Carbon credits trading offers a market-based approach where companies buy and sell permits to emit a certain amount of carbon dioxide, enabling flexible compliance with emission reduction targets. Green bonds provide a fixed-income investment specifically earmarked for financing environmentally sustainable projects, ensuring predictable returns tied to positive environmental impact. Explore how these two mechanisms drive sustainable finance and your opportunities within them.

Why it is important

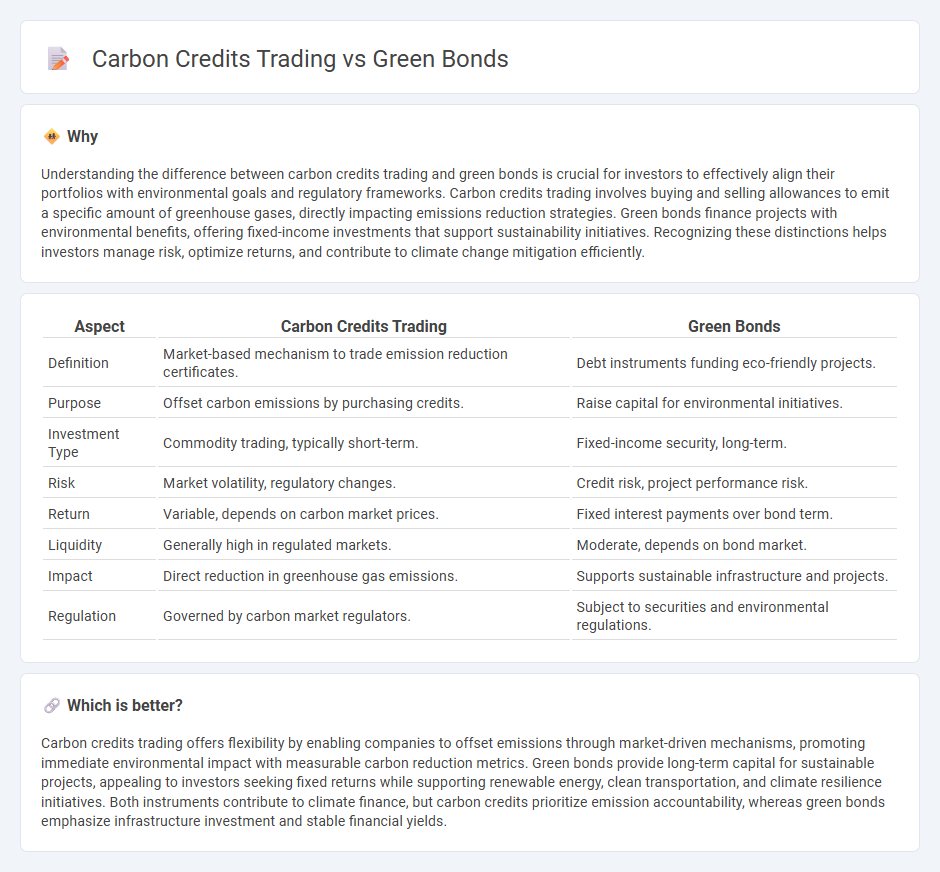

Understanding the difference between carbon credits trading and green bonds is crucial for investors to effectively align their portfolios with environmental goals and regulatory frameworks. Carbon credits trading involves buying and selling allowances to emit a specific amount of greenhouse gases, directly impacting emissions reduction strategies. Green bonds finance projects with environmental benefits, offering fixed-income investments that support sustainability initiatives. Recognizing these distinctions helps investors manage risk, optimize returns, and contribute to climate change mitigation efficiently.

Comparison Table

| Aspect | Carbon Credits Trading | Green Bonds |

|---|---|---|

| Definition | Market-based mechanism to trade emission reduction certificates. | Debt instruments funding eco-friendly projects. |

| Purpose | Offset carbon emissions by purchasing credits. | Raise capital for environmental initiatives. |

| Investment Type | Commodity trading, typically short-term. | Fixed-income security, long-term. |

| Risk | Market volatility, regulatory changes. | Credit risk, project performance risk. |

| Return | Variable, depends on carbon market prices. | Fixed interest payments over bond term. |

| Liquidity | Generally high in regulated markets. | Moderate, depends on bond market. |

| Impact | Direct reduction in greenhouse gas emissions. | Supports sustainable infrastructure and projects. |

| Regulation | Governed by carbon market regulators. | Subject to securities and environmental regulations. |

Which is better?

Carbon credits trading offers flexibility by enabling companies to offset emissions through market-driven mechanisms, promoting immediate environmental impact with measurable carbon reduction metrics. Green bonds provide long-term capital for sustainable projects, appealing to investors seeking fixed returns while supporting renewable energy, clean transportation, and climate resilience initiatives. Both instruments contribute to climate finance, but carbon credits prioritize emission accountability, whereas green bonds emphasize infrastructure investment and stable financial yields.

Connection

Carbon credit trading and green bonds are interconnected financial instruments promoting sustainable investment by channeling capital toward environmentally beneficial projects. Carbon credits create a market-driven incentive for reducing greenhouse gas emissions, while green bonds fund initiatives that deliver measurable environmental impact, often including carbon reduction efforts. Together, they enhance corporate sustainability strategies and support global climate targets by integrating emission reduction with green finance mechanisms.

Key Terms

Environmental Impact

Green bonds finance projects that generate measurable environmental benefits, such as renewable energy installations and sustainable infrastructure, directly contributing to carbon emission reductions and ecosystem preservation. Carbon credits trading involves buying and selling permits representing a specific amount of emissions reduction, allowing organizations to offset their carbon footprint while promoting carbon market liquidity. Explore how these mechanisms drive sustainable investment and corporate responsibility by learning more about their environmental impact and market dynamics.

Financial Instruments

Green bonds are debt securities that finance environmentally sustainable projects, providing investors with fixed returns while supporting green initiatives. Carbon credits trading involves buying and selling permits that allow companies to emit a certain amount of CO2, creating a market-driven approach to reducing emissions. Explore the key differences and financial impacts of these instruments to optimize your sustainable investment strategy.

Regulatory Framework

Green bonds operate under well-defined regulatory frameworks such as the Climate Bonds Standard and are subject to securities laws that ensure transparency and investor protection. Carbon credits trading is governed by regional and international mechanisms like the EU Emissions Trading System (ETS) and the Kyoto Protocol, which set limits and verify emission reductions. Explore the detailed regulatory nuances to understand the implications for investors and environmental impact.

Source and External Links

Green bond - Wikipedia - A green bond is a fixed-income instrument used to fund projects with positive environmental benefits such as renewable energy, energy efficiency, clean transportation, and climate change adaptation, allowing investors to meet ESG goals while financing sustainable development.

Green Bond Principles (GBP) - ICMA - The Green Bond Principles provide voluntary guidelines to issuers for transparency and integrity to ensure raised funds are directed to environmentally sound projects that support a net-zero emissions economy, emphasizing disclosure and impact reporting.

What are Green Bonds and what projects do they finance? - Iberdrola - Green bonds are debt instruments issued to finance sustainable and socially responsible projects in areas like renewable energy, energy efficiency, clean transportation, and waste management, with funds strictly committed to environmental or climate change projects.

dowidth.com

dowidth.com