Wine investing platforms offer unique opportunities by allowing investors to diversify portfolios through tangible assets with potential for appreciation based on vintage and provenance. Venture capital syndicates focus on high-growth startups, pooling resources from multiple investors to share risks and rewards in emerging industries. Explore the key differences and benefits of both investment avenues to enhance your financial strategy.

Why it is important

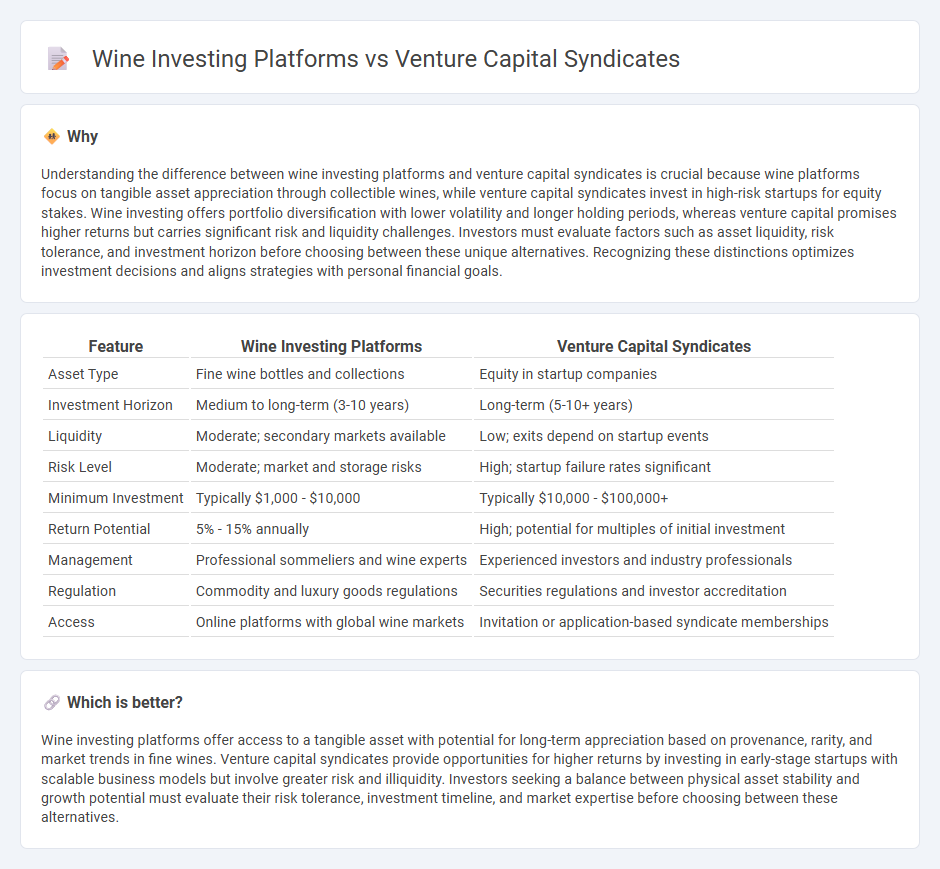

Understanding the difference between wine investing platforms and venture capital syndicates is crucial because wine platforms focus on tangible asset appreciation through collectible wines, while venture capital syndicates invest in high-risk startups for equity stakes. Wine investing offers portfolio diversification with lower volatility and longer holding periods, whereas venture capital promises higher returns but carries significant risk and liquidity challenges. Investors must evaluate factors such as asset liquidity, risk tolerance, and investment horizon before choosing between these unique alternatives. Recognizing these distinctions optimizes investment decisions and aligns strategies with personal financial goals.

Comparison Table

| Feature | Wine Investing Platforms | Venture Capital Syndicates |

|---|---|---|

| Asset Type | Fine wine bottles and collections | Equity in startup companies |

| Investment Horizon | Medium to long-term (3-10 years) | Long-term (5-10+ years) |

| Liquidity | Moderate; secondary markets available | Low; exits depend on startup events |

| Risk Level | Moderate; market and storage risks | High; startup failure rates significant |

| Minimum Investment | Typically $1,000 - $10,000 | Typically $10,000 - $100,000+ |

| Return Potential | 5% - 15% annually | High; potential for multiples of initial investment |

| Management | Professional sommeliers and wine experts | Experienced investors and industry professionals |

| Regulation | Commodity and luxury goods regulations | Securities regulations and investor accreditation |

| Access | Online platforms with global wine markets | Invitation or application-based syndicate memberships |

Which is better?

Wine investing platforms offer access to a tangible asset with potential for long-term appreciation based on provenance, rarity, and market trends in fine wines. Venture capital syndicates provide opportunities for higher returns by investing in early-stage startups with scalable business models but involve greater risk and illiquidity. Investors seeking a balance between physical asset stability and growth potential must evaluate their risk tolerance, investment timeline, and market expertise before choosing between these alternatives.

Connection

Wine investing platforms and venture capital syndicates are connected through their shared focus on alternative asset classes and portfolio diversification strategies. Both utilize structured funding mechanisms to pool resources from multiple investors, enabling access to niche markets such as fine wine and innovative startups. Leveraging expert valuation models and market analytics, these entities optimize asset growth potential while mitigating risks inherent in non-traditional investments.

Key Terms

**Venture capital syndicates:**

Venture capital syndicates pool resources from multiple investors to collectively invest in high-growth startups, leveraging expert-led deal sourcing and due diligence for optimized returns. These syndicates provide access to early-stage funding rounds typically unavailable to individual investors, enhancing portfolio diversification and risk management. Explore in-depth insights on how venture capital syndicates can amplify your investment strategy today.

Carry

Venture capital syndicates typically offer carry structures where lead investors receive a percentage of profits, aligning incentives for successful exits and higher returns. Wine investing platforms, however, often operate with management fees but lack traditional carry models, focusing instead on wine appreciation and resale value for profit. Explore detailed comparisons to understand how carry impacts investor returns in these distinct asset classes.

Deal flow

Venture capital syndicates provide diversified deal flow through collaborations among experienced investors targeting startups with high growth potential. Wine investing platforms source unique and rare vintages, offering access to exclusive wine collections and market data that enhance portfolio diversification. Explore how each platform's deal flow can influence your investment strategy and returns.

Source and External Links

Syndicates: Why Angel Syndicates are Valuable - Syndicates are deal-by-deal venture capital groups led by a lead investor who forms a Special Purpose Vehicle (SPV) to pool angel investors' funds, allowing smaller checks, greater deal flow exposure, and networking, while sharing profits between lead and investors.

What is a syndicate? - On AngelList, a syndicate pools investor capital via SPVs to invest in startups, enabling investors to access deals individually, benefit from lead expertise, invest smaller amounts, and diversify portfolios.

Startup Syndicate Funding: Here's How it Works - Syndicates operate with a lead investor who identifies startups and pools backers' funds through an investment vehicle, distributing investment materials to attract capital before making collective investments into startups.

dowidth.com

dowidth.com