The secondaries market offers investors liquidity by allowing the purchase and sale of pre-existing private equity interests, while mergers and acquisitions (M&A) involve the consolidation of companies to drive growth or gain competitive advantages. Key players in the secondaries market include institutional investors seeking portfolio diversification and risk management, whereas M&A transactions frequently involve strategic buyers aiming for synergies and market expansion. Explore deeper insights into how these distinct investment avenues operate and their impact on financial portfolios.

Why it is important

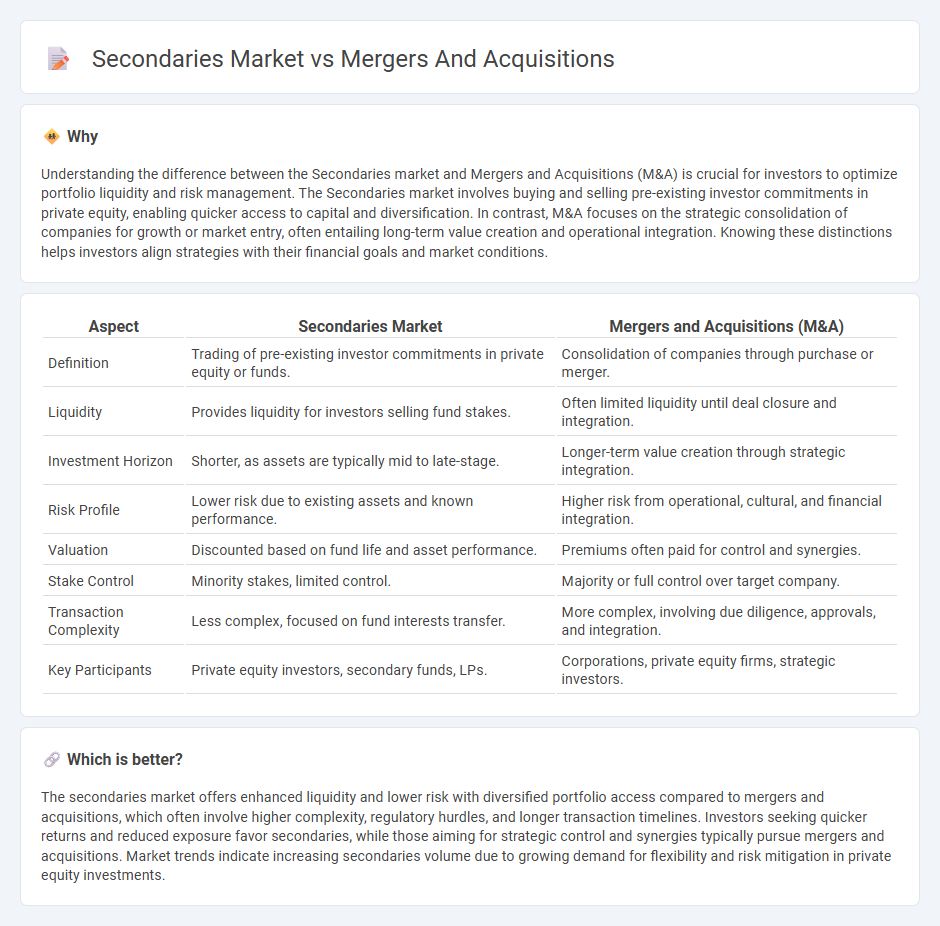

Understanding the difference between the Secondaries market and Mergers and Acquisitions (M&A) is crucial for investors to optimize portfolio liquidity and risk management. The Secondaries market involves buying and selling pre-existing investor commitments in private equity, enabling quicker access to capital and diversification. In contrast, M&A focuses on the strategic consolidation of companies for growth or market entry, often entailing long-term value creation and operational integration. Knowing these distinctions helps investors align strategies with their financial goals and market conditions.

Comparison Table

| Aspect | Secondaries Market | Mergers and Acquisitions (M&A) |

|---|---|---|

| Definition | Trading of pre-existing investor commitments in private equity or funds. | Consolidation of companies through purchase or merger. |

| Liquidity | Provides liquidity for investors selling fund stakes. | Often limited liquidity until deal closure and integration. |

| Investment Horizon | Shorter, as assets are typically mid to late-stage. | Longer-term value creation through strategic integration. |

| Risk Profile | Lower risk due to existing assets and known performance. | Higher risk from operational, cultural, and financial integration. |

| Valuation | Discounted based on fund life and asset performance. | Premiums often paid for control and synergies. |

| Stake Control | Minority stakes, limited control. | Majority or full control over target company. |

| Transaction Complexity | Less complex, focused on fund interests transfer. | More complex, involving due diligence, approvals, and integration. |

| Key Participants | Private equity investors, secondary funds, LPs. | Corporations, private equity firms, strategic investors. |

Which is better?

The secondaries market offers enhanced liquidity and lower risk with diversified portfolio access compared to mergers and acquisitions, which often involve higher complexity, regulatory hurdles, and longer transaction timelines. Investors seeking quicker returns and reduced exposure favor secondaries, while those aiming for strategic control and synergies typically pursue mergers and acquisitions. Market trends indicate increasing secondaries volume due to growing demand for flexibility and risk mitigation in private equity investments.

Connection

The Secondaries market provides liquidity for investors in private equity and other illiquid assets, enabling them to buy and sell stakes in funds or companies before the typical exit. This liquidity plays a critical role in mergers and acquisitions (M&A) by allowing investors to optimize portfolio positions, facilitate deal financing, and manage risk exposure during transactional processes. Consequently, the interplay between Secondaries and M&A markets enhances capital flow efficiency and supports strategic restructuring in corporate transactions.

Key Terms

**Mergers and Acquisitions:**

Mergers and acquisitions (M&A) involve the consolidation of companies or assets through various types of financial transactions, such as mergers, acquisitions, consolidations, and tender offers, primarily aimed at enhancing market share, achieving synergies, and driving growth. M&A activity is often characterized by significant deal sizes, regulatory scrutiny, and strategic restructuring compared to the secondary market, which deals primarily with the buying and selling of existing securities. Explore deeper insights into M&A strategies, valuation techniques, and market implications to understand their pivotal role in corporate finance.

Due Diligence

Due diligence in mergers and acquisitions (M&A) involves a comprehensive evaluation of financial statements, legal contracts, and operational risks to ensure accurate valuation and risk assessment before transaction completion. In contrast, due diligence in the secondaries market primarily centers on fund performance, underlying asset quality, and seller motivations, emphasizing liquidity and portfolio diversification aspects. Explore detailed insights into the nuances of due diligence processes across these investment avenues.

Synergy

Mergers and acquisitions (M&A) create synergy by combining resources, technologies, and market access to increase operational efficiency and accelerate growth, often resulting in higher valuation multiples. The secondaries market offers liquidity and portfolio optimization opportunities by enabling investors to buy and sell pre-existing private equity stakes, enhancing flexibility without the integration risks associated with M&A. Explore how synergy impacts value creation differently in M&A and secondaries markets to make informed investment decisions.

Source and External Links

Mergers and acquisitions - Wikipedia - Mergers and acquisitions (M&A) are business transactions where companies combine ownership, including types like "acqui-hire" for talent and "merger of equals" for similarly sized companies, with prominent examples such as AOL-Time Warner and DuPont-Dow Chemical.

Mergers & Acquisitions (M&A) - Corporate Finance Institute - M&A involves transactions where companies combine, distinguishing mergers (forming a new entity between equals) from acquisitions (larger company absorbs smaller) and including types like horizontal, vertical, and statutory mergers.

Merge and acquire businesses | U.S. Small Business Administration - Mergers combine two businesses into a new entity, often challenging due to blending resources, whereas acquisitions absorb the purchased company into the buyer without creating a new company, with advice on valuation and agreements.

dowidth.com

dowidth.com