment funds rather than investing directly in securities, providing diversification by pooling multiple funds, with types including mutual, hedge, or private equity funds, but may involve higher fees due to multi-layered investing.

Fund Of Funds (FOF) - Association of Mutual Funds in India - A Fund of Funds invests in units of other mutual fund schemes, offering diversification and suited for smaller investors or those without specific fund expertise, with tax treatment depending on the underlying fund's equity orientation.

What is a Fund of Funds? Definition, types & advantages | StoneX - A fund of funds pools money to invest in various funds, enhancing diversification, risk management, convenience, and professional management, though typically charging double management fees--once at the fund of funds level and again at the underlying funds.

dowidth.com

dowidth.com